Understanding Capital Markets and its Importance in an Economy

Commentary

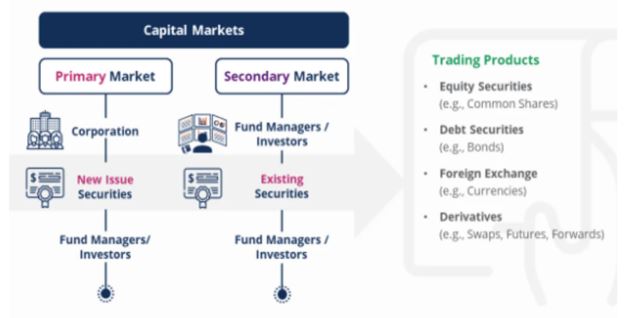

Capital markets play a vital role in an economy as one of the most powerful drivers of economic growth and wealth creation. Capital markets match borrowers with savers and their respective risk appetites for financial instruments, with an aim to produce a profitable investment opportunity for both parties. Essentially, these markets bring those who hold capital and those seeking capital together and provide a place where securities can be exchanged for capital.

What is a Capital Market?

A capital market refers to a segment of the financial system aimed at channelling the savings of an economy to those in need of capital. These transfers of capital are undertaken through financial instruments and securities. These can include money market assets, sovereign and non-sovereign bonds, securitized assets (such as mortgage-backed securities), participations in collective investment schemes (such as mutual funds), and preference and common equity. In contrast to deposits, investors bear the risk of such investments.

Capital markets consist of:

- A primary market – where the financial instruments described above are sold by their issuers (governments, companies, collective investment schemes, special purpose vehicles) to the investors for the first time, such as in an initial public offering (IPO).

- A secondary market – where already-issued securities are traded between investors. The Trinidad and Tobago Stock Exchange is an example of a secondary market.

Securities can be issued via private placements or public offerings. Private placements are restricted to institutional and other sophisticated investors and have limited price disclosure and trading activity. Securities issued under a public offering are accessible by all and are traded on regulated markets with sufficient pre- and post-trade price transparency.

Capital markets rely on professional intermediaries and require market infrastructure, including trading platforms, clearing houses and central securities depositories, and a capital markets-specific legal and regulatory framework backed by government supervision and enforcement.

Why do Capital Markets Matter?

In a study published in December 2019, the World Bank confirms that “a strong correlation has been found between capital markets and economic growth” and points to “the increased attention given to capital markets as a mechanism that can potentially help channel private sector funding to key strategic sectors of the economy, from corporates to infrastructure, housing, small and medium enterprises, and climate change.” Capital markets mobilize additional savings into the economy, making more capital available to companies, which may then in turn, create jobs and facilitate real-wage growth.

From the perspective of investors’ and savers’, capital markets offer investment opportunities and risk management tools. First, capital markets can offer more attractive investing opportunities in terms of their return than bank deposits, albeit with a higher risk. Further, if a wide range of instruments exist, then capital markets can provide investors with a diversified portfolio, which contributes to risk management. Well-developed capital markets also provide risk management tools through the derivatives markets, not only to market participants, but also to end users as diverse as companies and agriculture producers.

On a microeconomic level, for businesses that already enjoy access to banking finance, capital markets can provide an important alternative as they can give these businesses access to larger volumes of funding, longer maturities and potentially better economic terms, thus reducing overall funding costs. This funding can be a crucial source for companies seeking to expand their business. Capital markets can also fund riskier and more collateral-scarce businesses and activities that would not traditionally be served by the banking sector as they bring investors with higher risk profiles.

For governments, while some can access international capital markets, the development of local capital markets can increase access to local currency financing and thereby help manage foreign exchange risk and inflation better. Capital markets are also an important source to finance governments’ fiscal deficits as well as expenditures for social services and job creation. Additionally, the creation of local capital markets is tremendously beneficial to governments attempting to finance development internally.

Preconditions for the Development of Capital Markets

In its 2019 study, the World Bank highlighted certain preconditions for capital markets to develop. They are:

- A stable macroeconomic environment. This essentially means economic growth, low inflation and robust fiscal policies.

- A certain level of development of the financial sector, including a healthy banking sector, institutional investors and financial openness.

- A robust legal and institutional environment, including mechanisms to ensure the protection of investors and, more generally, that the country abides by the rule of law.

