Global Tourism Outlook 2022

Commentary

As one of the industries most dependent on globalisation and the ease of travel, tourism has been one of the hardest hit by the COVID-19 pandemic, which is now entering its third year. The spread of infections as well as the restrictions necessary to contain it, have impacted the industry with the concomitant loss of output and jobs. Nevertheless, some green shoots of recovery began to show in 2021 as vaccination rates rose globally and countries entered a policy and public health regime of ‘living with the virus’.

2021 in Review: Improved but Not Fully Recovered

According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals increased by 4% in 2021 to 415 million, compared to the 400 million observed in 2020. Extending the scope of the analysis, however, arrivals in 2021 were still 72% lower than they were in the pre-pandemic period. In dollar terms, tourism contributed USD1.9Tn in 2021, up from 2020’s USD1.6Tn, but still far from the USD3.5Tn recorded in 2019. Promisingly, longer stays as well as pent-up demand (supported by fiscal stimulus in the developed source markets) led to higher spending per arrival of USD1,500, up from USD1,300 in 2020.

In particular, the rebound in tourist activity took place mainly in the second half of 2021, as the availability and uptake of vaccines, gradually relaxed travel requirements in several major inbound destinations, and greater cross-border coordination among countries, allowed for more travellers to make business and leisure trips. All told, H22021 saw international arrivals at 62% below their 2019 levels, based on the UNWTO’s estimates, though it noted that the impact of the Omicron surge was yet to be incorporated.

2022 Outlook: Hopeful but Subject to Change

Organisations such as the UNWTO and the World Travel and Tourism Council (WTTC) have posited that tourism activity will continue to recover and strengthen in 2022. The UNWTO’s scenario analysis indicates a range of 30%-78% growth in international tourist arrivals for 2022, which would still register at 50%-63% below pre-pandemic levels. On the spending side, the WTTC forecasts that global international spending on travel will rise by 93.8% in 2022. Despite these hopeful estimates, the touted recovery is subject to a great deal of uncertainty.

Primarily, the emergence of the Omicron variant of COVID-19 and the potential for further variants have already dampened the outlook globally, and in particular regions which are forced to re-impose travel restrictions to limit their spread. Further, the variance in border controls around the world, with places such as the UK relaxing vaccination and requirements while others such as the Asian countries continue to restrict foreign entry, will be another variable influencing the differentials in national and regional tourism outlooks for 2022. Vaccine uptake and acceptance will also influence the ability of various countries to recover to pre-pandemic levels of travel and tourism activity. Much will also depend on the continued macroeconomic recovery in Europe and North America, the key source markets for most tourism-heavy destinations.

Domestic travel will be relied upon increasingly to cushion the impact of the pandemic on international arrivals, particularly in larger markets. This trend was already observed in 2021, as countries like China and the US noted increased domestic airline bookings as well as higher domestic hotel and hospitality revenue, according to EIU.

A further trend to watch out for in 2022, and a possible headwind to the tourism growth outlook, is a rise in air travel costs. In particular, as energy prices remain elevated and compliance with climate change regulation becomes a greater factor in the global travel industry, there is expected to be a significant impact on fuel costs and subsequently airfares. The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) developed by the UN, faces its first triennial review in 2022. Though CORSIA compliance is not expected to have a major impact in 2022, due to lower international travel demand compared to the business-as-usual scenario, this will be a factor moving forward especially as the price of carbon credits continues to climb. Other factors expected to drive travel costs higher include an anticipated wave of merger and acquisition (M&A) activity in the airline industry, along with rising industry wages as a result of inflationary pressures.

Caribbean Outperforms in 2021, Omicron Tempers 2022 Outlook

With 63% growth in international tourist arrivals compared to 2020, the Caribbean was the best-performing tourist region in the world in 2021, although this is tempered by the fact that arrivals were still 33% below their pre-pandemic 2019 levels. In contrast, the Asia-Pacific region saw a decline of 65% from 2020 arrivals. Many key Asian-Pacific tourism markets (such as Japan) remained closed to non-essential travel, as travel restrictions remain one of the region’s primary tools in fighting the spread of COVID-19. Having been relatively quick to ease travel restrictions and implement vaccine passport programmes for inbound travellers, Caribbean destinations (particularly in the northern Caribbean) saw an uptick in arrivals especially for H22021.

