The Impact of Russia and Ukraine Tensions on Financial Markets

Commentary

14 March 2022

The ongoing conflict between Russia and Ukraine is not new and has existed well before now. The current tensions emerged since 2014 when Russia annexed the Crimean Peninsula from Ukraine and established control over the area. This event happened in the aftermath of political unrest and mass rallies in Ukraine leading to the Viktor Yanukovych led Ukraine government being overthrown. Since then tensions between the two countries remained high as civil issues continued with pro-Russian rebels clashing with authorities continually.

In more recent times, after it became apparent that Ukraine was contemplating a possible alliance with NATO, Russian president Vladimir Putin reacted swiftly, warning Ukraine against such as he believed that this would represent a formidable security threat to Russian sovereignty. With little hesitation and in defiance of warnings from NATO and the United States, Russia launched a large scale invasion into Ukraine on 24 Feb 2022 declaring an act of war. This gave rise to the current geopolitical crisis that is causing shockwaves throughout the global economy.

The invasion was met with strong opposition from international governments which resulted in a barrage of economic sanctions, export controls and other measures implemented on Russia. On the 8 March 2022, President Biden increased the pressure on Russia as he banned imported oil and other energy products from Russia. The US had previously resisted cutting off Russian oil imports as this would likely push up gasoline prices further. Russia’s invasion of Ukraine has also roiled financial markets around the world and sent commodity prices soaring.

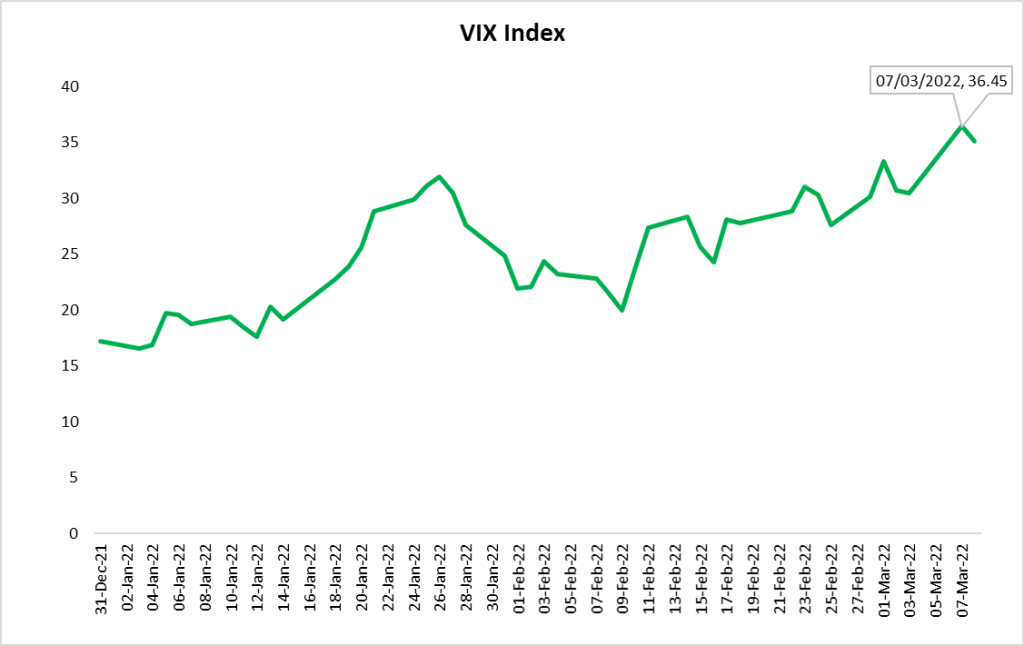

Market Volatility

Even though the threat of a Russian invasion was apparent as Russia began strengthening their military presence on the Ukraine/Russia border, it still shocked the world when the invasion occurred. The market’s initial knee-jerk reaction was typical of that seen during past geopolitical flare ups. Escalating tensions between Russia and Ukraine sent the VIX Index up to 36.45 on the 7 Mar 2022, the highest recorded in 52 weeks.

