US Government Debt Limit and its Impact on Financial Markets

Commentary

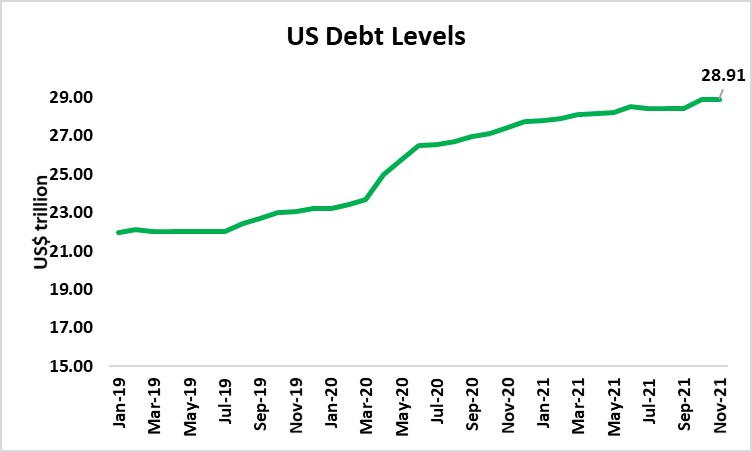

Over time, the US Congress has passed a number of Bipartisan Budget Acts and other legislation to either raise or suspend the debt ceiling. In recent years, the Bipartisan Budget Act of 2018 suspended the debt ceiling through March 2019 and then effectively raised the limit to US$22 trillion. Following this, the Bipartisan Budget Act of 2019 suspended the debt limit through July 31, 2021 and a new debt ceiling was set at about US$28.4 trillion. On October 14, 2021, four days before the Treasury Department estimated it would no longer be able to pay the nation’s debts, the debt limit was raised by $480 billion to a total of $28.9 trillion by Congress.

The Treasury Department has already reached the new debt limit of US$28.9 trillion and currently has no room to borrow, other than to replace maturing debt. To avoid breaching the limit, the Treasury is using the extraordinary measure that allows them to continue to borrow additional amounts for a limited time. On November 19, 2021 the Treasury Secretary Janet Yellen indicated that the US may not be able to pay its bills after December 15, 2021 as the Treasury Department has to transfer US$118 billion to the Highway Trust Fund on December 15, 2021. This transfer is tied to President Biden’s recent signing of the $1 trillion infrastructure bill and could put strain on how much cash the Treasury Department has on hand.

What is the Debt Limit?

The debt limit was first enacted in 1917 in order to simplify the process used previously in which each individual issuance of debt required approval and to also improve borrowing flexibility. The debt limit, also known as the debt ceiling, is the maximum amount of debt that the US Government through the Treasury Department can issue to the public or other federal agencies. Congress limits how much money the government can borrow and once the limit is reached, lawmakers must raise or suspend the ceiling before the Treasury Department can issue more debt. An increase in the debt limit does not authorize new spending, but it essentially allows the Treasury Department to raise money to pay for expenses the government has already authorized.

When the US government runs a budget deficit such that its ongoing operations cannot be funded by Federal revenues alone, the Treasury Department borrows money by issuing new debt in the form of government securities to cover these deficits. There are many different types of Treasury debt such as bills, notes, and bonds which range from a few days up to 30.

Main cause of higher debt levels

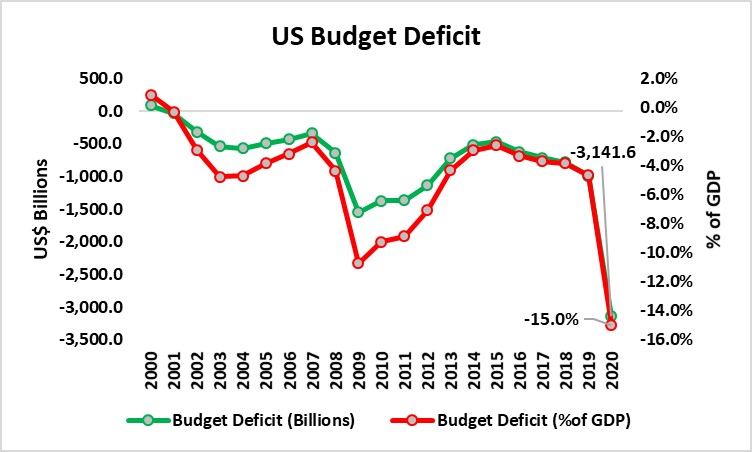

The US government has been running consecutive budget deficits since 2001. Based on actual data from the Congressional Budget Office, the US experienced its largest deficit of US$3,141.6 billion in 2020 and it is projected to be around US$3,003 billion for 2021. These high deficits are due to a number of policies implemented to provide fiscal stimulus to the economy and relief to those affected by the Covid-19 pandemic. These policies include a US$8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act, an estimated US$2.3 trillion Coronavirus Aid, Relief and Economy Security Act, US$483 billion Paycheck Protection Program and Health Care Enhancement Act and a US$868 billion coronavirus relief and government funding bill. In March 2021, President Biden signed into law the American Rescue Plan, which provided another round of coronavirus relief with an estimated cost of $1.84 trillion.