The Trinidad and Tobago Securities and Exchange Commission (TTSEC) is the regulator of the local capital market and as the regulator, can take specific action in relation to the activities of market participants.

According to the Oxford Business Group, the TTSEC, in conjunction with market participants, has made considerable strides in implementing a comprehensive regulatory framework, though certain shortfalls remain. Also, a wide investor base continues to be a challenge, as most citizens gain exposure to the markets primarily through the National Insurance Scheme, occupational pension plans, mutual funds and credit union accounts.

The pace of capital market development varies according to country-specific circumstances, and is also affected by domestic market shocks, exogenous events and global market conditions. Even if these events do not otherwise have a major or lasting economic impact, they can in some cases, have a significant adverse effect on the confidence of market participants and set back the market’s development.

Challenges to the Development of Capital Markets

The potential for and timing of capital market development are to a large extent dependent on the level of economic and structural development of a country. Also, capital markets are also not without risks. Changes in local and global macroeconomic conditions could trigger sudden stops and reversals in foreign flows that, if not well managed, could take a significant toll on economic growth. The COVID-19 pandemic adds further challenges to the development of capital markets. For many emerging markets and developing economies, challenges have intensified as a result of:

- The deterioration in the macroeconomic environment, including the contraction of economies and larger fiscal deficits.

- Reduced investor appetite due to uncertainty.

- The nature and scale of the interventions used by governments to support the economy (which while necessary) might have limited the viability of different capital markets solutions, at least in the short to medium term.

If anything, the need for capital markets solutions is more critical than ever given the more limited space that governments (and possibly also banks) will have going forward to support new financing. These challenges however, do not outweigh the benefits capital markets can have.

Trinidad & Tobago Capital Market

T&T has already taken steps towards further developing its capital markets. In late 2018 and 2019 there were a series of IPOs and bond issuances on both the equity and debt markets. For example, the issuance of National Investment Fund (NIF) bonds in 2018, secured by shares in corporations such as Angostura, Republic Bank and WITCO, which was oversubscribed, is a clear sign of high investor interest in the corporate debt market. Should companies continue to issue debt, it is highly probable that there will be more than enough demand for such investments.

However, the local market tends to be highly concentrated among a few large firms and lacks substantial participation from smaller companies. Policies have been launched to boost engagement in the capital markets, especially those targeting small and medium-sized enterprises (SMEs) and the youth.

Additionally, the Ministry of Finance has introduced fiscal policies to incentivise the listing of SMEs. In the 2022 budget, Finance Minister Colm Imbert introduced a full tax holiday for the first five-year period for new SMEs listing on the TTSE by granting tax exemption on Business Levy and Green Fund Levy, in addition to tax incentives in the Finance Act 2020.

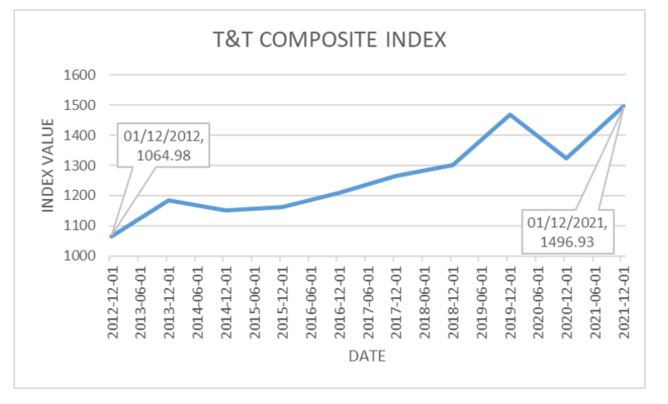

Below is an illustration of the performance of the T&T Composite Index over the past ten years. With the exception of the dip that would have occurred in 2020 around the same time the pandemic hit the country, the index has generally trended upwards.

There is no ‘one size fits all’ solution with regards to the development of capital markets. Countries with developed capital markets tend to grow more quickly, provide better financial services to all segments of their populations, and enjoy greater prospects for long-term financial and economic stability.

Improving public understanding of how Trinidad and Tobago’s stock exchange and fixed-income products function is essential for the continued development of the market. Public education is required for the population to view investing as an opportunity to grow their wealth. Bond issuers, investors, intermediaries and regulatory authorities all stand to benefit from an effective and efficient capital market.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.