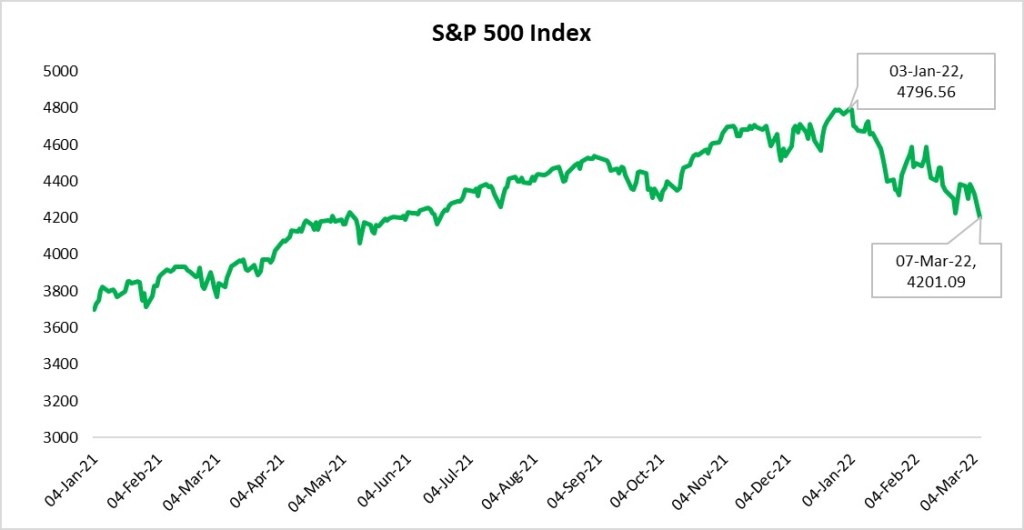

US Stock Market

Prior to the invasion, at the beginning of the year, the US stock market was somewhat volatile as investors speculated on a potential rate hike by the Federal Reserve given rising inflationary pressures. On a month on month basis at the end of February, the S&P 500 index was down 3.14%.

Russia’s escalating conflict with Ukraine added to the existing volatility in the stock market. Following the announcement of Russian troops entering Ukraine, the S&P 500 fell to 4,304.76 points, down 10.3% from its recent peak on 3 Jan 2022 of 4,796.56. Year to date, the S&P registered a decline of 11.86% as at 7 Mar 2022. The Dow Jones Industrial Average as well as the Nasdaq Composite Index also declined year to date by 9.69% and 18.0% respectively.

From a historical point of view, while the stock market fluctuates significantly with geopolitical events, the overall impact on the stock market is usually short-lived. According to a report by LPL Research that tracked 20 international geopolitical events for the period 1941 to 2020, the S&P 500 index fell by an average 1.2% on the day of the event’s occurrence, registered an average 5% loss over the drawdown period, reached the lowest point in 22 days and recovered in 47 days.

