Conflict, Sanctions and Stagflation

Commentary

The crisis in Eastern Europe has rocked the global economy, casting shadow over what was expected to be a year of strong recovery following two years of depressed activity brought on by the global pandemic. Countries around the world have responded to Russia’s invasion of Ukraine with extensive sanctions designed to incapacitate the Russian economy by disrupting activity in key sectors including financial, energy and transportation. The economic repercussions of the sanctions, together with the sharp spike in commodity prices have increased the risk of global stagflation. This risk is even more pronounced as policy makers globally are in the midst of tightening measures to contain escalating inflation. Stagflation is usually characterized by simultaneous conditions of low economic growth, rising prices and high levels of unemployment. The term was coined by British politician Iain Macleod in November 1965 who was quoted as saying “we now have the worst of both worlds —not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of ‘stagflation’ situation and history in modern terms is indeed being made.” Stagflation is a paradoxical economic condition since typically, low economic growth and rising prices do not concurrently occur. Indeed, low economic growth usually coincides with a decline in prices caused primarily by lower aggregate demand and further, unemployment and inflation tend to follow an inverse relationship as depicted theoretically in the Phillips Curve. However, once stagflation sets in, it significantly complicates policy decisions.

Sanctions Further Fuel Inflation

Russian’s invasion of Ukraine has prompted a barrage of sanctions levied upon Russia by large economic players worldwide, including the US, the European Union, the UK and Canada among many others. The most recent sanction imposed by the US, EU, UK and Canada include a ban on certain Russian banks from SWIFT[1], which is the high security network which facilitates the smooth transfer of funds across borders. This network is used by approximately 11,000 financial institutions in 200 countries. Seven (7) Russian banks were banned, however, access was retained for other banks, including two key lenders (Sberbank – Russia’s largest bank by assets, and Gazprombank) to facilitate payments to Russia for critical energy supplies. This move will have significant implications for international trade, including investment and remittances flows. Germany also froze the Nord Stream 2 gas project which was designed to significantly increase Russian gas supply directly to Germany. Meanwhile, Western countries have frozen the assets of Russian Central Bank, which now limits the access to approximately USD630 billion held in international reserves. Essentially, any assets in US dollars held by the Russian Central Bank cannot be accessed or used. Sanctions have also been imposed on the Russian Direct Investment Fund – a sovereign wealth fund. Major state-owned companies in Russia were also cut off from raising capital in the US, including the country’s energy company Gazprom and the largest bank, Sberbank. Sanctions were imposed on elite Russians as well as export blocks on technology, including restrictions on semiconductors, avionics and maritime technologies. Further, all Russian flights have been banned from US, UK, EU and Canadian airspace.

Russian retaliated with closing its airspace to 36 countries, which may cause possible increases in airfreight costs.

These are among various other measures imposed on Russia by various countries throughout the world aimed to immobilize Russia’s critical sectors, which will undeniably have significant implications for the global economy, especially as pandemic-related headwinds persist.

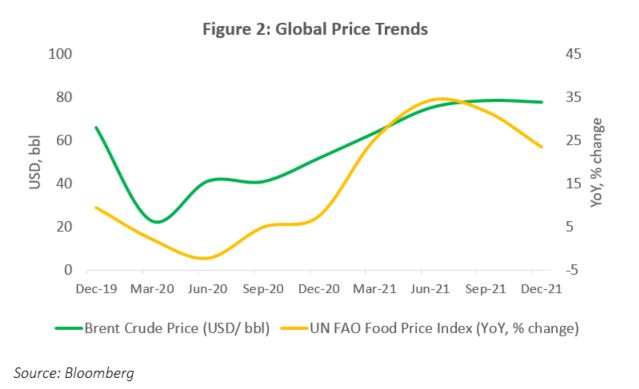

Since the invasion into Ukraine, commodity prices have accelerated rapidly as concerns about shortages saw spikes in prices of oil, gas and metals to wheat and other grains. Russia is the world’s largest exporter of food staples and together with Ukraine, provides around 30% of the world’s wheat, 19% of corn and 80% of sunflower oil. Importantly, Ukraine provides a significant portion of Europe’s food, including wheat, barley, rye and corn and there are increasing concerns that any prolonged tensions may severely disrupt the food supply chain in the continent. Based on the UN Food and Agriculture World Food Price Index, food prices rose by 23.5% in 2021, relative to 2020 and even before the crisis broke out between Russia and Ukraine, the FAO was already warning of consistently high cost of inputs which will continue to drive food inflation higher in 2022. The conflict will further stoke food inflation, given the importance of the both Russia and Ukraine in the global agriculture commodities market.

