The U.S. Market’s Reaction to the Fed’s Rate Hikes

Commentary

The Federal Reserve (Fed) in the US is tasked with monitoring risks to the economic and financial systems and takes steps to support a healthy economy. On 11 March 2020, the World Health Organisation (WHO) declared the spread of the COVID-19 virus a pandemic. Due to aggressive measures taken to control the spread of the virus, the global economy fell into a recession. To support the economy, the Fed maintained the fed fund rate near zero, rolled out stimulus packages and bought bonds on the open market which boosted liquidity in the economy.

Two years since the first coronavirus case was reported, the number of infections has fallen and much of the world economy has reopened and resumed operations. With the reduction in restrictive measures and subsequent rise in employment, demand increased sharply for many goods and services which served to create bottlenecks in the supply chain, stoking inflationary pressures. The Consumer Price Index in the US currently is at a 40-year high as it increased by 7.9% year on year in February 2022.

The war between Ukraine and Russia is adding further stimulus to inflation, as energy and food prices continue to climb.

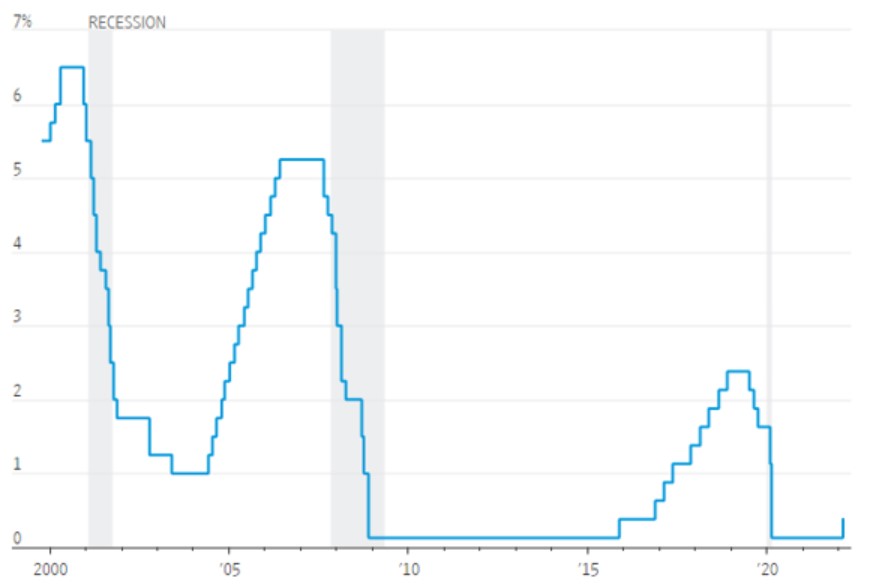

Federal Funds Target Rate

Against the backdrop of a stronger economic footing and a healthy labour market, the Federal Reserve focus has shifted to taming the steady rise in prices. At the Federal Open Market Committee (FOMC) meeting on the 15-16 March 2022, after months of anticipation and forewarning, the Fed increased the interest rate from near zero for the first time since December 2018 by 25 basis point or 0.25%. They also signalled hikes at all six remaining FOMC meetings this year.

Impact on the Stock Market

Following the Fed’s rate hike announcement, markets have responded positively with the S&P 500 increasing by 3.57% over the last week despite the threat of growing geopolitical tensions between Ukraine and Russia.

