International Stock Market 2021 Performance

Commentary

After a tumultuous year of volatility and uncertainty in 2020 as the coronavirus pandemic tore into economies globally, stock markets saw record losses as lockdowns and restricted movement contributed to a dim economic environment underscored by rapid unemployment and the erosion of corporate earnings. Swift implementation of supportive government policies to boost the economy as well as strong international vaccination campaigns early in 2021 provided stability for economies and allowed financial markets to mount a recovery.

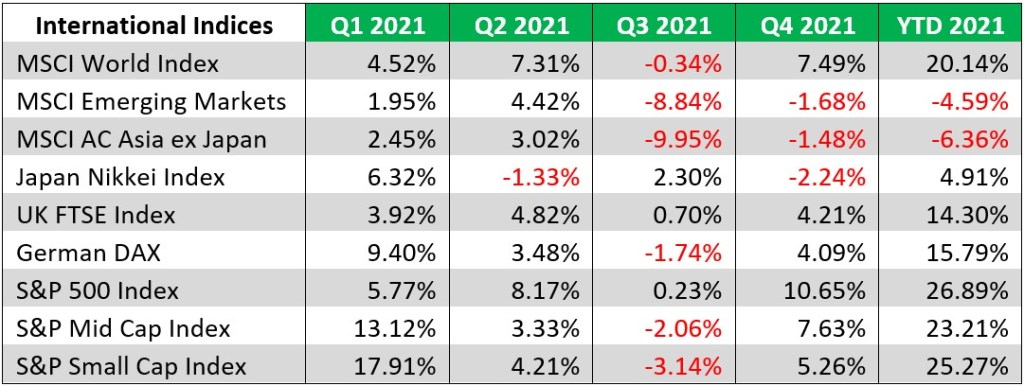

The MSCI World index, a benchmark for global equities, gained 20.14% in 2021. The index was led by the U.S. (which has the highest country weighting in the index) as well as the performance of the Information Technology Sector (IT) (which has the highest sector weighting). Despite a strong dip in U.S. stock indices in late November 2021 on fears of the new omicron variant of covid-19 as well news from Fed officials stating that they may seek to end bond buying stimulus support sooner than expected, stocks rebounded returning 26.95% on the S&P.

In Europe, the stock market recorded its best year since 2016 as vaccination provided room for comfort, bolstering investor confidence. Despite rising inflation and severe supply chain bottlenecks throughout the year, economic headwinds were largely shrugged off by investors with stocks gaining 13.33% in 2021.

In Asia, Japan trailed the other indices with a 4.9% gain, led by semiconductor equipment makers. China’s stock market performance on the other hand, was its worst in a decade with a 14% loss in 2021 owed largely to regulatory crackdown which hampered sectors affecting e-commerce, videogames, property, gambling and after-school tutoring.

Stock markets in the emerging markets also underperformed in 2021 given the headwinds being faced coupled with vaccination drives that trailed the more developed economies. The MSCI Emerging Markets Index fell by 4.59% in 2021 with China being among the worst performers.

U.S. Stock Market Performance

The first round of earning releases in the U.S. in 2021 were off to a better than expected start and set the tone for corporate earnings throughout 2021 with the economy being supported by continued stimulus support as well as a strong vaccination drive which allowed for the gradual reopening. According to FactSet (a financial data and software company), the estimated year-over-year earnings growth rate for 2021 was 45.1%, the highest since it began tracking the metric in 2008.

The U.S. stock market had a recording breaking year in 2021 with the S&P500 hitting record highs 70 times. The S&P 500 closed the year at 4,766.18, the Dow Jones Industrial Average at 36,338.30 and the Nasdaq Composite at 15,644.97. The S&P 500 rose 26.89% in 2021, its third consecutive year of growth, with the Dow and Nasdaq also notching three-year winning streaks, gaining 18.73% and 21.39% for the year, respectively.