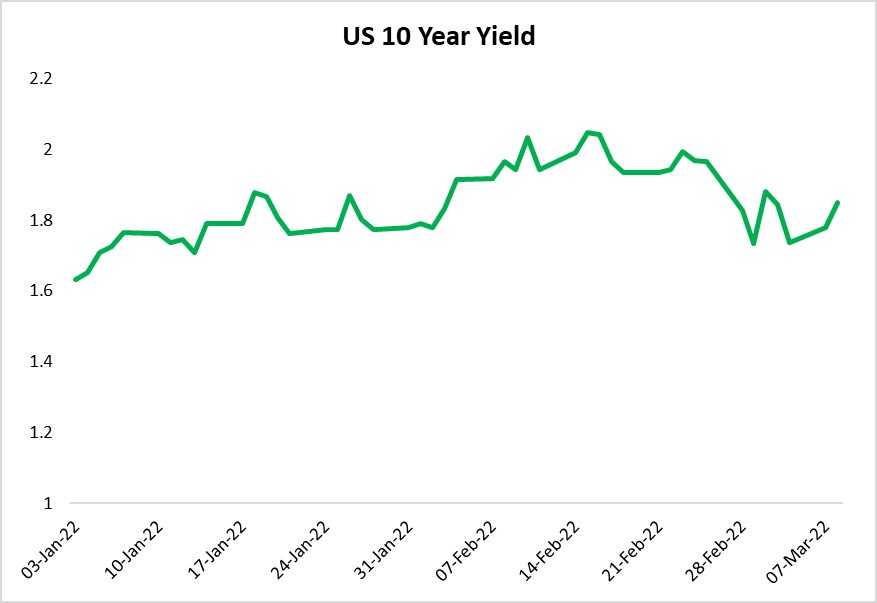

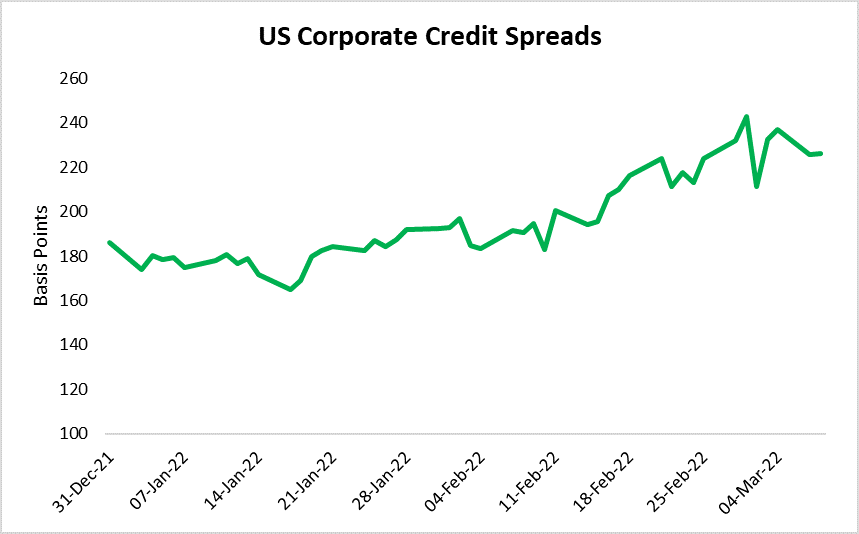

US Fixed Income Market

Yields on the US benchmark 10 year Treasuries started to decline the night after Russian President Vladimir Putin ordered the invasion in Ukraine. The yields initially declined as the tensions sent investors flocking toward safe haven assets like US treasuries, pushing yields down to as low as 1.73% on the 1 Mar 2022. Treasury yields then rose to 1.85% on 8 March 2022 despite growing investor concerns about increasing price pressures brought about by the Russia-Ukraine war.

US corporate credit spreads, a market gauge for credit risk remained slightly below pre-pandemic levels for much of 2021. In mid-February, spreads on 10-year investment grade US bonds widened to 223.74 basis points by 21 Feb 2022. After retreating slightly, spreads widened again as Russia invaded Ukraine seeing spreads widen to 225.96 basis points by 8 Mar 2022.