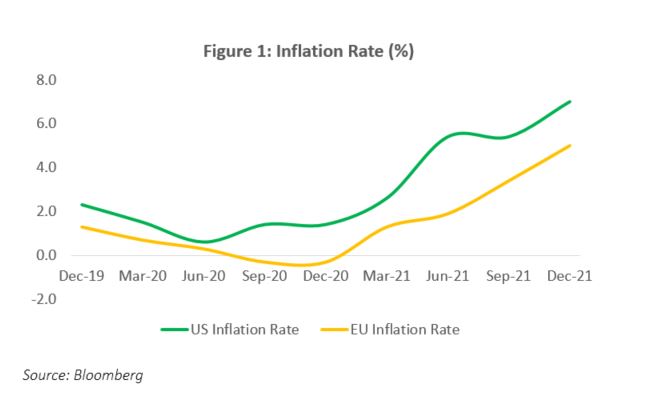

Similarly, Russia is the world’s third largest oil producer, accounting for 11% of world production in 2020, only behind the US and Saudi Arabia, based on data from the US Energy Information Administration. Russia and Ukraine combined account for 17% of the world’s natural gas production. Crude oil prices topped USD110 per barrel on 2 March 2022 on supply concerns. The energy markets were already tightening as demand strongly recovered from the lows during the pandemic. The Bloomberg Energy Sub Index, which is composed of futures contracts on crude oil, heating oil, unleaded gasoline and natural gas, returned 82.53% in the one-year to 2 March 2022, while year to date, it is up by a significant 44.2%. Russia supplies approximately 40% of Europe’s natural gas and 25% of its oil and Germany is even more dependent on Russia for the energy needed to fuel its large manufacturing sector. Inflation in the Eurozone accelerated to a record high of 5.8% in February mainly due to the surge in energy prices, which jumped 31% as the conflicts have begun to filter through to consumer prices. The European Central Bank was already preparing to gradually unwind its pandemic-related stimulus measures.

In the US, the Federal Reserve continues to grapple with a sharp jump in prices, with inflation recorded at almost a 40-year high of 7.5% in January 2022. The extent to which the current crisis will further impact upon US consumer prices will thwart the Fed’s policy response. The Fed meets on March 15-16 – and a quarter-point interest rate hike is widely expected. The Fed Chairman has indicated that the inflation risk is paramount over the risks from Russia’s invasion of Ukraine and has noted that if inflation is persistently higher, the Fed is prepared to move more aggressively in its interest rate hikes.

Strong but Slowing Economic Growth

Towards the end of 2021, policy makers across the world moved to tighten policy, as the threat of inflation escalated, while at the same time, economic activity was recovering following the trough of 2020 and early 2021. Governments withdrew substantial fiscal stimulus measures while central bankers raised policy interest rates and began tapering quantitative easing. In its January 2022 World Economic Outlook, the IMF projected growth of 4.4% for the global economy in 2022, less than its earlier projection of 4.9%, and follows a strong rebound estimated at 5.9% in 2021. The US economy is expected to post above trend growth of 4% in 2022, but risks remain elevated and are related to stimulus withdrawal, continued supply chain bottlenecks and the stalled ‘Build-Back-Better’ Plan. The Euro area is projected to grow by 3.9% from an estimated 5.2% in 2021. China, the world’s second largest economy is showing signs of slowing due to disruptions caused by the pandemic as well as the challenges in the housing market. The IMF projects growth of 4.8% in 2022, well below China’s 10-year average of 6.7%, and 2021’s 8.1% expansion. Even at the start of 2022, optimism about a full global recovery was fading given the ever present pandemic threat and the effects of new variants, supply chain disruptions as well as the negative impact that rising inflation would have on economic growth.

Notably, the forecasts from the IMF were prior to the Russia-Ukraine crisis, which will undoubtedly suppress the global economic recovery due to the sanctions imposed and the spillover effects. Even though Russian’s contribution to global GDP is relatively small at less than 2% and major economies have limited trade exposure to Russia (0.5% of total trade in the US and 2.4% for China), it is a major player in the energy market. As sanctions took effect, Russian authorities implemented a series of measures, including doubling its main policy interest rate to 20% to protect its currency which has tanked by about 45% since the invasion. The stock market was also closed and Russians have been barred from transferring money to overseas accounts. Given the country’s strategic importance in the energy exports market, the sanctions imposed will have major implications for global trade which will stifle the global economic rebound. Following the invasion, Russia’s credit rating was cut to speculative grade by all three major international credit rating agencies. Ukraine’s credit ratings were also downgraded and both sovereigns’ ratings were placed on a negative credit watch.

Will Stagflation Threaten?

Stagflation is certainly one possible scenario for the global economy in 2022. The ongoing conflict coupled with the unprecedented sanctions levied against Russia would disrupt international trade and would likely fuel inflation even further, particularly energy prices. Meanwhile, the spillover effects from the sanctions, the withdrawal of pandemic-related stimulus coupled with monetary tightening will all have a dampening impact on the global economy. Given Europe’s high dependence on Russia for its energy needs, the risks are much higher. Already, a member of the ECB’s governing council has noted that while the region is expected to follow its current growth trajectory, a stagflation situation cannot be ruled out, as such the ECB will need to adjust its policies accordingly, but policy normalization should continue, if only at a less aggressive pace. The US Fed is also committed to its inflation fight and is expected to continue with its hawkish stance.

Policy decisions are at a crossroads as central bankers now have to weigh the accelerating inflation risks against the possibility of weakening economies. So far the impact on global growth seems to be limited – a view that can change quickly and warrants agile policies in such a dynamic and uncertainty environment.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.