Global Inflation Puts Pressure On Emerging Market Economies and Currencies

Commentary

Around the world, inflation has been reaching levels not seen for many years, with global prices rising 4.9% year-on-year in October 2021. Several major markets including the United States (6.2% y-o-y in October 2021), Russia (8.1%) and Turkey (19.9%) have seen significant increases recently. The region suffering the most from inflation has been Latin America, with Argentina (52.7%), Brazil (10.7%), Chile (6%) and Mexico (6.2%) all seeing price surges well beyond central bank estimates. Multiple factors, including supply chain bottlenecks in key industries affected by the COVID-19 pandemic, unprecedented stimulus spending in major developed markets (especially the United States) and spiking commodity prices, have all contributed to the latest inflationary wave.

Among 24 major economies tracked by Fitch Solutions in November 2021, inflation was above the respective central banks’ mid-range inflation targets in 13 countries, while 6 countries had inflation rates beyond their central banks’ upper inflation targets, implying that the surge in prices has been unanticipated and that decisive policy responses are likely to come sooner rather than later.

The US Response and Its Global Impact

While debate continues apace on whether the current uptick in US inflation is ‘transitory’ or otherwise, the emerging consensus is that the Federal Reserve (the Fed) will act to bring the inflation rate under control at some point in the next year. More specific forecasts of US interest rate increases are dependent on the pace of price increases in the coming months, with Goldman Sachs analysts expecting the Fed to raise rates as early as June 2022, while JPMorgan economists anticipate the increases to come later, perhaps in September.

The key points underpinning the argument for US inflation being transitory, are that the Fed has influence over the rate of inflation, and that the Fed’s credibility is dependent on it keeping inflation under control. Though the Fed has recently instituted flexible average inflation targeting (FAIT), a subtle modification from the inflation targeting regime it employed previously, it remains unlikely that it would allow inflation to continue at or above current rates for much longer before it hits the brakes and engages in tighter monetary policy. Given the importance of US economic decision-making on the global scenario, the timing and degree of the Fed’s response will have a major impact on the international outlook for 2022.

Emerging Markets Quickest to Act

Without the enviable position of managing the world’s reserve currency, central banks in several emerging markets (EMs) have had to act earlier and more decisively, to try to curb domestic price pressures and defend their currencies to the greatest extent possible. The difficulty of such decisions is increased by the disparities in growth performance between developed markets and EMs in 2021. While most developed countries have seen positive and even surging economic growth from 2020’s COVID-19 induced doldrums, most EMs have posted weak to non-existent recoveries. As a result, the imposition of contractionary monetary policy poses a latent threat to their already tentative short-term growth prospects. Despite these multi-faceted challenges, several EM central banks began raising interest rates in the second half of 2021. Russia has raised its benchmark rate by 325bps to 7.5% with a further rise to 8% anticipated by the end of 2021, while Poland raised rates by 75bps to 1.25%, with expectations of further rises to 2.5% by the end of 2022.

