Special Economic Zones (SEZs)

Commentary

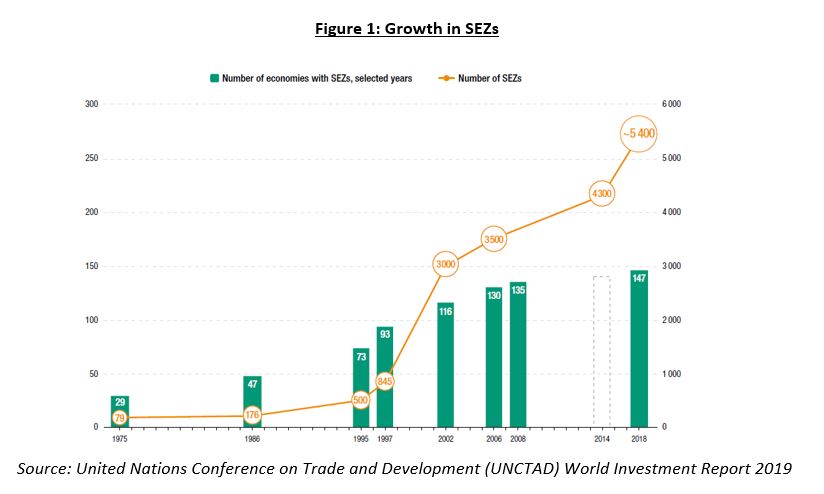

In the budget presentation for fiscal year 2021/2022, the Trinidad and Tobago government expressed its interest in implementing Special Economic Zones (SEZs) as a means to comply with global requirements, including those of the European Union (EU). This would be done via a repeal of the current Free Zones Act of 1988 in favor of the Special Economic Zones Authority which would regulate these authorized zones. SEZs are areas in a country which are designated for industrialization. The sectors which operate in SEZs can range from Agriculture (in the form of Agro Processing Plants) to STEM-based sectors (such as IT services, Pharmaceuticals, Engineering Products, etc.). They offer different regulations, approved by the government, which allow for an environment that promotes quick and efficient production in a hassle free manner. A United Nations (UN) report in 2019 estimated the number of operational SEZs worldwide to be 5,383 spread across 147 economies. SEZs are a popular tool used among developing economies as a means to spark industrialization and diversification. Asian economies account for around 75% of all operational SEZs, with China alone accounting for almost half of all SEZs worldwide. Figure 1 shows how the number of SEZs as well as the number of countries adopting them have grown over the years.

One of the overarching benefits of SEZs is that businesses are able to operate more competitively. In order to efficiently approve businesses and get them licensed to operate in the domestic economy, administrative processes are usually streamlined. Tax advantages are the most common incentive offered to businesses. In the past there have been complete breaks from corporate taxes for a limited period of time, usually between five and ten years, after which they would be subject to a rate which is still lower than the national average.Relaxed customs duties is another major benefit. A large number of businesses that operate in SEZs are involved in some form of manufacturing. Duty free imports on raw materials and exports of finished products and intermediaries allow for prices that may be more competitive on a global scale.

Infrastructural benefits may be provided in the form of further developed land, factory shells, or preferential rates for utilities which can facilitate quick startup of business operations.

An economy that facilitates SEZs can benefit both directly and indirectly. The first and most obvious potential benefit would be an increase in investments, both domestic and international with private investors targeted. For Small Island Developing States (SIDS) such as Trinidad and Tobago, much needed foreign investment will boost reserves and offer more external liquidity buffers. Export-oriented companies further aid the foreign exchange needs of SIDS.

Employment opportunities can arise in both the short and long term with the introduction of SEZs – short term employment in the form of construction required for initial infrastructure; long term employment would come from the operations of the company. Spillover effects can also arise from the employment generated. This can come in the form of domestic labour acquiring the skills necessary for the SEZ; this benefit can be limited if permanent workers in high skilled operations are not from the domestic labour but outsourced.

Some problems can also arise from SEZs resulting in the main, from lack of proper oversight. This must be proactively guarded against as it could result in SEZs becoming havens for illicit activities. The relaxed customs duties in itself could promote a lack of transparency by businesses in SEZs, however, it may also lead to lapses by customs for imports and exports for SEZs. Complications may also arise for countries that are a part of the World Trade Organization (WTO). The benefits offered must be compliant with the WTO’s mandates. In 2019, India lost a case against the WTO regarding the subsidies given in SEZs, and as a result their policy had to be redrafted. Costs attached to gain approval to operate as an SEZ or to transition a business entity as an SEZ may be unattractive. An example of this is in Jamaica where many former free zone businesses did not transition to SEZ status due to the cost attached. The productive capabilities and economic contribution of SEZs diminishes over time, tending towards being in line with the rest of the economy after the initial setup. Adherence to sound industrial relations policies for workers in an SEZ is also essential. In 1988 some allegations of unfair practices arose in Jamaica.

