Chequing Accounts

First Citizens provides easy, 24/7 access to your money. Experience the advantages of banking just the way you want to.

Personal Chequing

Your first option for easy chequing!

When managing your finances becomes challenging, our Personal Chequing account can help you manage your finances. You’ll have easy access to your funds when you use this convenient and secure account.

The Personal Chequing account is a convenient account that is just right and it delivers competitive returns on balances $500,000 and over. This chequing account also offers a standing order facility to take care of regular monthly payments.

- Start with a deposit of at least TT$250

- Quick and easy access to your funds

- Monthly statements to track your spending

- Salary Processing and Standing Order facilities

- Competitive fees

Insured by the DIC Corporation of Trinidad and Tobago. (Up to $125,000)

Super Chequing

Let your balance pay you with interest!

The Super Chequing Account is an added value account which you can start with just $500 for those who want easy access plus earnings! This chequing account has a standing order facility to take care of regular monthly payments.

There are also no monthly service fees when you maintain a balance of $2,500 and this account earns interest on balances over $1,000.

- Start with a deposit of at least TT$500

- Earn interest on balances of TT$500 and over

- No service charges when your balance stays above TT$2,500

- Monthly statements to track your spending

- Salary Processing and Standing Order facilities

Insured by the DIC Corporation of Trinidad and Tobago. (Up to $125,000)

Money Maker

Earn higher interest with our prestige deposit chequing account!

You can benefit from our Money Maker Chequing Account which is tailored to savers with lump sums of $15,000 and over. It delivers high yields and a range of free services. This chequing account suits persons that want a transactional as well as an interest bearing account.

The Money Maker Chequing Account offers a flexible and optional overdraft facility which helps you to take care of unexpected expenses. This chequing account also offers tiered interest rates, which means the higher your balance, the greater your reward.

- Start with a deposit of at least TT$15,000

- High multi-tiered interest calculated daily and credited monthly

- Salary Processing and Standing Order facilities

- Range of free services

Insured by the DIC Corporation of Trinidad and Tobago. (Up to $125,000)

Evergreen

Extra special benefits for our customers aged 50 and over!

You can enjoy the fruits of your labour after the age of 50 with the First Citizens Evergreen Account.

It offers personalised service, retirement planning, greater access to your funds and health benefits.

- High multi-tiered interest calculated daily and credited monthly

- No Service Charges once the minimum balance is maintained

- Free annual TTARP* membership

- Several free and important services from us

- Medical discounts

*TTARP – Trinidad and Tobago Association for Retired Persons

Insured by the DIC Corporation of Trinidad and Tobago. (Up to $125,000)

Standardisation and Enhancement of the Security Features in Our Cheques!

First Citizens is pleased to advise that we have upgraded our cheques aimed at enhancing customer safety and facilitating easier and faster processing of cheques. This upgrade has become necessary as we seek to implement an industry-wide Electronic Cheque Clearing System that will improve the efficiency of the cheque clearing process.

What are the expected changes to my cheques?

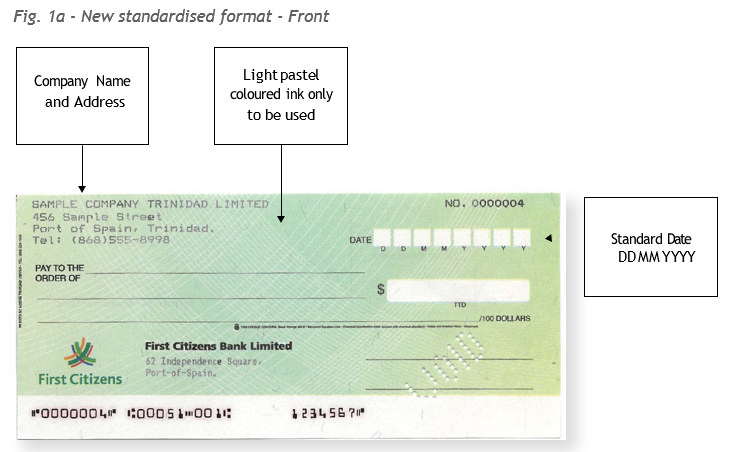

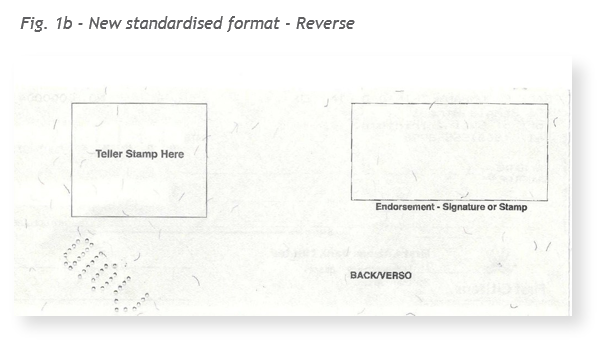

All customer cheques have been standardised in compliance with the Canadian CPA 006 Standard. These changes include:

- Standardised formatting and positions for key fields of all Personal, Commercial and Corporate cheques

- Upgraded cheque paper

- Enhanced security features

- Light pastel coloured ink on background screening/images

- Teller crossing stamp and Endorsement area at the reverse side

- Date format standardised to DD MM YYYY

- Alterations in material fields (such as date, payee name, words and figures, and signature field) are not allowed

- Cheques must be written in black or blue ink ball point pens only

Example of CPA Standard Format

Is this new cheque format mandatory for all customers?

Yes. The revised cheque format is mandatory, as it is required for an industry-wide transition to an electronic exchange of cheque images among commercial banks. Customers with customised cheques are also required to adopt these amendments.

How do I order Canadian CPA 006 Compliant Cheques?

Yes. The revised cheque format is mandatory, as it is required for an industry-wide transition to an electronic

Updated cheque books can be ordered via any of the channels outlined below:

1) Visit our website: firstcitizenstt.com to complete the Cheque Book Ordering Form. Once completed your cheque book(s) will be delivered to your door, free of charge

2) Log in to your Online Banking (Personal Cheque holders), click on the My Services tab and select the Reorder Cheques option. Choose your account and enter your details; your cheque book(s) will be delivered to you or your selected Branch

3) Contact your Account Relationship Manager (Commercial/Corporate Cheque holders)

4) Visit any of our Branches

IMPORTANT: All cheques orders must be fulfilled by the Bank’s approved vendors

Are there any additional costs for the new cheques?

- Ordinary cheque books would be supplied at no additional costs at this time.

- Special cheque books can be ordered at an additional cost.

What is an Electronic Cheque Clearing System (ECCS)?

The Electronic Cheque Clearing System (ECCS) is an automated, image-based system which will facilitate the electronic exchange and settlement of cheque transactions in Trinidad and Tobago (TT) dollars when drawn against local banks from personal and business accounts across Trinidad and Tobago. The implementation of the ECCS will result in the reduction of other bank cheque holds from 4 business days to 3 business days. This industry-wide initiative is supported by the Banker’s Association of Trinidad and Tobago (BATT) and Central Bank of Trinidad and Tobago (CBTT) to provide a faster, more secure and automated payment settlement service to you.

What are the benefits of the ECCS?

The benefits of the ECCS include:

- Faster access to funds (reduction of holds on other-bank cheques to 3 days, in the first instance)

- Enhanced cheque security through improved cheque security features

- Enhanced fraud mitigation capabilities via Customer Cheque Verification built into the solution when full cheque truncation is realised

- Faster payments to vendors

- Facilitation of online image based statements

- Standardisation of cheque features throughout the industry

For further details send us an email at ppcchqbkorders@firstcitizenstt.com

or

Contact your Account Relationship Manager.