Global Agriculture Prices

Commentary

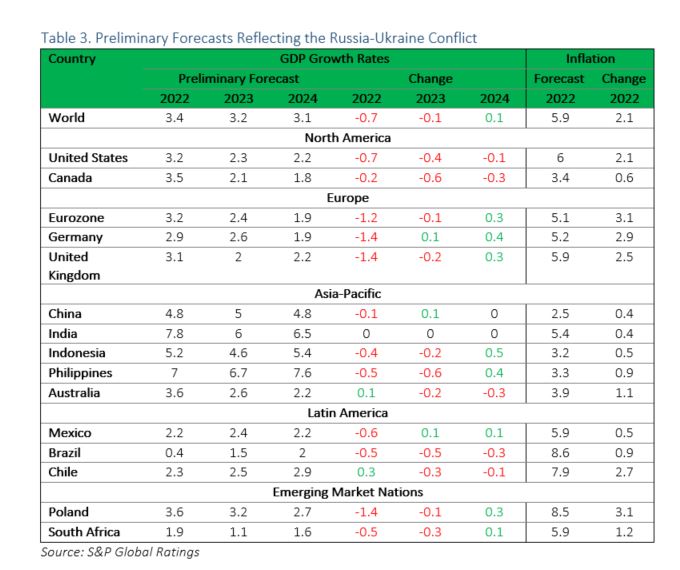

At the beginning of the year economic activity across the globe continued picking up as governments’ covid-19 vaccination drives boosted consumer confidence. Although robust fiscal and monetary stimulus packages unwound, pent-up household demand in developed nations aided in the consumption driven recovery evident in 2021. Supply-chain disruptions faced in 2021 due to microchip shortages, higher shipping costs due to increased energy prices and the outbreak of new Covid-19 variants placed substantial upward pressure on the final prices of goods and services. Several governments eased their Covid-19 restrictions considerably near the end of 2021 and the beginning of 2022, going as far as removing mask-wearing in public places. A glimmer of hope was on the horizon for a return to normalcy as several central banks began hiking their interest rates to mitigate the inflationary impact of higher commodity prices and strong consumer demand in their respective countries. However, near the end of February, Russian President Vladimir Putin initiated a “special military operation” in Ukraine which led to hundreds of causalities for both nations. The two nations have been fraught with disputes throughout the period of the Soviet Union (1917 – 1991) and even after due to disagreements by their leaders on various geopolitical matters. The invasion on Ukraine is ongoing and has since led to the escalation of most commodities in categories such as energy, industrial and precious metals and most importantly agricultural.

Current Trends

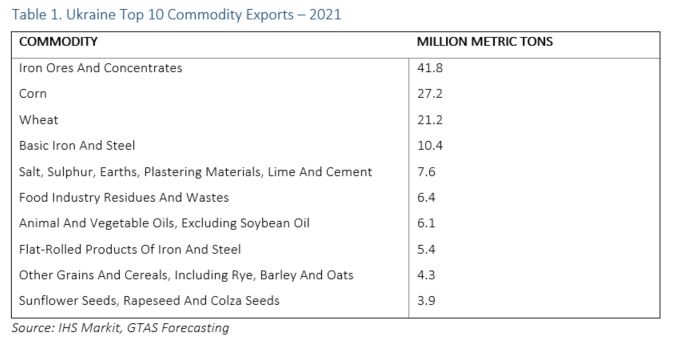

The ongoing invasion of Ukraine has been condemned by most governments, organisations and persons across the world. Several significant economically weakening sanctions have been placed on Russia to deter the invasion but, have thus far been futile as the invasion continues. Ukraine is one of the world’s main exporters of agricultural products such as vegetable oils, corn and wheat. In 2021, it was deemed the largest supplier of grains to the European Union based on exports and a large food supplier for nations in Asia and Africa. Ukraine is the fourth largest exporter of corn in the world accounting for roughly 12.8% of total global exports in 2021. In the same year Ukraine was the fifth largest exporter of wheat contributing to 10.5% of the world’s total exports. Further, Ukraine’s top exports include other food and agricultural products such as salt, animal, vegetable oils, grains, cereal and sunflower seeds. Not only is Ukraine a major source market for a lot of the world’s agriculture but so too is Russia, with exports of wheat accounting for more than 18% of total global exports in 2019.

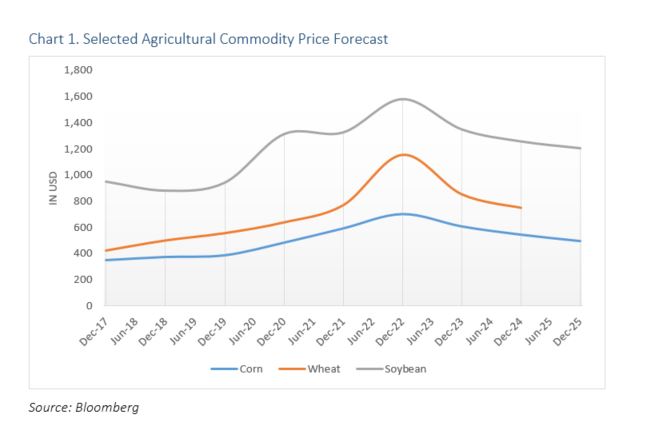

Disruptions in the production of wheat and other commodities grown in Ukraine is currently driving up international prices as supply becomes constrained. Since the start of the global economic recovery in 2021, wheat prices steadily increased from USD663 per bushel in January 2021 to as high as USD761.25 per bushel in January 2022. During the period January to February prices moved from USD761.25 per bushel to USD928 per bushel, a 21.90% increase month-on-month. The price of corn rose to USD697.5 per bushel in February 2022 from USD555.5 per bushel a year ago. In March 2022, prices continued their climb owing to the invasion with wheat and corn raising to USD1,115 and USD746 per bushel respectively as at 9 March. Other commodity prices such as soybean and soybean oil followed similarly with their prices growing substantially over the same period. Soybean moved from USD1,405.25 per bushel in February 2021 to USD1,644.25 in February 2022, a more than 17% increase year-on-year.