Commodities Market

Energy

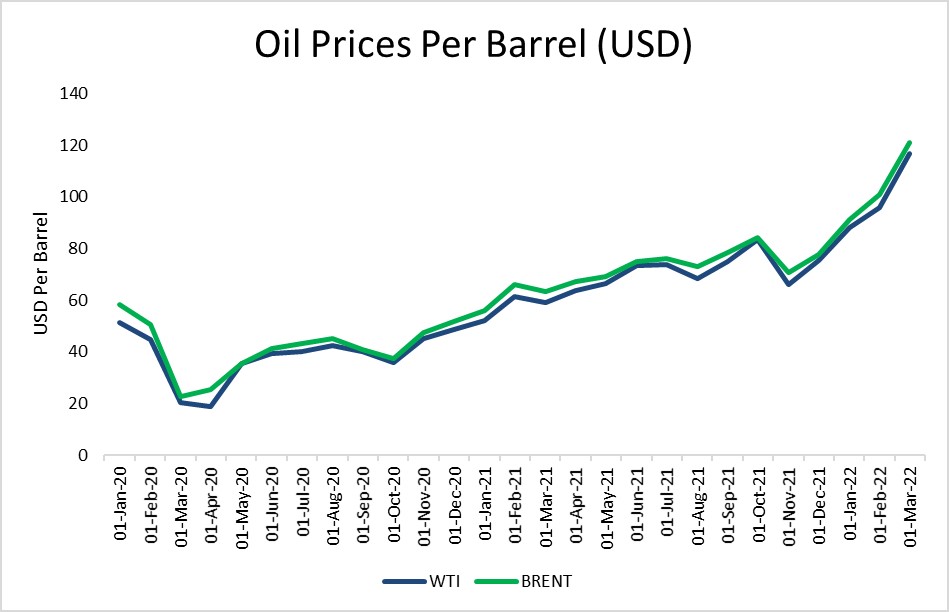

Russia is the third-largest oil producer worldwide and has been negatively impacted by sanctions imposed from countries who are opposed to the invasion. Germany halted the approval process for the Nord Stream 2 pipeline that was built to double the amount of gas Russia would be able to send to Germany. Europe currently imports around 40% of their gas needs and more than 25% of its oil from Russia.

Major oil and gas companies, including BP and Shell have announced plans to exit Russian operations and joint ventures. Additionally, buyers of Russian oil are facing difficulty over payments and vessel availability due to sanctions, with BP cancelling fuel oil loadings from Russian ports.

In an effort to mitigate against much of Russia’s oil being pulled off the market, all 31 member countries of the International Energy Agency which includes the United States have agreed to release 60 million barrels of oil from their strategic reserves. Despite this, energy prices are still poised to continue to rise. In OPEC’s recent meeting held on 3 Mar 2022, there was no indication of removing Russia from the cartel or imposing sanctions on them following their invasion of Ukraine.

Agriculture

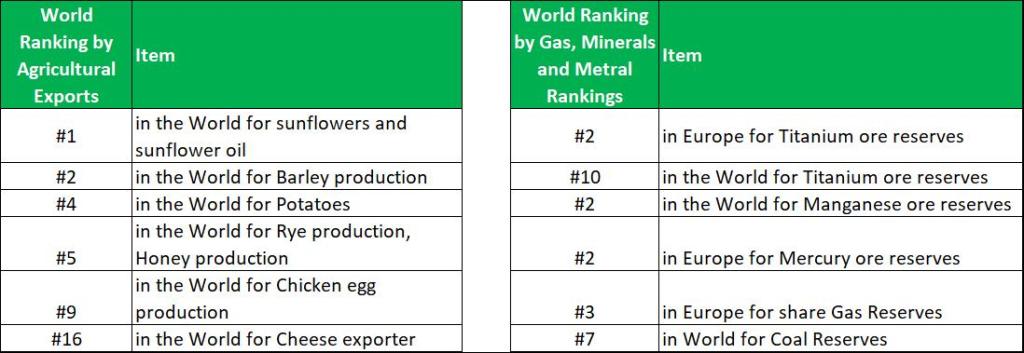

Ukraine is the second largest country by area in Europe and is known as ‘The Breadbasket’ due to its highly fertile soil and high soil moisture that is rich in organic matter. As such, it is the world’s largest producer of several agricultural commodities. Ukraine is also the leading exporter of several critical resources.

