Uncertainty Clouds 2022 Economic Recovery

Commentary

2021 started off with great expectations that COVID-19 restrictions around the world may ease and some level of normalcy may return during the course of the year. Indeed, projections at the start of the year were quite optimistic, with almost all economies forecasted to rebound sharply in the aftermath of the pandemic. However, this was not to be. As the year progressed, markets were hit by wave after wave of COVID-19 infections and the emergence of even more transmissible and severe variants of the virus, which only exacerbated the human and economic crisis for many countries. While countries grappled with the persistent impact of the pandemic, global inflationary concerns emerged due to various exogenous factors and policy-induced economic activity started to slowly wane as expansionary policies were scaled back. Policy makers worldwide are now left to contend with what appears to be stagflationary economic conditions as we begin the new year.

Cautious Optimism for 2021

Back in January 2021, the International Monetary Fund (IMF) projected that the global economy would expand by 5.5% in 2021, an upward revision from its previous October 2020 forecast, and a sharp rebound from the 3.5% contraction that was estimated for 2020 at the time. This optimism reflected expectations for a ‘vaccine-powered strengthening’ of economic activity later on in 2021 as well as additional policy support in some large economies. In its April, 2021 World Economic Outlook, the IMF again revised its growth projection upward to 6%. While it remained constant in its July update, in October 2021, the Fund downgraded the projection to 5.9% due to supply disruptions as well as ‘worsening pandemic dynamics’ in the low-income developing economies in particular. Supporting the forecast was the robust commodity prices, which would enable stronger near-term prospects among commodity exporters. During the year however, the IMF would have consistently highlighted the unusual amount of uncertainties associated with their forecasts due to the evolution of the pandemic and the extent of policy support. Likewise, by December 2021, Fitch Solutions had also cut its 2021 global growth forecast to 5.7%, down from 6% anticipated in its September outlook.

Unrelenting Pandemic Woes

On 26 November 2021, the World Health Organization categorized a second variant of concern (VOC), named Omicron and noted that preliminary evidence suggests ‘an increased risk of reinfection with this variant, as compared to other VOCs’. The Omicron variant was first detected in South Africa on 24 November 2021 and has since spread to over 100 countries worldwide, becoming the predominant variant in some. At the end of 27 December, 2021, global COVID-19 infections hit a record of 1.45 million cases and on Monday 3 January, 2022, the US reported a record single-day number of daily COVID cases, with more than one million new cases. The Delta variant was first detected in India and was designated on 11 May 2021 as a VOC. It rapidly spread globally and was responsible for almost all COVID-19 cases in the US up to mid-December and led to a surge in cases and hospitalizations. Data from the US Center for Disease Control and Prevention (CDC) for the week of 26 December 2021 – 1 January 2022 showed that Omicron accounted for 95.4% of US infections while the delta variant accounted for around 4.6% of cases.

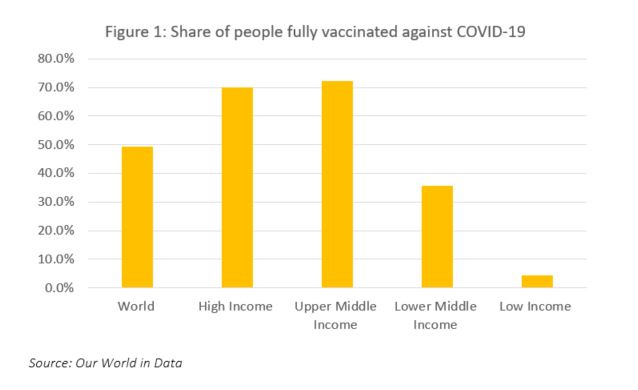

With the record surge in the number of COVID-19 cases recently, many countries have reverted to tighter restrictions. As at 3 January 2022, the number of cases globally inched closer to 300 million, with 5.45 million deaths. At the same time, 3.9 billion persons have been fully vaccinated against COVID-19, representing approximately 49% of the global population, however, there remains large disparities amongst countries. While most of the high and middle income countries have been able to vaccinate over 50% of their population, the low income countries continue to struggle, as a mere 4% of its population is fully vaccinated against COVID-19.

