The Global Supply Chain Disruptions – Is There an End in Sight?

Commentary

A supply chain is the network between a company and its suppliers to produce and distribute a specific product or service to the consumer. Producers, vendors, warehouses, transportation companies, distribution centres, and retailers are all key players in a supply chain that needs to work in unison to function efficiently.

News of rising inflation, labor shortages, scarcity of goods and materials, and images capturing the congestion of cargo ships at ports worldwide have ricocheted across financial news over the past year. The Covid-19 virus that bulldozed its way into economies worldwide in 2020 left the global supply chain, the backbone of global trade, ravaged. Globally, ports remain backlogged with cargo ships waiting for days to unload, freight charges remain elevated around record highs, shortage of truck drivers available persist and shortages of important materials all remain on the list of things wrong with supply chains today.

What caused the disruptions?

Stringent social distancing protocol to limit the spread of the Covid-19 virus drove populations indoors and forced companies to keep their stores closed (with the exception of essential businesses). As a result, the global economy, and by extension supply chain networks, were drastically disrupted. Unemployment increased as workers were laid off or left their jobs. Manufacturers shut down production and in some cases operated at reduced capacity as workers got sick from the Covid-19 virus, leading shipping companies to cut their schedules in anticipation of a drop in demand for moving goods around the world.

With unemployment rising and the economy being stifled, Governments and Central Banks lent their support through monetary and fiscal policies including stimulus payments to citizens. By the time vaccinations became available and the economy was allowed to gradually reopen, pent up demand from a stimulus fueled population saw a strong rebound in orders which was too intense for suppliers who were still operating at a reduced capacity. Supply chain networks became bombarded with increasing orders which essentially led to the prolonged supply chain disruptions currently being faced.