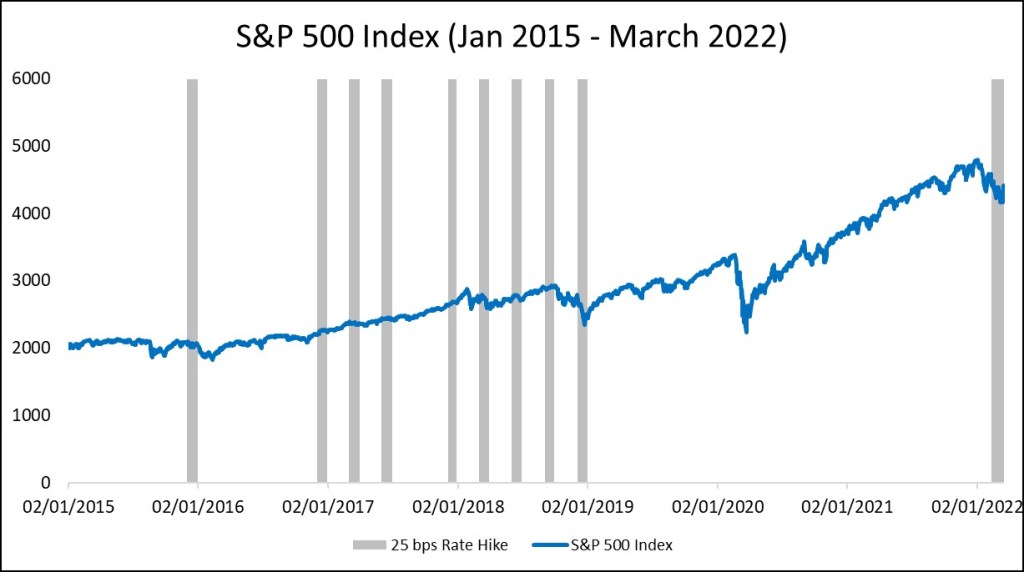

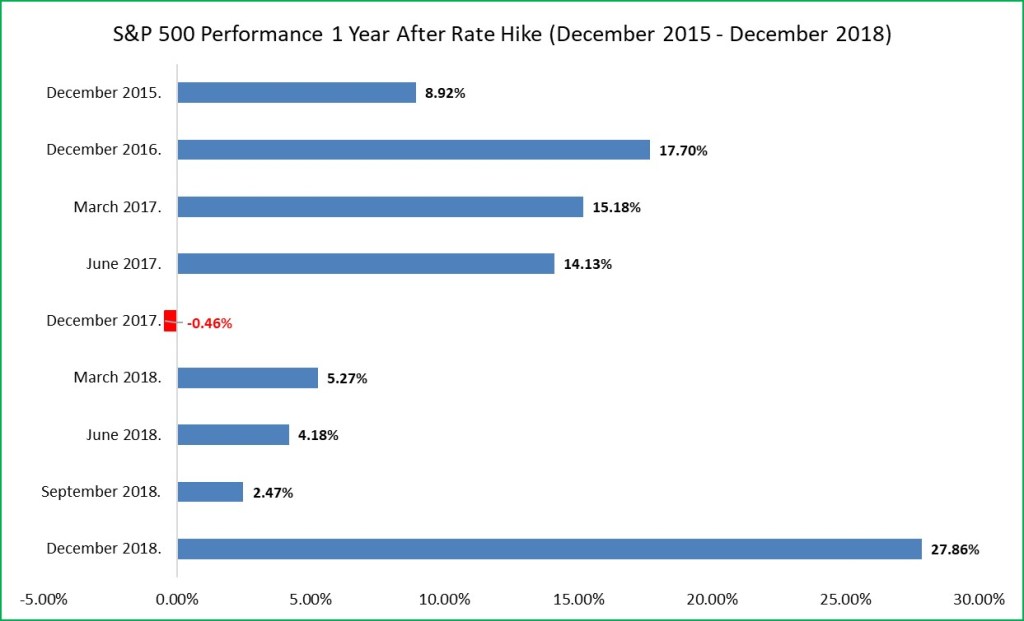

Historically, during the previous nine rate hikes (2015 -2018), the S&P 500 Index posted gains one year after the first increase nearly every time. Additionally, all rate increases during this period have been allocated in increments of 25 basis points.

S&P 500 Index performance vs Fed Fund Rate Hikes

Performance of S&P 500 Index 1 year after rate hike

Investors largely remain interested in stocks over other safe havens securities as it is currently expected to offer the best protection for the value of their investment from the impact of inflation which is expected to continue to rise.

