The Jamaican Stock Exchange

Commentary

History

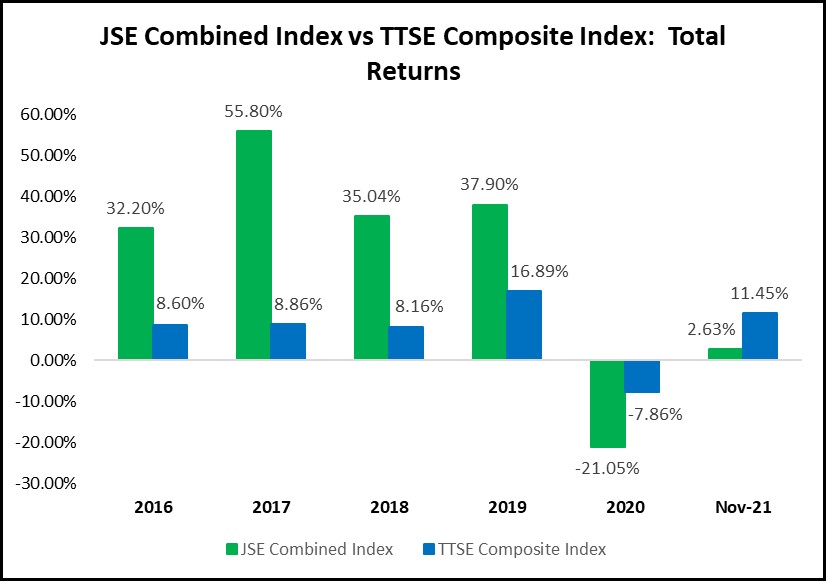

The Jamaican Stock Exchange (JSE) was the first stock exchange established in the Caribbean. It was incorporated in 1968 and commenced operations in 1969. The JSE stands as one of the largest stock exchanges in the Caribbean with a market capitalization of USD12.16 billion, only behind the Trinidad and Tobago Stock Exchange (TTSE) which has a market capitalization of USD21.4 billion. Despite the TTSE boasting a larger market capitalization, the performance of the JSE over the past few years has yielded superior returns, with the JSE Combined Index increasing by over 200% in the five years prior to the pandemic vs 28% for the TTSE Composite Index. The JSE was named on two occasions as the World’s Best Performing Stock Market by Bloomberg in 2015 and the Financial Times in 2018. In 2019 Bloomberg also recognized the JSE as the fifth best performing exchange out of 94 exchanges that were tracked.

The JSE’s growth is also tied to the dramatic turnaround in the Jamaican economy which saw the country successfully exit its IMF programme in September 2019. Jamaica’s adherence to the strict terms of the IMF’s programme, including running one of the largest budget surpluses in the country’s history would have resulted in debt to GDP falling below 100% for the first time in nearly two decades. Rising optimism has helped push unemployment to a record low and triggered increased investor sentiment in the JSE. While the pandemic has tempered growth over the last year, the JSE remains an attractive market both from an issuer and investor standpoint.