No doubt the rapid spread of the virus and the potential negative impact of tighter restrictions will result in increased uncertainty regarding the economic recovery in 2022.

Inflation Heats Up While Policies Diverge

There have been many underlying forces which have pushed prices higher in recent months. Higher commodity prices, a shortage of semiconductors as well as shipping and production bottlenecks have all contributed to the uptick in prices globally. The initial plunge in demand caused by COVID-19, followed by its rapid increase affected supply chains and has caused tremendous volatility in prices. In the 12 months to November 2021, global food prices, as measured by the UN Food and Agriculture Organization (FAO) Food Price Index rose by 27.3% led by strong demand for wheat and dairy products. Year to date, the index has increased by an average of 27%, reaching as high as 40.1% at the end of May 2021. Shipping and transportation costs have also skyrocketed year to date. The Baltic Dry Index, which provides a gauge of the cost to ship raw materials on approximately 50 shipping routes, has increased dramatically over the past few months. Based on data from Bloomberg, the index has climbed sharply by 146% in the 12 months to November 2021 and even though the index has dropped from its peak in September, it remains elevated at levels last seen around 2010.

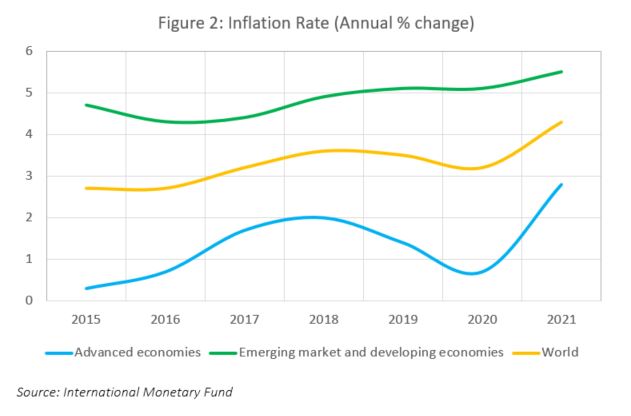

Data from the IMF shows that global inflation is estimated to average 4.3% in 2021, the highest level since 2011, with prices rising by 2.8% in the advanced economies – well above its 10-year average of 1.4%. Rising price levels have certainly frustrated policy makers given that economic growth in some cases and labour market conditions are not yet at desired levels. The evolution of GDP growth and prices will determine the pace at which expansionary policies deployed over the past two years will be scaled back, especially given that the partial rebound in private demand witnessed in 2021 was largely policy driven, as the advanced economies in particular, administered massive fiscal stimulus packages to support individuals as well as businesses hit by the pandemic.

As inflationary pressures build, there has been a divergence in policies across the emerging markets (EMs) and the advanced economies (AEs). There has been an increasing trend towards tighter economic policies in the EMs enabled by an uptick in economic activity as well as prices. Interest rates started to increase during 2021 with several EMs implementing rate hikes to safeguard against excessive currency volatility especially as the AEs are yet to assertively raise policy rates. Brazil and Russia have increased interest rates by an aggressive 725 basis points and 425 basis points respectively during 2021. From a fiscal policy perspective, AEs have been significantly more accommodative while EMs have had little flexibility to continue with stimulus packages and have had to start the process of fiscal consolidation much earlier than the advanced economies.

Omicron Likely to Delay Caribbean Recovery

The surge of COVID-19 cases within the past month and the emergence of the Omicron variant has significantly dented the outlook for the Caribbean, given the region’s dependence on the tourism industry. Indeed, before the pandemic, travel and tourism contributed 14.1% of total GDP in the region, 15.4% of total employment and 21.2% of total exports. In 2020, the World Travel and Tourism Council (WTTC) noted that travel and tourism’s contribution to regional GDP fell sharply to 6.4%, while the number of jobs in the industry fell 25%. The region is estimated to have lost USD24 billion in visitor spend as a result of the pandemic and the resulting travel restrictions imposed.