Immediately preceding the pandemic, in 2019, the Caribbean posted record stayover and cruise arrivals of 31.5 million and 30.2 million respectively, according to the Caribbean Tourism Organization (CTO). With the devastation of the pandemic in 2020, the WTTC estimated that 680,000 jobs in the Travel and Tourism industry were lost across the Caribbean, representing almost 25% of industry employment. For 2021 it estimated that jobs grew by 12% (compared to 0.7% globally), and forecasts further employment growth of 11.5% in 2022.

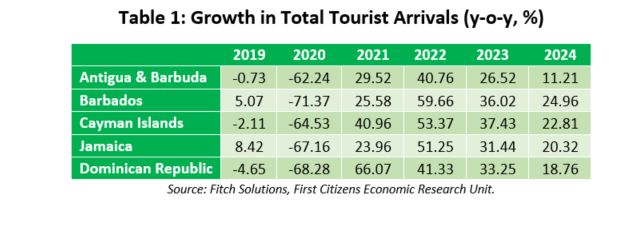

Table 1: Growth in Total Tourist Arrivals (y-o-y, %)

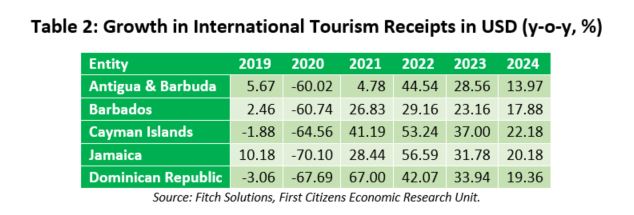

Table 2: Growth in International Tourism Receipts in USD (y-o-y, %)

Table 1 above shows the forecasts for 2022 total tourist arrival growth in key Caribbean destinations, according to Fitch Solutions. Each of the countries is expected see growth of at least 40% over their 2021 levels, with double-digit arrival growth continuing to 2024. Table 2 summarises the forecast for dollar receipts from tourism in the selected Caribbean countries, with broadly similar trends anticipated.

As is the case globally, the evolution of the COVID-19 pandemic is the main headwind to the Caribbean tourism outlook for 2022. Domestic vaccine uptake in the tourism-dependent Caribbean countries varies significantly. The Cayman Islands leads the way with 86% of its population fully vaccinated, while Jamaica lags behind at 21%, as of 31 January 2022. The emergence of the omicron variant has also put a damper on tourism, with the Dominican Republic, Puerto Rico, Jamaica, Aruba and the Bahamas all experiencing a fall in bookings between late November and early December, compared to their 2019 levels.

The worldwide surge in omicron cases has come at a particularly inopportune time for the Caribbean, as the first half of 2022 was set to feature an accelerated increase in winter arrivals from the key source markets. Since the arrival of omicron, the Caribbean Tourism Organization (CTO) has updated its outlook, noting that there were 5.4 million arrivals in Q32021 compared to around 1.8 million in the same period of 2020, and stating optimistically that “the exceptional results recorded in the summer to year-end period of 2021 show that a scaled or gradual rebound is likely and very possible by the end of 2022.” Fitch Solutions forecasts growth in tourist arrivals of 48.3% for 2022, though it maintains that overall numbers will remain below pre-pandemic levels.

Conclusion

Fundamental trends point in the direction of a limited recovery in global tourism for 2022. The key drivers of this recovery, as in 2021, will be increasing vaccination rates in both source and inbound markets, as well as the availability of spending power in the source markets. The Caribbean is set to maintain the positive momentum generated in 2021, with high rates of tourist arrival and spending growth expected for 2022, though pandemic uncertainty makes it difficult to project exactly.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.