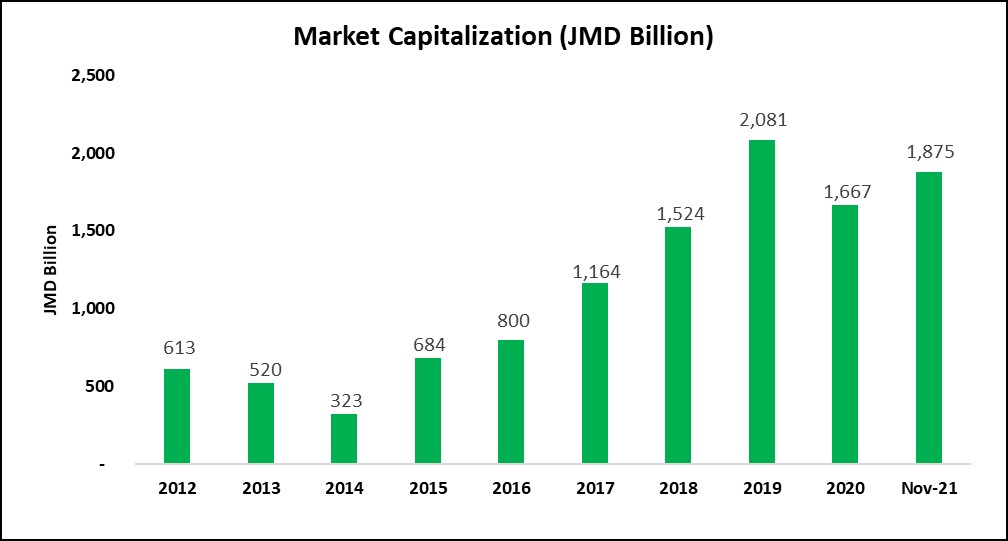

Market Capitalization

The JSE’s market capitalization, also known as the total dollar market value of the exchange’s outstanding shares, has increased significantly over the last 10 years. The capitalization of the exchange has increased by 178% between December 2015 and November 2021. The stock exchange’s market capitalization reached a peak of JMD2.08 trillion in 2019 however there was a 19.9% decrease in 2020, mainly as a result of the negative impact of the pandemic on global financial markets including the JSE. During 2021 however, the JSE has recouped the majority of losses incurred during 2020 and has increased year to date by 14.23% with a market capitalization of JMD1.9 trillion.

Number of Listed Companies

In addition to the growing market capitalization, the number of companies listed on the exchange continues to gain momentum. The total number of listed companies on the JSE over the last five years have increased by more than 50%. This growth highlights the attractiveness of the exchange to both domestic and regional companies.

In Jamaica, the Initial Public Offering Market – the process of a private company listing its shares on the stock exchange, is quite strong relative to its Caribbean peers. For the period 2015 to 2020, 32 new companies were listed on the JSE, increasing the number of listed companies from 60 in 2015 to 92 in 2020. For the period 2015 to 2020, the TTSE recorded four new company listings however the total number of listed companies remained at 33 in 2020 as other companies delisted from the TTSE.

The majority of listings on the JSE have occurred on the Junior Market by small and medium sized businesses with much of the attractiveness emanating from the generous 10- year Government tax incentive. New companies listed on the Junior Tier enjoy a five-year waiver of corporate taxes, followed by a 50% reduction in corporate taxes for the final five years. The JSE Main Market has also attracted regional attention with Trinidad and Tobago-based Guardian Holdings Limited cross listing in 2021 and is to be followed by Massy Holdings Limited. Massy is scheduled to cross list on the exchange in January 2022.

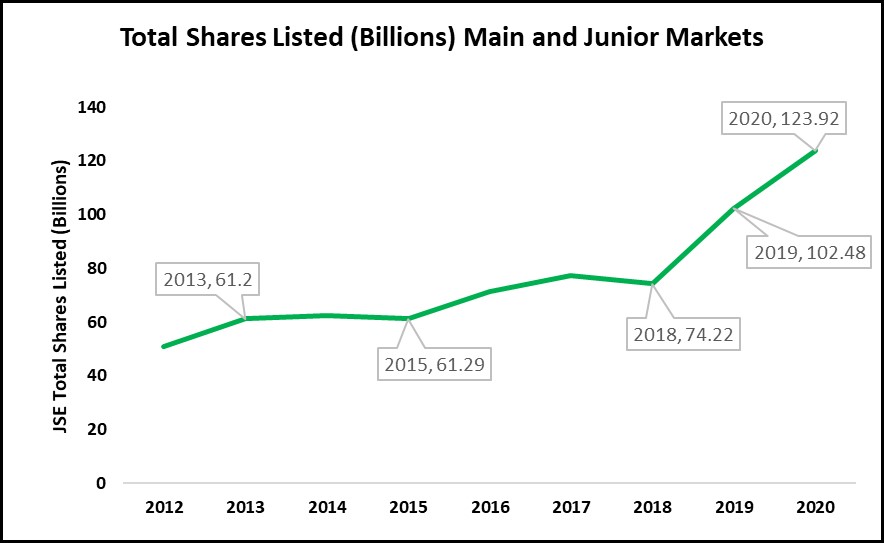

Rise in Number of Shares Listed

As a direct result of new company listings, as well as additional public offerings by existing companies on the exchange, the number of shares listed on the JSE has trended upward. The highest growth over the last five years occurred in 2019 which saw a 38.08% increase, resulting in total listed shares increasing to 102 billion. This was followed by a further increase of 20.92% in 2020. The upward trend in the number of shares listed highlights the confidence in the market and this momentum is anticipated to continue as more companies seek to list on the exchange.