Top Performers and Major Decliners

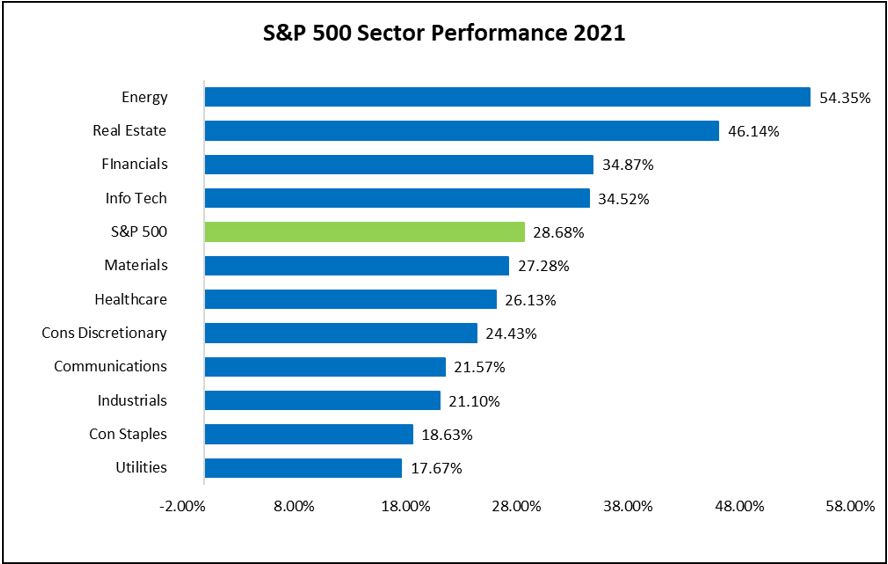

All eleven sectors on the S&P 500 posted gains in 2021 with four of the sectors out-performing the index. The bottom three sectors in 2020 led the S&P 500 in 2021. The best performing sector on the S&P500 in 2021 was Energy, after being the worst performer in 2020, with a gain of 54.35% as the demand for energy recovered as movement restrictions eased and air travel picked up. The Real Estate sector, the runner up loser of 2020, was the second best performing sector in 2021 with gains of 46.14% led by a high demand for homes as construction resumed, encouraged by persistent trends of remote working and social distancing, coupled with record low mortgage rates. Financials was next with a gain of 34.87% with Info Tech, the top performer in 2020, right behind with a gain of 34.52% continuing to take centre stage as digitisation accelerates.

The worst performing sectors on the S&P were Industrials, Consumer Staples and Utilities which gained 21.1%%, 18.63% and 17.67% respectively.

Fixed Income Performance

Rising inflation and a bumpy economic recovery saw bond markets endure a turbulent year. As 2021 progressed, persistent inflation presented continued headwinds to fixed income with the Fed holding rates near zero. The Bloomberg Treasury index provided a total return of -2.3% in 2021, its first slump in nominal terms since 2013. Bond indices largely produced losses in 2021 with the Barclays U.S. Aggregate Bond Index down 1.51% for the year after rising 5.21% in 2020. The Schwab US Aggregate Bond Index Fund also fell by 3.79%.

Local Stock Market

The performance of the TTSE improved in 2021 in line with global trends as economies continued towards recovery. In 2021, as opposed to the performance in 2020, all the indices on the TTSE were up with the Composite Index gaining 13.14%, the All T&T Index 17.61% and the Cross Listed Index gaining 3%.

