Trading Arbitrage Opportunity on the Stock Market

Commentary

Understanding Arbitrage

Today’s financial markets are interconnected like never before. Investors can buy and sell financial instruments all over the world, literally in a matter of seconds, using a device with internet access and a brokerage account. While investors chase profits in their own market, sometimes an opportunity lies in a different marketplace. The combination of the two, when applied to the same asset is a tactic known as arbitrage. Arbitrage is the simultaneous purchase and sale of the same asset in different markets in order to profit from tiny differences in the asset’s listed price. Like all trading, when it comes to arbitrage, timing is everything. If you hold on to your shares while the markets correct themselves, for example, you could miss out on the price discrepancies required to make a profit.

Investors who practice arbitrage are called arbitrageurs, and they typically trade their choice of financial instruments. While an arbitrage opportunity can arise in any asset class that is traded in different markets, it often occurs in currency and stock markets. Arbitrage usually involves using very large amounts of money to get a meaningful return, making it a potentially expensive approach to investing. While markets rarely operate as efficiently as they might in the ideal world of theory, price differences typically are small, and arbitrage opportunities disappear almost as rapidly as they are discovered. Arbitrage opportunities are not limited to just investments in stocks, but really any market where inefficiencies exist.

Breakdown of Arbitrage

For Arbitrage to be successful it requires the following:

- Perfect information, via the stock exchanges or computerized trading systems set to monitor fluctuations in the same financial instruments across markets

- Very fast/instantaneous purchasing and selling to avoid losing out on price discrepancies

- Low/zero transaction costs (broker fees) in purchasing assets

- Low/zero transaction costs in exchanging currency

Benefits of Arbitrage

Resolves inefficiencies

In the course of making a profit, arbitrage traders enhance the efficiency of the financial markets. As they buy and sell, the price differences between identical assets narrow. The lower-priced assets are bid up while the higher-priced assets are sold off. In this manner, arbitrage resolves inefficiencies in the market’s pricing, adds liquidity to the market and equalizes the price of dual-listed stocks.

Low-risk profit

Arbitrage trades entail profits at extremely low-risk exposure because buying and selling are done simultaneously to capitalize on the price variations. The trade is triggered with the intention of booking a fixed profit by trading in large volumes of shares.

Ease of currency conversion

Due to excess demand for foreign exchange, individuals often face lengthy delays in acquiring foreign exchange. However, arbitrage allows the ease of currency conversion while trading on the stock markets. If you are purchasing and selling shares or receiving dividends, investors have the opportunity to receive funds in a foreign currency.

Arbitrage Opportunity on the Stock Market (Regional)

An arbitrageur would look for differences in price of the same financial instruments in different markets, buy the instrument on the market with the lower price, and simultaneously sell it on the other market which bids a higher price for the traded instrument.

A very common example of arbitrage opportunity is with cross-border listed companies. On the Trinidad and Tobago Stock Exchange (TTSE) and the Jamaican Stock Exchange (JSE), there are a few such companies. They are Grace Kennedy Limited, Guardian Holdings Limited, JMMB Group Limited, NCB Financial Group Limited and Massy Holdings Limited to soon join that list when they cross-list on the JSE.

Let’s assume that an investor owns stock in a company listed on the TTSE, which is trading at TTD4.00. At the same time, the company’s stock listed on the JSE trades at JMD75.00 and on the same date, the JMD/TTD exchange rate is JMD28.20/TTD$1.00. An investor could purchase that company’s shares on the JSE for the TTD equivalent of $3.29 and sell the shares on the TTSE for TTD4.00. In doing so, the investor will make a profit of TTD0.71 per share.

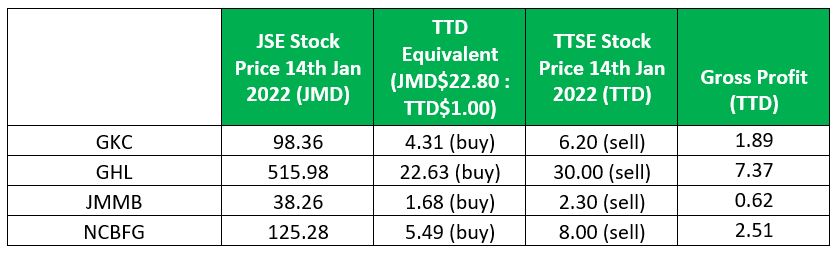

While price differences are typically small and short-lived, the returns can be impressive when multiplied by a large volume. The table below highlights the opportunities that may be available on the regional stock markets.

Price Differentials on the JSE and TTSE

Source: Trinidad and Tobago Stock Exchange, Jamaica Stock Exchange

Generating Additional Income with Arbitrage

There are many variables an investor needs to know before aiming for a short-term profit through arbitrage trading. You will need to have a thorough knowledge of different markets and price differences to be successful. Arbitrage, in its many forms, can be an effective tool for investors seeking low-risk yields. Because yield is often small, it requires high volumes to realize the benefits of arbitrage and generate enough profit to overcome transaction fees. For this reason, arbitrage is generally not a strategy individual investors can leverage for themselves. It is, however, often used by hedge funds and other institutional investors that are capable of high volumes. As with any investment strategy, arbitrage involves the risk that whatever you purchase could lose its entire value.

For retail investors who don’t have the experience to execute arbitrage trades, there is an opportunity to invest nonetheless by placing money in arbitrage funds that participate in arbitrage but also invest in equity-based stocks. Investors prefer arbitrage funds because it provides returns at a lower risk as compared to an equity fund without having a high holding period like a debt fund. Arbitrage funds invest more than 65% of their net assets into equity and equity-related securities which classifies them as equity funds.

As safe as arbitrage funds are, their returns are contingent on the arbitrage opportunities available. As arbitrage funds grow, the same capital will chase the limited opportunities which means returns can be lower.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.