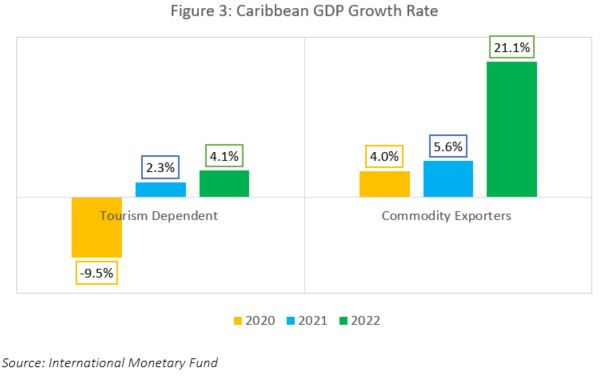

For 2021, the IMF projects growth of 2.3% for the tourism dependent territories in the region, while commodity exporters are forecasted to grow by 5.6%, driven largely by strong growth in Guyana. The slow recovery in tourism will facilitate a moderate acceleration in GDP growth to 4% in 2022 for the tourism-dependent economies while the outlook for the commodity exporters is greatly dependent on how international energy prices evolve. The region’s debt levels have climbed sharply due to the increased spending associated with safeguarding vulnerable businesses and individuals during the pandemic as well as reduced revenue as restrictions curbed spending and business activity. The year on year change in debt to GDP ratios for most countries in 2020 were in double digits, and was as high as 73 percentage points of GDP in Suriname. The average debt to GDP ratio in the Caribbean is estimated at around 75% in 2021, significantly up from approximately 60% in 2019.

Headwinds Cloud Outlook

Two of the most notable threats to the global economic recovery is the rapid spread of the recently identified highly transmissible Omicron variant and the surge in price pressures globally. Global GDP growth is forecasted to moderate to 4.9% in 2022 from an estimated 5.9% in 2021, with fairly strong contributions from both the advanced economies which are forecasted to expand by 4.5% and the emerging markets with projected growth of 5.1%. Inflation is expected to moderate from 2021’s average of 4.3% globally to around 3.6% in 2022. The IMF has indicated that ‘headline inflation in both advanced and emerging markets is expected to subside to pre-pandemic ranges by mid-2022’ but the outlook is subject to a high degree of uncertainty given the ambiguous path of the global economic recovery. Labour market conditions, while improved from 2020, are yet to recover to their pre-pandemic levels. According to estimates from the International Labour Organization (ILO), the global unemployment rate may reach 6.3% in 2021, representing approximately 220 million jobless persons worldwide. The outlook for 2022 is slightly better, with a global unemployment rate forecasted at 5.7%, still above 2019’s 5.4%.

As policy makers across the world grapple with higher inflation largely caused by supply-side issues, together with a highly uncertain economic recovery, policy determination will be challenging, specifically related to the removal of substantial monetary and fiscal stimulus deployed since 2020. Premature tightening of policies while the pandemic rages on can have indelible implications for economies which are still struggling to regain footing, even as price pressures rise and employment gains stall. Conversely, continued focus on supporting the economic recovery through accommodative policy may sustain persistent price pressures, and according to the IMF, risk ‘de-anchoring inflation expectations’. As such, policy responses will likely vary across economies and must be tailored based on country specific economic data. The pace of recovery in the global economy will dictate when the Caribbean will eventually emerge from the current slump. The relentless surge of COVID-19 cases across the world, especially with the new highly contagious Omicron variant will likely weaken tourism demand in the short term. This can be offset by an increase in vaccination uptake globally which should instill greater confidence in international travel. A rebound in tourism activity is critical in mitigating the risks associated with the region’s already fragile fiscal and external liquidity position.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.