Weaker Economic Prospects for Latin America and Caribbean

Commentary

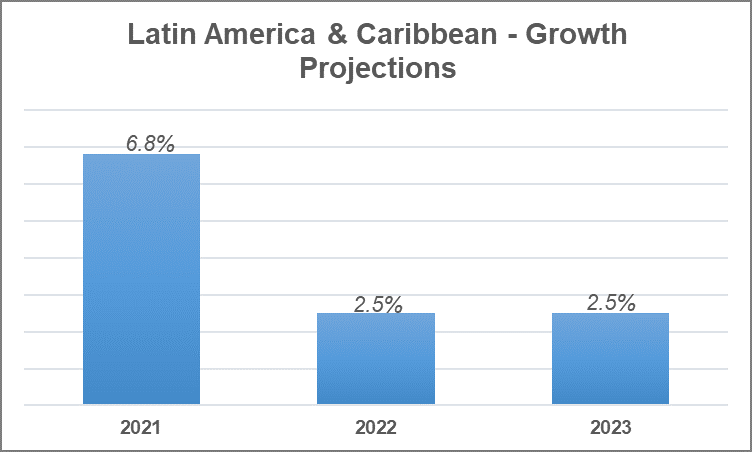

After experiencing the worst economic downturn in more than a century, 2022 was ushered in with hopeful signs for recovery albeit with the scars of the crisis still visible in Latin America and the Caribbean (LAC). The latest estimates according to the International Monetary Fund (IMF) indicate that regional GDP rose by 6.8% in 2021, however, real GDP growth is expected to slow considerably in 2022 and 2023 to 2.5% for both years (a downgrade from previous forecasts). This downgrade in growth reflects the significant obstacles to recovery presented by rising inflation levels, tighter monetary policy, increasing debt levels, high unemployment, and the recent impact of the Russia/Ukraine crisis. The challenge to sustainable growth will lie in ensuring that recovery measures will benefit those who need it most.

Figure 1: Real GDP Growth (%, y-o-y)

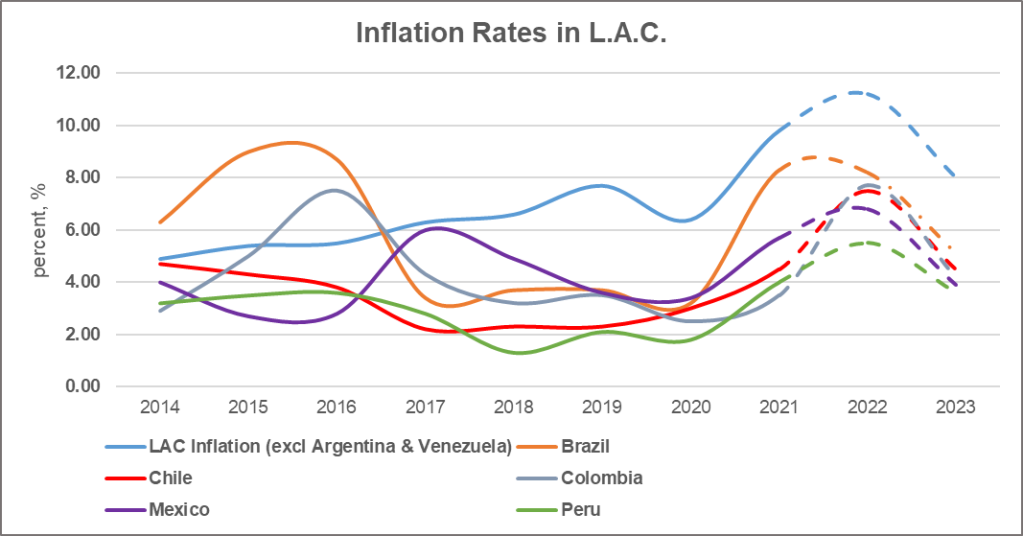

Rising inflationary pressures pose a major challenge for the economic recovery for the region. Inflation shocks have been witnessed globally, however, the LAC region has been affected the worst. After reaching low levels of inflation during 2020, the economies of Latin America and the Caribbean experienced an acceleration in inflation in 2021. The surge in international energy and food prices, as well as the increase in global inflation, have also contributed to driving up inflation in the region. The IMF reported general inflation of 9.8% for the LAC region in 2021, (excluding Argentina and Venezuela) and these pressures are expected to continue in 2022. Central banks in the region anticipate that inflation levels will remain above the established target range, and are expected to converge towards the target range by the end of 2022 or early 2023.