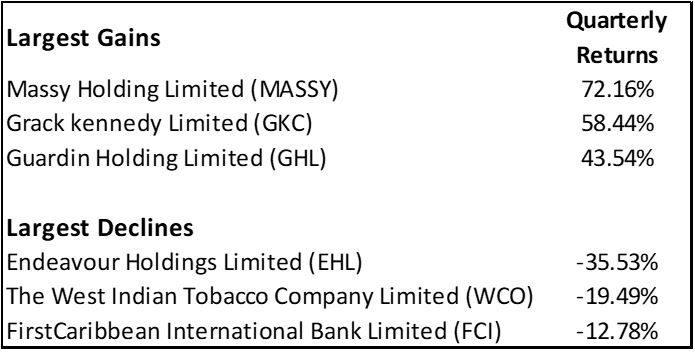

In 2021, a steady resumption of business activity locally and in the region saw many companies on the TTSE improve as earnings rebounded and margins began recovering. Major company news on the exchange included GHL’s cross listing on the Jamaica Stock Exchange (JSE), Massy’s continued divestment in non-core business and news of their intention to cross list on the JSE. The government imposed quotas and tariffs that saw Rock Hard Cement exit the Trinidad cement market leaving Trinidad Cement Limited to operate as a monopoly.

Sector Performance

The scale and diversity that characterize the conglomerates allowed them to withstand the headwinds faced in 2020 and build momentum in 2021 to lead the TTSE. The conglomerates, comprising three companies, AMCL, GKC and Massy, lead the sector in 2021 with all equities gaining in 2021 seeing a combined average stock price appreciation of 47.27%. Massy was the top performing company in the group, seeing a gain of 72.16%. News of the company’s intention to list on the JSE also added to the buzz around the company.

The manufacturing sector, consisting solely of TCL, ended the year with a 43.2% return. The company benefitted by a resumption of construction activity as well as its improved competitive position after Rock Hard Cement exited the market in August 2021.

The energy sector rebounded after being the worse performing sector in 2020 amid lockdown protocols globally. The energy sector on the TTSE, which comprises only of NGL, improved by 22.94% as energy prices recovered due to increased demand for travel as restrictions were lifted.

The Manufacturing I sector, comprising of six (6) equities, was led by the performance of AHL which posted a return of 9.76%. The other stocks, GML, NFM, OCM, UCL and WCO, all recorded negative returns resulting in a combined average loss of 6.96%. This sector was the hardest hit in 2021 as inflation, shortage of inputs and increasing inputs costs hampered earnings.

Trading Activity

After falling by 20.36% in 2020 to its lowest over a five-year period, trading activity in 2021 flourished with a 54.7% increase in shares traded to 94,770,267 on the first tier of the TTSE. This figure easily represents the highest volume of trading activity over the last five years. The value of shares traded rose by 26.1% to TTD1.3 billion when compared to 2020 snapping two years of consecutive declines in the year prior.

Outlook

Financial markets will have to navigate through rising inflation and severe supply chain disruptions well into 2022 with the usual uncertainty surrounding Covid-19. Added to the economic headwinds already being faced, government policies that were implemented to support the economy early in the pandemic are set to be unwound. To combat inflation, Fed officials in the latest Fed meeting (January 2022) indicated that bond purchases should end by March 2022. Interest rates, which were anchored at near to 0% to promote economic activity is now expected to start increasing from March 2022.

Expectation of the U.S. stock market is mixed and seemingly hard to predict given all the forces at play with much volatility expected. Wells Fargo expects the momentum on the S&P to hold throughout the year ending at around 5,300 while on the other end of the spectrum Morgan Stanley has a year-end target for the S&P 500 of 4,400, which would represent a decline of around 9%. The general consensus by professionals and financial news outlets is that the S&P will at least see single-digit gains this year.

The stock market is expected to record further gains in 2022 while fixed income securities are expected to remain largely flat. Persistent inflation in a low interest rate environment continues to subdue the attractiveness of fixed income securities. With interest rate hikes imminent in 2022, fixed income securities would become more attractive but would still pale in comparison to the returns expected from riskier assets. Fixed income assets would remain a shock absorber for the financial markets should conditions lead to glaring volatility and subdued investor confidence.

On the Local Stock Market, the impact of the global supply chain disruptions, elevated freight charges and inflation are expected to continue to affect local business, especially those that rely on imports. We expect more recovery in 2022 as companies continue to adapt to survive in the new economic environment. The Manufacturing I sector is expected to continue to face similar challenges in the first half of 2022 at least, which would likely depress company earnings for most of the sector. Investors should be wary of any developments in the areas affecting the market as they manage their portfolio in 2022.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.