Ukraine’s World Ranking

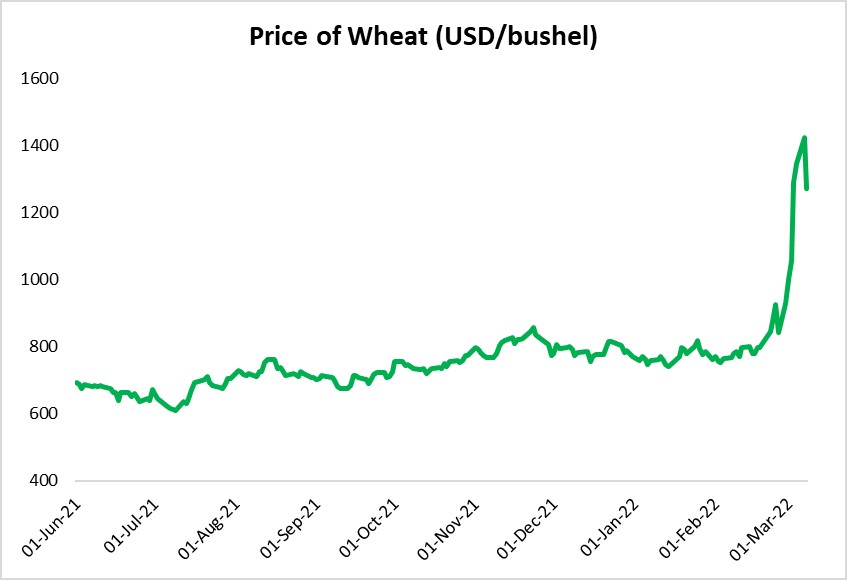

Russia and Ukraine account for a quarter of the global grains trade. The current conflict will force other countries to seek alternative grain supplies. The invasion has resulted in Ukraine suspending commercial shipping from its ports while Russia has paused grain trade owing to the sanctions imposed by Western countries. The effects are already being seen, with the price of wheat up 65% year to date as at 8 Mar 2022.