Agricultural Commodities Outlook

In the coming months, food and agriculture prices are expected to remain elevated, driven by supply shortages created by the invasion. The supply of Ukrainian wheat is expected to decline considerably this year as several major farmers note that the lack of fertiliser, pesticide and herbicide will weigh heavily on their yield. A grain brokerage firm in Ukraine said the nation’s wheat yields could fall by around 15% compared to a year earlier if fertilisers are not applied soon. On 9 March 2022, the Ukrainian government banned the export of wheat, oats and other staples to ensure the needs of their population are met. This ban will directly and immediately affect many nations across the globe such as Africa, Egypt, Lebanon and European countries, reducing their respective food supplies and creating shortages and even food insecurity in some cases.

Chart 1. Selected Agricultural Commodity Price Forecast

Sanctions imposed on Russia resulted in numerous companies withdrawing from doing business with the nation and several international shipping groups to suspend shipments to and from Russia. This too will place substantial upward pressure on prices in the short-term as exports of wheat from the worlds’ largest supplier dwindles. Crop and soil nutrients such as potash, phosphate and nitrogen based fertilisers produced in Russia account for 13% of the global trade in fertilisers and will contribute further to the higher commodity prices. In 2022, the prices of corn, wheat and soybean are projected at USD702, USD1,153 and USD1,584 respectively per bushel but should decline in the coming years as supply disruptions subside. In 2023, these prices are likely to fall to USD608, USD853 and USD1,352 respectively for corn, wheat and soybean.

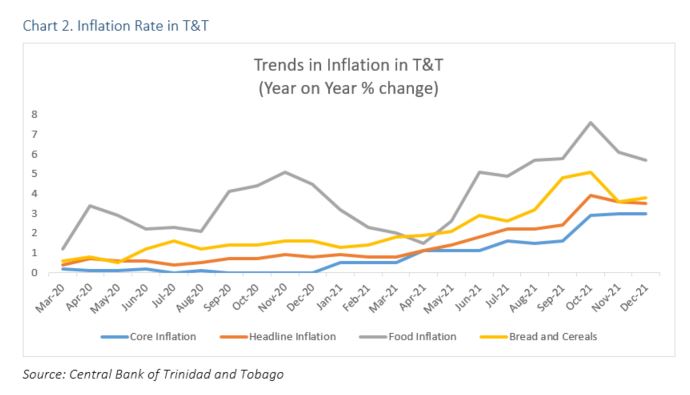

Agricultural Commodities in Trinidad and Tobago

According to trade data from the Observatory of Economic Complexity (OEC), Trinidad and Tobago (TT) imports the majority of its agricultural commodities from the United States (US). In 2019, all wheat imports to TT originated in the US, US corn imports accounted for 95.9% of the total with the balance stemming from Belize, Brazil, Jamaica and Argentina. Of TT’s soybean oil imports roughly 77.1% of the total came from the US and the balance originated from countries such as Brazil, Canada, Barbados, Belgium, Netherlands and Malaysia. Although the imports of TT’s agriculture products do not come from Ukraine or Russia, the domestic prices will be adversely impacted due to the effects of global price movements. In the earlier half of 2021, headline inflation remained subdued at around 1.8% by June but began increasing as food inflation crept up. Headline inflation reached its highest in the year at 3.5% in December 2021 driven by the uptick in food inflation to 5.7%. According to the Central Bank of Trinidad and Tobago (CBTT), the sub index bread and cereals contributed noticeably to the overall increase in inflation for the year rising by 3.8% in the 12 months to December 2021.

Chart 2. Inflation Rate in T&T

In the coming months, food price inflation should remain elevated given the inflationary impact on commodity prices due to the various aforementioned supply problems. According to the Chief Executive Officer at National Flour Mills (NFM) “there is a possibility that a price increase will be required” in order to keep the company profitable in the wake of higher wheat prices. Recently in December 2021, NFM announced an increase in the wholesale price of flour between 15 to 19% with an average increase of around 19% on the retail price of flour to consumers. The increase in flour prices led to almost immediate price hikes for items such as bread, pastries and even one of TT citizens’ favourite food items, doubles.

Conclusion

Russia’s invasion of Ukraine has quickly reversed the improvement in consumer sentiment across the globe and continues to weigh heavily on stocks, commodity prices and ultimately growth prospects in the short-term. The export of agricultural commodities such as wheat, corn and soybean from Ukraine and Russia account for a significant portion of worldwide exports of those products. According to the United Nations, the invasion will result in a decline in wheat production, higher food insecurity and food supply shortages in the nations that gain much of their food imports from Ukraine and Russia. In TT, the import of agricultural products account for around 14.7% of total imports as at 2019 according to the World Trade Organisation and the nation’s major wheat importer, NFM, has noted the higher prices may be passed onto consumers to ensure the company remains profitable. Although trade with Ukraine and Russia is minimal for TT, the effects of the invasion on global commodities will ultimately impact our economy in the short-term.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.