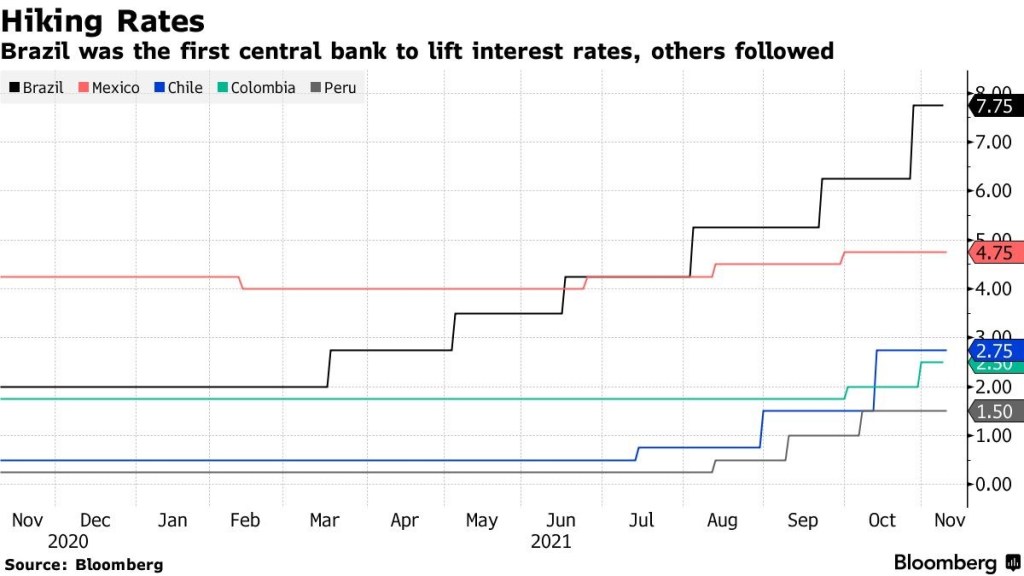

Figure 1: Selected Latin American Interest Rates,

November 2020 – November 2021

Given the widespread inflationary challenges in Latin America, the region’s central banks have unsurprisingly adopted aggressive rate increases, as illustrated in Figure 1. Chile’s benchmark rate has risen to 2.75% from 0.5% in July, while Brazil’s rate has risen steadily from 2% in March to 7.75% in November. Worryingly, though, the rate hikes have thus far had little impact on inflation. The global nature of the inflationary drivers – e.g. shipping costs and commodity prices – as well as the size of Latin America’s informal economy, have been cited to explain monetary policy’s ineffectiveness in the region. Moreover, the interest rate rises have not had the expected strengthening effect on Latin American currencies, as Argentina, Chile and Colombia’s have all fallen in value by over 10% in 2021, while Mexico and Brazil have also seen currency declines over this period.

Expectations for 2022

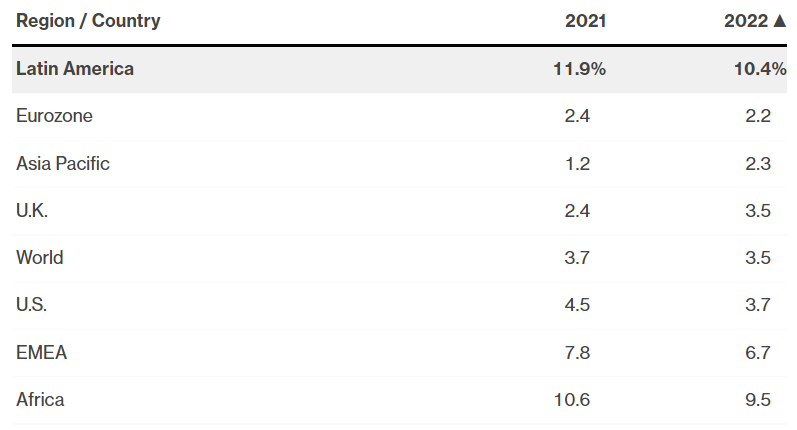

Figure 2: Inflation Expectations in Selected Countries/Regions,

2021-2022

Source: Bloomberg.

Inflationary pressures in the EMs are expected to persist through 2022, with Latin America leading Bloomberg’s survey of inflation expectations, as it did in 2021 (see Figure 2). Similarly, the prospects for EM currencies are projected to remain dim in the coming year, with the emergence of the omicron variant of COVID-19 triggering further flight from risky asset classes. Entering the third full year of the pandemic, 2022 promises a continued challenge to EM policymakers.

Based on the global inflationary situation, as well as the current and anticipated responses in major economies, the implications for Trinidad and Tobago in 2022 are evident. While headline inflation has remained moderate in 2021 (2.2% y-o-y in July), food price rises have accelerated noticeably (from 3.2% y-o-y in January to 4.9% in July) due to increases in global sugar, wheat and vegetable oil prices as well as logistical challenges.

In September, the Central Bank of Trinidad and Tobago (CBTT) maintained the repo rate at 3.5%. The CBTT is more likely than not to follow suit if and when the Fed raises rates in 2022, as a widening differential between US and TT interest rates would exacerbate capital outflows, worsening the downward pressure on the TT dollar and putting greater strain on the foreign reserves position. On 19 November 2021 the country’s sovereign credit rating was downgraded to Ba2 from Ba1 by Moody’s, while the IMF forecasted a strong recovery in real GDP growth for 2022, at 5.6%. The impending tightening therefore comes at a sensitive time, as it could dampen the short-term growth outlook. Nevertheless, as a small open economy Trinidad and Tobago must remain responsive to global developments in order to preserve its long-term economic prospects.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.