US Inflation

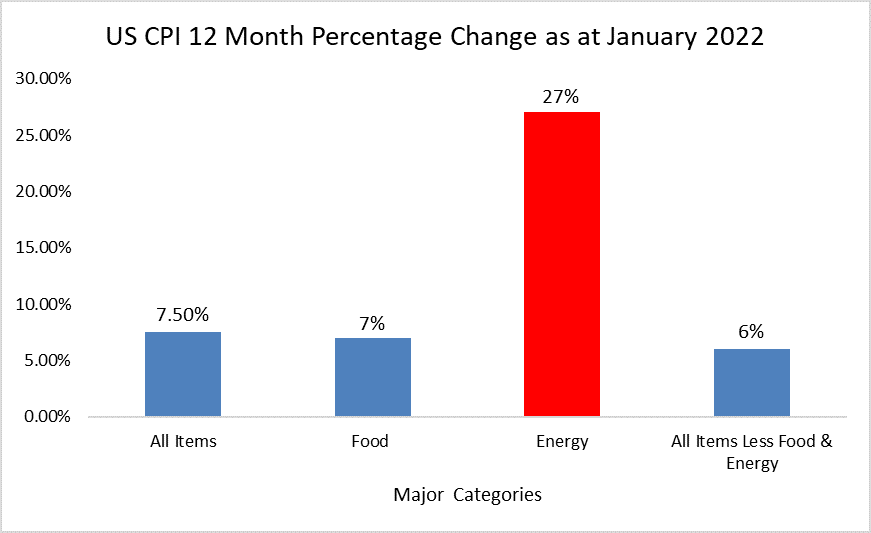

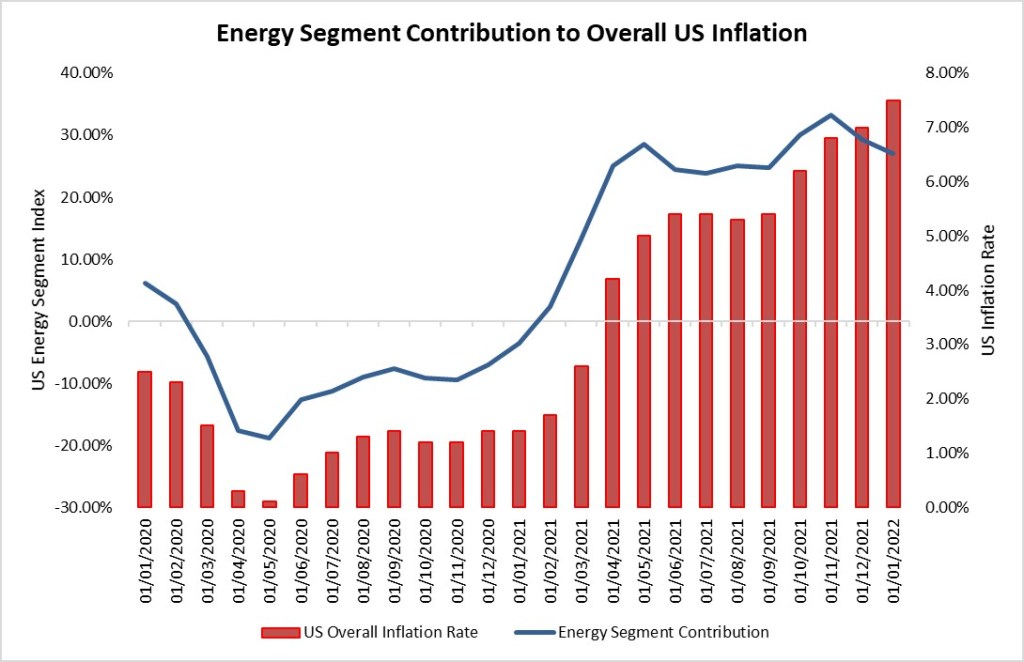

US inflation would have surged to a four decade high in January 2022, accelerating to a 7.5% annual rate. Energy continues to account for a large part of the overall increase in inflation. The breakdown of the US Consumer Price Index in January 2022 saw overall energy prices increase by 27% year on year. This represents the highest increase when compared to the other categories that contribute to inflation. The increases in global energy prices and grains prices will ultimately affect the US economy and add to the already high inflationary environment.

How Inflation Can Impact Monetary Policy

Against the backdrop of such exogenous supply shocks to agricultural and energy commodities, along with the dislocation that occurred in the pandemic, inflationary pressures may increase globally as manufacturers may not be able to absorb higher input costs. For those who opt not to pass on these higher costs, their profit margins will be negatively impacted.

In an effort to combat such price pressures, central banks may accelerate their plans to hike interest rates, directly impacting borrowing costs. With the cost of borrowing increasing, businesses may opt to cancel or delay their capital expenditure plans in an effort to protect their earnings.

In the aforementioned instances, companies’ earnings and profitability may be adversely impacted which may cause a reduction in dividend payments and lowering the return for shareholders.

Outlook

Based on the historical trends, it can be reasonably deduced that market downturns due to geopolitical tensions present buying opportunities for investors. In most cases, market downturns usually recover strongly following geopolitical tensions.

Despite these expectations, volatility is expected to remain elevated in the near term for stocks and bonds. Rising inflation tends to erode the purchasing power of a bond’s future cash flow, thus investors may demand a higher yield to compensate for the inflation risk.

Diversification across regions, sectors and asset classes is crucial as it reduces the risk investors are exposed to that may arise from the volatility in financial markets and economies. Investments in commodities will aid in protecting the portfolio against persistent inflationary pressures. In addition, investors should seek companies who have strong balance sheets, is not highly leveraged, well positioned in their respective industries and have the ability to mitigate impending supply chain disruptions.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.