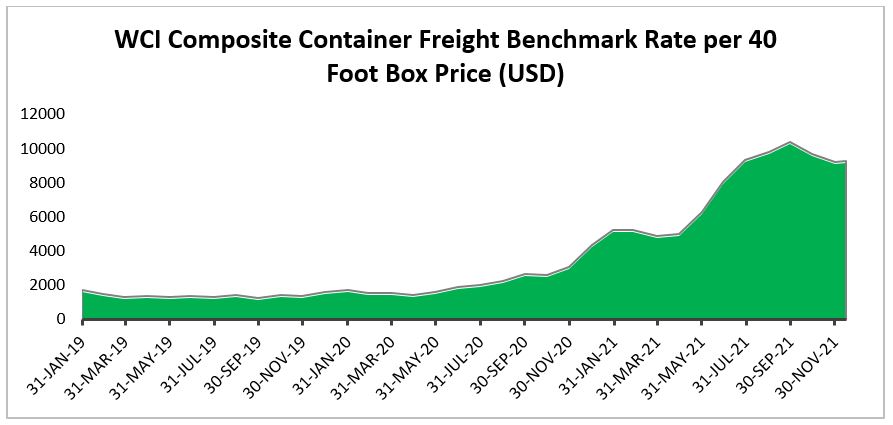

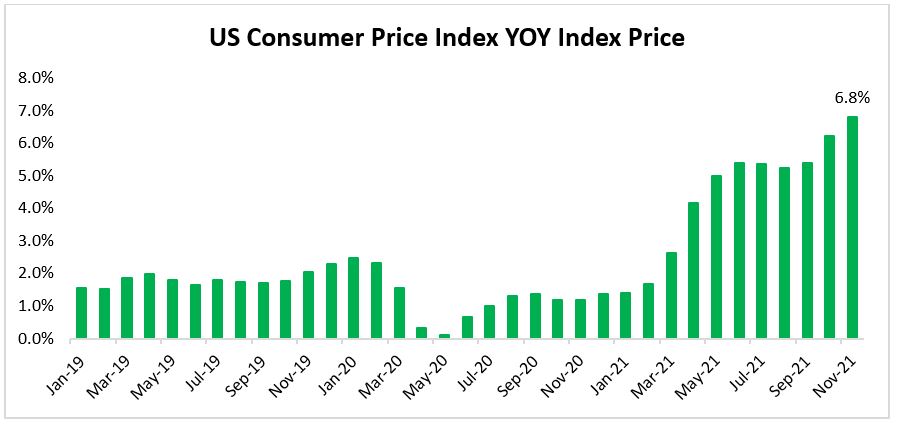

Freight costs rose rapidly from 2020 into 2021 hitting record highs as surging demand resulted in a shortage of containers available. The WCI Composite Freight Benchmark Rate per 40 Foot Box shows an increase from US$1,591.80 at the beginning of 2020 to a record high of US$10,360.87 as at Sept 2021. Inflation also began rising sharply as supply could not keep up with demand coupled with rising shipping costs. The U.S. CPI Urban Consumers YOY Index shows inflation dipping to near zero in Apr and May 2020 when lockdowns began before roaring back to highs of 6.8% as at Nov 2021.

Sectors most affected

Autos & Electronics

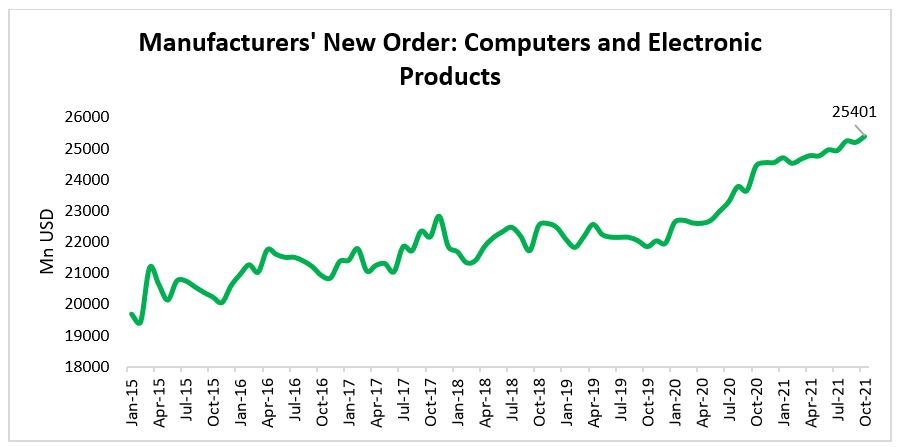

Microchips have become a staple in the manufacturing of products such as vehicles, communication devices and other household items. Since the pandemic, the demand for communication devices has soared given its increased importance in a world underscored with social distancing and remote working and schooling. Manufacturers’ new orders for computers and electronic devices shows new orders peaking with data available as at Oct 2021.

The pandemic has accelerated the digital revolution and these chips are fundamental ingredients for same. The digital revolution is also being complemented by the green revolution, with Electric Vehicles (EVs) set to be the future of transportation and a means to notably contribute to the reduction of Co2 emission. While manufacturing of these chips were temporarily shut down during the pandemic, demand raged on during periods of lockdown and even afterwards, leading to an inevitable shortage. With these microchips now key to modern society, demand is expected to remain strong.

Retail

The retail sector by nature relies heavily on the movement of goods from suppliers to their warehouses and their stores. In many instances, retailers usually furnish their shelves with a number of different brands and items meaning that they rely on a number of different suppliers from many different geographic locations. With the pandemic affecting supply chain networks worldwide, their inventory levels would be expected to experience some depletion given elevated demand.

In the U.S., prices at retail stores continue to rise in light of the headwinds being faced by corporates. Procter & Gamble, one of the largest consumer goods companies in the country, announced in October that it intends to again increase prices of its products given the increased freight and commodity costs being faced. Other consumer giants like Nestle, Coca Cola and Kimberly Clark have already raised prices this year to protect their profit margins from being eroded by increasing supply chain related costs.

