Central Bank Digital Currencies (CBDCs)

Commentary

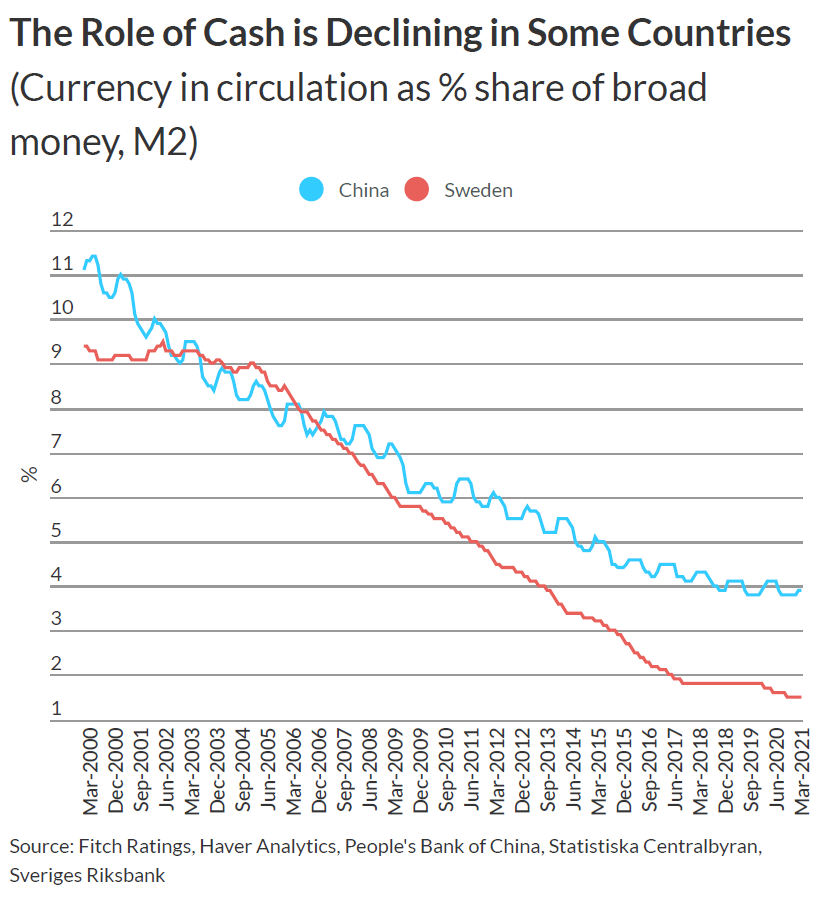

Digital currencies are not a new phenomenon in the modern world, as matter of fact, out of the USD21 trillion in circulation in the United States, only about USD2 trillion exists as physical currency, the rest exist as digital dollars, generally created by commercial banks though their lending operations. The role of physical cash is diminishing in favour of digital, cashless solutions, providing a gap in the market. This is where Central Bank Digital Currencies (CBDCs) come into play.

What is CBDCs?

CBDCs are a digital form of the typical fiat currency (printed money or any approved legal tender). Similar to fiat money, it is issued and regulated by Central banks and is backed by the issuing government.

The first consideration for CBDCs is access, whether it be token-based or account-based. Token-based would be very similar to how fiat money works currently, that being it will be denominated in various values, is not tied to a specific account, and at point of sale the only thing a merchant would need to worry about is the validity of the currency. While convenient, this would make theft possible for digital currencies.

Account-based systems on the other hand would function as the name implies, through an account in which the currency is stored. This account would be issued and held by the central bank for individuals. All transactions made can be attributed to an account, reducing the possibility of financial crimes being committed. While Know Your Customer (KYC) requirements will need to be met, it can be simplified and streamlined. It is possible for a CBDC to combine both token and account based features.

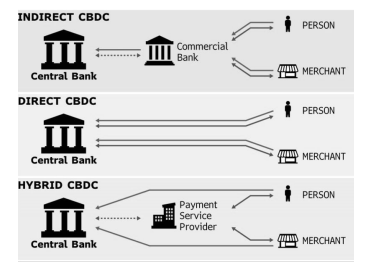

Another key consideration of CBDCs is the type of model being used. Different models affect the reach of CBDCs; the type of transactions allowed to be carried out, who is authorized to issue the currency, and also the impact on the financial system. The different models are:

Cross border model; this is issued by central banks to commercial banks and can be used for foreign exchange transactions across countries. This model allows for easy convertibility of currencies across countries. In the current landscape of digital money via credit and debit cards; cross border transactions require currency exchanges and financial institutions taking a role with settling electronic payments, driving costs up. While a cross-border model would be best for, it is the most theoretical version of a CBDC and would face the most issues with being implemented.

Retail (direct) model; the CBDC is issued by the central bank directly to a user’s account which is held in the central bank. This model would make a CBDC much more widely accessible as individuals who were not part of the commercial financial sector can be included. The responsibility of carrying out KYC procedures will lie in the hands of the central bank.

Wholesale (indirect) model; this model follows what is currently used with fiat currency, that is, the CBDC will be issued to commercial banks who in turn would distribute to the user. While this model allows for easier integration of a CBDC into the financial system, and even allows for a simplification of cross-border transactions; the access to CBDCs will be limited to those already in the financial system, providing no solution to the issue of financial inclusion.

A hybrid model which combines aspects of both the wholesale and retail model is another option available.

The advantages of CBDCs include increasing financial inclusion, prevention and tracking of money laundering and financial crimes; and improvements in the cost, efficiency and resilience of payment systems.