At the start of January 2020, the national debt level was around US$23.17 trillion which rose to around US$23.47 trillion at the start of March 2020. By the end of 2020, the US government had added over US$ 4 trillion in debt as the debt level soared to around $US27.75 trillion at the end of December 2020. The stimulus spending by President Biden earlier in 2021 also contributed to the debt level. As at the end of November 2021, the debt level was around $28.91 trillion.

Source: Congressional Budget office

The Debt Limit and Government Shutdowns

According to the White House, debt limit impasses and government shutdowns are entirely different concerns. When annual funding for ongoing Federal government operations expire and Congress does not renew it in time, government shutdowns usually occur. The Federal fiscal year begins on October 1st and shutdowns often occur around that time. Shutdowns can occur at other times if Congress authorizes shorter-term funding without renewing it in time later in the year. On December 3, 2021 President Biden signed a stopgap bill to avert a government shutdown just hours before the midnight deadline. Congress acted to prevent a shutdown on the evening of December 2, 2021 when both chambers voted to pass a stopgap bill to extend funding through February 18, 2022.

Historically the US has experienced a number of government shutdowns with the longest period being 34 days under President Trump. Based on our analysis, the stock market historically has shrugged off government shutdowns as positive returns were recorded during the last four shutdown periods. Even one week after the last three shutdowns, the S&P recorded positive returns. Despite the S&P not being significantly impacted by the government shutdowns, overall GDP was negatively impacted. For the last shutdowns in 2018 and 2019, the Congressional Budget Office indicated that US real GDP was 0.1% lower in the fourth quarter of 2018 and 0.2% lower in the first quarter of 2019 as a result of the government shutdown. While government shutdowns negatively impact the US economy, the White House stated that this is pale when compared to the impact of defaulting on the Federal government’s obligations because of the debt limit.

The Debt Limit and Government Default

The US has never defaulted on its debt obligations however, in 2011 the country was stripped of its triple A credit rating by S&P after Congress raised the country’s debt ceiling mere hours before the country could have defaulted on some of its obligations. S&P lowered its rating of long-term US debt from AAA to AA+, indicating that the trajectory of future US debt was unsustainable. If Congress does not raise or suspend the debt limit by December 15th, the US could be downgraded by credit rating agencies or worse yet default on its obligations. The Treasury Department has indicated this will have catastrophic economic consequences for the US economy. In the aftermath of the 2011 debt ceiling crisis where the US ultimately avoided a default, measures of consumer confidence and small business optimism weakened. Mortgage rates also rose by between 0.7 and 0.8 percentage points for two months after that year’s debt ceiling crisis passed, and only declined slowly thereafter. The mere threat of a default has negative effects on the US economy.

The US Treasury Secretary warned that a default will throw the US economy back into a recession especially as the economy is still recovering from the Covid-19 pandemic. Interest rates will increase on US Treasuries and stock prices will decline as investors move away from riskier assets such as stocks and bonds and into safe haven assets like Gold. Consumers in the US would also face higher costs of borrowing that would result from a federal default. A default would send shock waves through global financial markets and would likely cause credit markets worldwide to freeze up and stock markets to plunge. It would also make it more expensive for the Treasury Department to borrow money, which would increase federal debt more quickly.

While any increase or suspension to the debt limit historically was done with bipartisan support, this time around, Republicans refused to lend their support to raise the borrowing cap in protest of President Biden’s economic agenda. This is so as the Democrats are attempting to pass the US$1.75 trillion Build Back Better bill which Republicans argue will worsen the inflation situation and raise fuel prices. On the December 7, 2021, Democrats and Republicans signaled that they had reached a deal to raise the country’s debt limit. The deal itself does not directly raise the debt limit, but rather sets up a smoother process that allows Democrats in the narrowly divided Senate to accomplish the task without support from the Republicans. The arrangement under this deal would first see Congress pass a measure that allows Democrats to raise the debt ceiling just once using a simple majority in the Senate. This will require the support of at least 10 Republicans. Afterwards the Democrats alone could move ahead with the actual increase to the debt limit.

The recovery of the US economy hinges on the ability of the Democrats to successfully raise the debt limit and avert a credit rating downgrade or a potential default. If they are successful in increasing the debt limit, this will help boost confidence in the economy and help the upward momentum currently being experienced. On the flip side if the Democrats are unsuccessful in raising the debt limit, the US could see financial markets being negatively impacted and overall growth declining. Investors may demand a higher interest rate on bonds to compensate for the higher risk of holding US government debt which would also push the price of government bonds down. As for the stock market, investors may sell off shares as investor confidence falls and the overall health of the US economy declines.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.