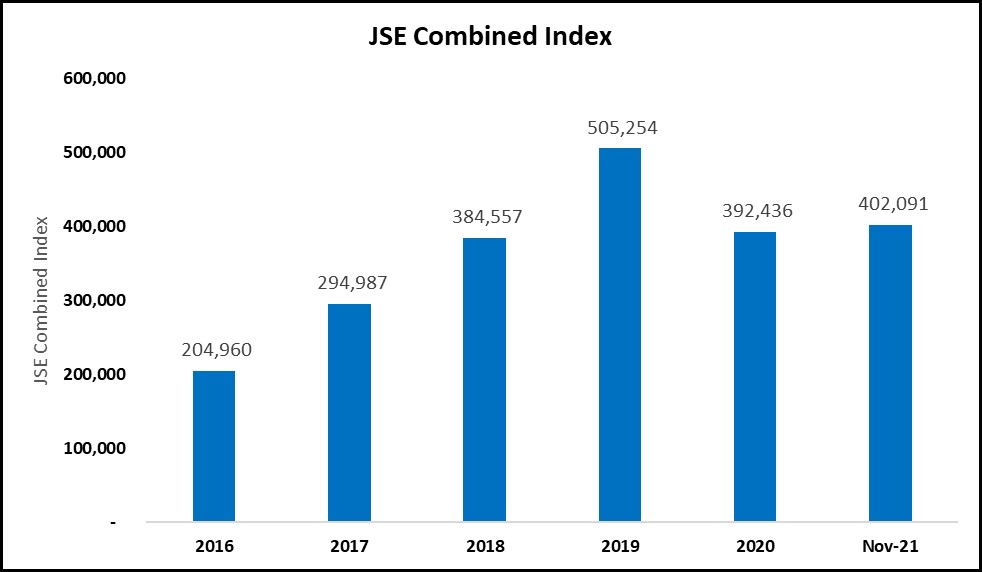

JSE Index Performance

The JSE comprises of four main equity markets, these include the junior market, the main market, the USD market and the combined market. Over the last five years, all indices have experienced phenomenal growth with the JSE combined index increasing by 96% over the period December 2016 to November 2021. This represents significant growth considering the adverse effects of the pandemic on global financial markets in 2020 with the JSE combined index declining by 21.05%.

The JSE main market and junior markets have also trended upwards with the main market increasing by 107% over the period December 2016 to November 2021. The junior market also increased by 30% during this period. The average daily share volume traded on the exchange has also increased significantly over the last five years reaching a peak of 34.8 million in 2019, when compared to an average daily volume of 7.4 million in 2015.

The strong performance of the main market coupled with an active junior market has generated positive investor sentiment towards the overall stock exchange, despite the drawbacks associated with the pandemic.

2022 and beyond

The headwinds of the COVID-19 pandemic have negatively affected financial markets globally and has impacted the JSE with all of the major indices declining in 2020. Despite these challenges however, the exchange has rebounded in 2021 with all major indices reporting growth on a year to date basis. In addition to the gradual improvement of the market, equity raising activity via Initial Public Offerings (IPO) and Additional Public Offerings (APO), which is the sale of additional shares to the public, has flourished. Based on information from the JSE, a total of JMD25.3 billion was raised in 2021 through IPO and APO activity.

Despite the prevailing challenges, the JSE has proven resilient. The strategic initiative to transition towards a digital environment through continued investment in the JSE’s online trading platform would have facilitated the smooth operation of the JSE’s trading system during the pandemic. This adds a layer of sophistication to the overall market which may enhance investor sentiment going forward. It is strongly believed that that the JSE will continue to reap the benefits of the prior years’ investments in its operational efficiency and human capital that will serve to accelerate the growth of the exchange despite the challenging macroeconomic backdrop caused by the pandemic.

The IMF in its Article IV report for Jamaica which was published in November 2021 indicated that tourism has rebounded to around 70% of its pre pandemic levels, despite experiencing two Covid-19 waves in 2021. Real GDP growth in Q2 of 2021 was 14.2% higher than the same period in 2021. The IMF projects strong growth of 8.25% in FY2021/22 which will moderate to around 3.5% in FY2022/23. The Covid-19 virus remains a major threat to Jamaica’s recovery as new Covid-19 waves in Jamaica or abroad could lead to a more prolonged disruption of tourism, trade and capital flows, which can have implications for the performance of the JSE.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.