Figure 2: Latin America & Caribbean – Consumer Price Index (CPI) (%, y-o-y)

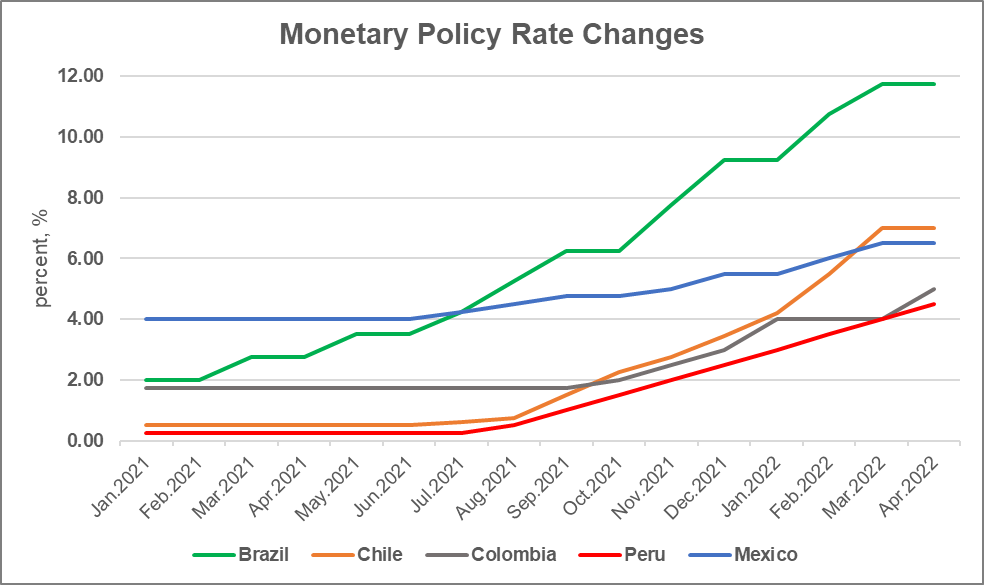

In an effort to combat inflationary pressures central banks reacted quickly and decisively. The region’s central banks have been among the first of emerging markets to start increasing interest rates, and is expected to continue throughout this year to stem further increases in the current above-target inflation expectations. The pace of monetary policy tightening has differed across countries depending on the degree and scope of price pressures, and their position in the economic cycle. Countries such as Brazil, Chile, Colombia, Mexico and Peru, saw their policy rates rise between 1.25 percentage points and 7.25 percentage points over the course of 2021, and are expected to continue rising throughout 2022. Therefore, the shift from an ultra-accommodative monetary policy to more aggressive monetary tightening will be a main cause of slower GDP growth as it consequently brings the erosion of real income and higher borrowing costs.

Figure 3: Monetary Policy Rate Changes

The pandemic additionally dealt a severe blow to the regions’ labor markets leading to rising unemployment. Although the region recorded strong economic growth in 2021, the revival of labor markets was limited resulting in unemployment of 9.6% in 2021 from 10.6% in 2020. The forecast of modest economic growth in 2022 is a clear indication that the region will take longer to recover from the COVID-19 crisis. The unemployment rate is forecasted to decrease marginally to 9.3 % in 2022 and 8.8% in 2023, according to the International Labor Organization (ILO). While unemployment is expected to decrease, these levels remain above pre-pandemic levels. According to the Economic Commission of Latin America & Caribbean (ECLAC), approximately 30% of the jobs lost in 2020 in sectors such as retail and hospitality are yet to be recovered. A prolonged employment crisis is worrying because it generates discouragement and frustration, which in turn has repercussions on social and political stability. There is urgency therefore to create and promote investment friendly business conditions for firms to develop and stimulate their productivity and create job opportunities.

The Russia-Ukraine conflict will also weigh on the region’s growth prospects although the region is not significantly exposed to Russia directly in terms of investment and trade. According to data from the UN Comtrade, trade with Russia and Ukraine represents less than 2% of the total exports and imports of goods of the main Latin American economies. However, due to the high uncertainty about the scope and duration of the war, experts warn that the region will suffer a strong indirect impact through the prices of raw materials. While higher prices could benefit some net commodity exporters, other parts of the region which depend heavily on imports, such as Central America and the Caribbean, will be adversely affected. Higher energy and food costs could considerably weaken the prospects of these countries by negatively affecting purchasing power and further increasing inflation.

Further straining the economics of the LAC region is the slowing of world growth. Global growth is projected to slow from an estimated 6.1% in 2021 to 3.6% in 2022 and 2023, according to the latest IMF projections. This includes the two main trading partners in the LAC, the United States and China, both of which will continue to experience an economic slowdown. Bottlenecks in supply chains will accelerate shipping costs, directly slowing down international trade which will influence the economic recovery of the region. Additionally, the increasing level of indebtedness in the region is worrisome as it grew more than 10 percentage points during the pandemic, to 75.4% of regional GDP, according to the World Bank. “Reducing this figure is crucial and efforts must be made to narrow the gap between public revenue and spending by using resources more efficiently, eliminating unnecessary spending and increasing revenue with a progressive impact”, according to World Bank’s Vice President Carlos Felipe Jaramillo.

In summary, the outlook for Latin America and the Caribbean remains challenging requiring governments to approach measures creatively to mitigate the damage left on the economies. The challenges of tighter credit conditions, persistent inflation and a slowdown in key markets of trade all darken the outlook for the region. While, these challenges must be addressed in the short term, a longer-reform agenda is also crucial to ensure equity and sustainable growth. Countries have a unique opportunity to bolster growth engines and to build forward toward a more prosperous, sustainable, and inclusive region.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.