In Trinidad and Tobago, the current Free Zone act offers benefits to businesses that are primarily export based, with the exception of some services. Businesses whose operations are in Manufacturing and Assembly, International and regional trading and distribution of products, Banking services, Insurance services, and professional services are all approved for Free zone benefits. The benefits enjoyed are exemptions on import taxes and duties, exemption from land and building taxes, exemption from income tax, corporation tax, business levy, and taxes relating to sales, receipts and profits or gains from the approved activity. Companies which are engaged in the Petrochemical sector do not benefit from Free Zone status.

Amending the current Free zone regime can allow for a wider scope of approved activities to benefit, potentially in industries that have been left behind in the economy, such as agriculture. The Finance Minister in the 2021/2022 budget presentation said: “The Authority’s function will include reviewing and assessing the performance of all Special Economic Zones; formulating standards and prescribing codes of practice to be observed by operators in the Special Economic Zones; facilitating an enabling environment in areas designated as Special Economic Zones; developing the modern infrastructure required to attract foreign direct investment and stimulating domestic investment; promoting economic development in local communities and advancing further diversification of the economy.”

SEZs a Mixed Bag: The recent case of India.

India has rapidly developed to become a leading world economy, currently ranked as the 6th largest in the world by GDP. India’s economic success stems from the implementation of economic reforms since 1991 which saw heavy industrial development for the economy. The reason these reforms became necessary was due to a debt crisis stemming from unsustainable government spending (primarily financed from loans) and low production. Among the many policies implemented, SEZs were introduced.

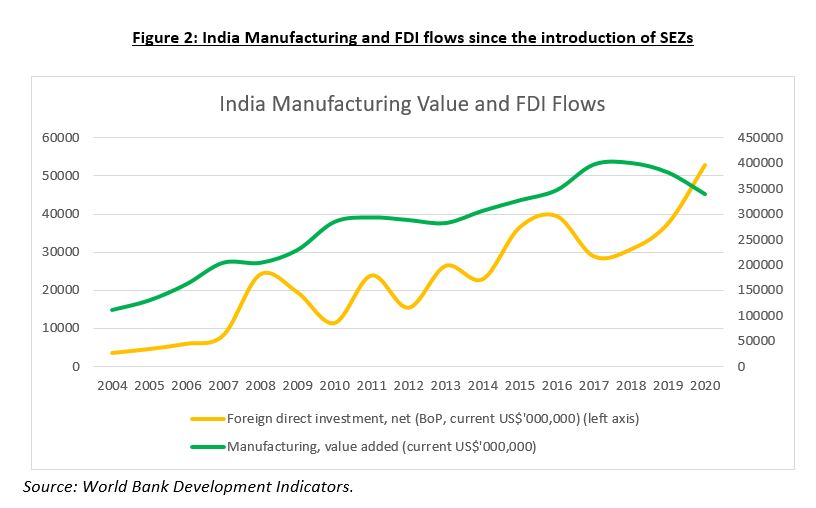

In order to facilitate proper implementation, the SEZ Act was passed in June 2005, closely modelled after the extremely successful Chinese model. This Act laid the foundational rules and regulations that would be present in SEZs, it also outlined how their Export Processing Zones (EPZs) were to be converted to SEZs. The approved business activities were outlined as well; being in line with government’s goal to increase Foreign Direct Investment (FDI) by allowing companies in industries that would offer a major contribution to the Indian economy. With regard to attracting foreign firms to boost FDI and boosting overall manufacturing output, SEZs have been very successful for India. This success is shown in Figure 2.

While most of the benefit enjoyed was in industrial sectors, the financial sector of India also saw benefits with the introduction of SEZs. Banks which established themselves in SEZs were not subject to the monetary policies of the Bank of India. They were instead allowed to provide financing at global rates, increasing their competitiveness.

The problems faced by India with SEZs

Much of the problems India faced with SEZs come in the form of bureaucracy and allegations of corruption. The political system in India is much different to that of China; India follows a democratic political system, meaning that those in charge serve their term but are not guaranteed multiple successive terms. This has given local politicians less incentive to promote the long term growth goals of SEZs. Research from Princeton University indicated that the selection of SEZs did not consider maximizing growth and development in India, instead having self-serving agendas. This is compared to the environment in China where even if the level of corruption may be the same, there is greater incentive to maximize the amount of productive SEZs due to longer political terms. From the business side of things, India saw problems with the tax benefits offered to companies. Businesses in SEZs were exempt from their Minimum Alternate Tax (MAT) and Dividend Distribution Tax (DDT), major factors attracting businesses, however, this benefit was abused. Real estate arbitrage occurred and Information Technology companies which had tax benefits from the Software Technology Parks of India scheme were using the guise of an SEZ to regain tax benefits they lost when the scheme ended.

Conclusion

SEZs can offer some much needed benefits to the Trinidad and Tobago economy. Promoting economic activity, boosting foreign reserves by promoting exports, and even diversification of the economy are just some of the benefits that can be enjoyed. However, the mistakes and drawbacks of SEZs regionally and internationally must be taken into account to draft an effective legislation for the proposed SEZ authority. Proper regulation and oversight will also be required in order to ensure international compliance, a beneficial contribution to the economy, and to minimize the risk of illicit activity.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.