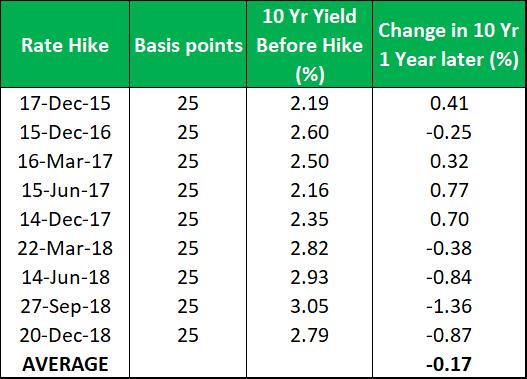

Bonds

Given the inverse relationship between interest rates and bond prices which is known as interest rate risk, the recent rate hike will cause bond prices to fall. The reason for the price decline is because new bonds will be issued with a higher coupon rate, reflecting the higher interest rates. The coupon rate on the original bond that was purchased before the rate hike will be lower than the newly issued bonds. As such, in order to attract investors, the bond will have to be sold at a discount. There may be further price pressures as investors may opt to sell their current bonds to purchase the bonds with the higher coupon rate.

Bonds with longer maturities are particularly more sensitive to interest rate hikes than bonds with shorter maturities. Thus, bonds whose maturities are beyond 5 years will experience a larger price reduction when compared to those with maturities less than 5 years. Historically, increases in the federal funds rate has been met with a decline in the 10 yr Treasury yields one year later.

Change in 10 Yr Yield 1 year after rate hike

Will Trinidad Follow with Interest Rate Hikes?

In Trinidad, the Central Bank (CBTT), much like the Fed, is tasked with supporting the economy by protecting the integrity of the economic and financial systems. The CBTT uses the repurchase (repo) rate to influence the rate of borrowing in the economy as this is the rate that the Bank charges commercial banks for borrowing funds on an overnight basis. This rate is usually announced on the last Friday of every quarter.

On 17 March 2020 however, a few days after the country recorded its first case of the coronavirus, the monetary committee of the CBTT advanced its monetary policy announcement to report that they would be reducing the repo rate to 3.5% from 5% as well as lowering the reserve requirement to 14% from 17%. The policy changes were announced in an effort to support economic activity from the Covid-19 induced recession that affected economies globally.

At the time of the policy announcement, inflation was last recorded around 0.4% in January 2020. Since then, in the latest CBTT Monetary Policy Announcement on 31 December 2021, headline inflation rose to 3.9% as at October 2021. In that announcement, mention was made of the 7.6% surge in food inflation in October 2021 from 5.8% in September 2021. In the latest monetary policy announcement, it was indicated that the repo rate will remain at 3.5% after noting the improvement in local business operations following the gradual reopening of the economy from the third quarter in 2021.

The hike in the US federal funds rate may see the CBTT also increasing rates in an effort to maintain the interest rate differential between the two countries. This may be needed as the higher US interest rates may cause capital flight as investors seek to sell local assets and invest in US securities to benefit from the higher rate. Large outflows of assets and capital from a country can negatively impact the value of the exchange rate.

Outlook

The Federal Reserve has been transparent in its communication on future rate hikes which allows the markets to price these future policy actions in long before they occur. This transparency may act to stimulate investor confidence which may ultimately lead to growth in the US equity markets. There does exist room for volatility should the Fed announce accelerated rate hikes to combat inflation.

Despite these expectations however, there are other factors which may negatively impact the performance of US equity markets. One such example is the current war between Russia and Ukraine. Further escalation of the war may have a negative effect not only in the US but also global equity markets, thus increasing volatility and reducing investor confidence.

As a result of these factors, investment bank Goldman Sachs has forecasted the S&P index to end 2022 at 4,700 points, while J.P. Morgan’s forecast is at 5,050 points. As at 23 March 2022, the S&P closed at 4,470.34.

On the bond market front, as interest rates increase, the price of active bonds falls since new bonds coming onto the market would have more attractive yields for the same level of risk. With the anticipation of relatively predictable rate hikes through 2022, bond yields are expected to rise.

As it pertains to the local economy, with the recent easing of restriction measures and the pick-up in business activity, a move to increase the interest rate now may cause this momentum to slow down or be derailed altogether. With no hint from the CBTT of any policy changes we will be monitoring for signals as to their outlook in the monetary policy announcement coming at the end of this month. The worrying rise of inflation does still leave room for the possibility of the repo rate being lifted higher.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.