Construction & Materials

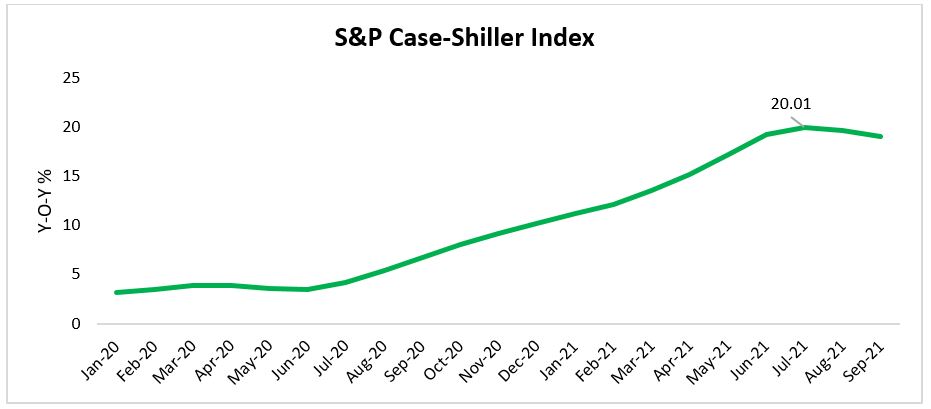

Construction is another industry that was placed on a stand-still during lockdown periods as ongoing projects were halted and new projects were delayed. The demand for housing in the U.S. was strengthened by record low mortgage rates as the the Federal Reserve dropped the federal funds rate to between 0% and 0.25% to help the economy fight the pandemic. A housing boom ensued and with supply somewhat constrained, demand pressure caused prices for materials to skyrocket with lumber and steel hitting record highs in 2020. House prices rose sharply as demand increased while supply shrank. Demand was boosted by a combination of record low-mortgage rates, social distancing protocols and work from home practices making home-ownership more attractive. The S&P Case-Shiller Index which tracks the value of single family housing in the US saw a sharp rise in prices towards the end of 2020 which continued into 2021 reaching a peak in July 2021.

Impact on the Caribbean

Caribbean countries’ reliance on imports from outside of the region, namely the U.S. makes them especially susceptible to supply chain disruptions. The top imports into the region are energy, agricultural items and equipment/machinery. In 2013, according to an Inter-American Development Bank, the Caribbean imported 93% of its energy demand (with the exception of T&T) while only 12.7% of food imports were sourced from within the Caribbean according to a CARICOM report. Though many of the islands in the Caribbean have already started to invest in renewable energy to become more energy efficient, they still currently rely on these sources and the increasing energy prices would increase their import bill while the pandemic continues to affect tourism in the region.

In Trinidad and Tobago food inflation is up to 4.9% in July 2021 compared to 3.2% in January 2021. Companies, namely in manufacturing, are faced with a limited supply of materials as well as high freight and commodities prices which are increasing their costs. Companies in this sector have seen their revenue and profit erode despite efforts to trim costs. According to data sourced from the TTSE, the Manufacturing I sector has seen its shares’ prices fall by 6.97% for the year thus far. Excluding Angostura Holding Limited, the stock prices for companies in Manufacturing I sector are down 9.8%.

When will it end?

Many analyst and logistic professionals believe that the ongoing supply chains disruptions would last into late 2022 and possibly into 2023. A Moody’s report published earlier this month indicated that they expect the Supply Chain stresses to show signs of easing in the first quarter of 2022 and recede gradually throughout that year.

Despite the persistent mismatch between supply and demand, trade activity is strong and the labour market continues to improve to address the labour shortage. Some reports on the supply chain dilemma shows that there are signs that it has already begun to ease. Ocean freight rates have retreated from record levels, cargo ships congestions at ports are easing and supplier delivery times although it lengthened again in December still remain lower than in previous months. Also, major retailers in the U.S. including Walmart and Home Depot told investors that they are sufficiently stocked ahead of the Christmas holidays.

Considering the current state of the global supply chain, any added kinks in the chain would further delay a return to normalcy. The key risk to recovery currently is the re-emergence of covid-19 cases once again led by the new Omicron strain that is spreading more rapidly than any other Covid-19 variant. Another risk to supply chain recovery comes through the Biden administration vaccine mandate that may lead employees, like truck drivers, to leave their jobs, further exacerbating the labour shortage.

As the supply chain problems continue, elevated inflation is expected to continue in 2022 and possibly into 2023. Without any viable options to notably mitigate against the supply chain disruptions in sight, economies would have to face the realities presented as best as possible until the bottleneck clears up and the flow of goods and forces of demand and supply gradually return to pre-pandemic levels.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.