Financial inclusion will be promoted since individuals would require a basic account in the central bank to access a CBDC. Promoting financial inclusion can see benefits for unbanked individuals. In a study titled ‘Cheque In: Increasing Access to the Formal Financial System’ carried out by Caribbean Policy and Research Institute (CaPRI) in Jamaica found that approximately 17% of Jamaicans were unbanked, coming from mainly low income to low-middle income households. These individuals faced higher costs to carry out normal transactions, especially transactions which required them to interact with the financial sector. Transactions such as cashing a cheque came at a cost to the individual in the form of a direct fee as well as time lost. For individuals that are paid on an hourly basis and are unbanked CaPRI estimated that the financial loss each month is JMD6,825 or one week’s worth of minimum wage.

Improvements in the efficiency of payment systems can see benefits primarily for emerging market economies and developing countries. The IMF explains that the non-profit nature of central banks means that the payment system developed for the use of CBDCs can be offered at a lower cost than what already exists. Further to this, the speed of transactions can be greatly improved since transactions will be done in a single system. Countries that lack the infrastructure for an interbank system to carry out real time transactions will see the most benefit from the alternative provided by CBDCs. In the case of cross-border CBDCs, similar benefits can be seen though on a larger scale. Remittances for example would become cheaper and more efficient to send and receive. According to The World Bank the cost of sending remittances through the financial system comes in at an average of 8% of the amount sent; further complications include uncertainty to the remitter that the amount sent will reach the recipient in full, and that international remittances suffer from the absence of interoperability between domestic payment systems. A well designed cross-border CBDC can be made to tackle these issues, though its development will be costly and time consuming.

The downsides of CBDCs include data privacy concerns, a larger role of the central bank in the financial system that destabilizes the financial system, and the resilience of infrastructure in less developed countries.

Starting with data privacy; all transactions carried out with CBDCs are recorded on a ledger which is kept and tracked by the issuing central bank. The data that is stored is highly attractive and valuable to hackers. A need for stricter measures to protect this data will be of utmost importance for central banks that do issue CBDCs as a leak in the any data consumers would make consumers vulnerable to profiling and predatory marketing.

Commercial banks can be undermined with CBDCs since central banks now become depository institutions. This destabilizes the existing relation between central banks and commercial banks. These accounts would be much easier to create than a commercial bank account and may impose little to no cost to the consumer, making them more attractive to the individual. Other factors such as transferability of funds between commercial and central bank accounts, as well as if central bank accounts are interest bearing may cause bank runs – a situation where a large number of consumers withdraw funds from the bank, straining their cash reserves – further destabilizing the financial system.

The resilience of infrastructure is another concern for CBDCs primarily in poorer and disaster prone countries. Service outages will cause a loss in economic activity, a problem that would be exacerbated if transactions in an economy are done primarily by digital means. Investment into more resilient infrastructure will be needed to mitigate the effect of disruptions.

How are CBDCs different from Cryptocurrencies?

In its simplest form, cryptocurrency is a decentralized monetary system that uses blockchain and cryptographic technologies or encryption algorithms to monitor the generation of units and transmission verification. This means that it is not distributed by monetary authorities (as such is unregulated), and is virtually impossible to counterfeit. The amount of units that can exist is limited and cannot be increased (for Bitcoin the limit is about 21 million, for Ethereum the limit is 100 million units), there is no limit on how much can be used in a transaction, transaction speeds are fast compared to transfers through the financial system, and they are available to anyone to use with very little paperwork. The biggest downside to crypto currencies is the extreme volatility attached to them since they are publicly traded and are not backed by any asset or institution. Take Bitcoin for example; when first introduced it was valued at mere cents (USD0.20 in 2010), the value appreciated gradually over time, eventually reaching USD13,412.44 as of December 2017. Ethereum, the second most valuable crypto currency has seen a similar trend.

Crypto currencies have been subject to much scrutiny and have been banned in several countries, with Thailand being the most recent country to ban its use in March 2022. Other notable countries that have banned the use and ownership of crypto currencies are: China, Bangladesh, Nigeria (though payments can be made through peer to peer networks), Bolivia, Qatar etc. Reasoning for the bans is largely the same, the unregulated nature and grey area crypto currencies pose to the established types of financial assets.

There does exist similarities between crypto currencies and CBDCs, these include; both are a digital currency which would require an electronic wallet to make and receive payments and funds, and use of blockchain technology to record transactions. Blockchain technology in its most simplified form is a ledger that records all transactions that occur with the currency, this ledger cannot be edited or tampered by any unauthorized persons; in the case of crypto currencies this ledger is available to the public where as CBDCs would be available to central banks.

CBDCs regionally and around the globe

Most central banks around the globe are conducting research into the feasibility of implementing a CBDC, with even fewer conducting pilot projects to test their functionality in the existing economic landscape. A Bank for International Settlements (BIS) indicated that 86% are actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects. Some countries that have launched pilot projects are:

The Eastern Caribbean Central Bank (ECCB) currently has a CBDC in the pilot phase and is the only currency union in the world to do so. “DCash” was launched in March 2021 in four EC countries, Antigua and Barbuda, Grenada, St Kitts and Nevis, and Saint Lucia. It was further expanded in August 2021 to Saint Vincent and the Grenadines, and again in December 2021 to Dominica and Montserrat. It follows a hybrid model and utilizes token based access. DCash has currently run into issues in its network, with it being down for over a month due to the certificate for the transaction ledger expiring, though the ECCB is working towards resolve this issue by March 2022.

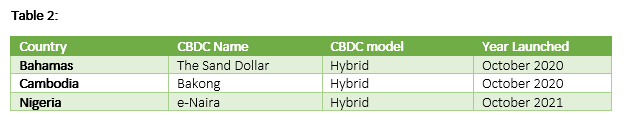

In terms of official launches, only 3 CBDCs have been launched as of February 2022, all coming from emerging market economies.

The Bahamas is currently leading the way when it comes to CBDCs; being the first country to officially launch their CBDC in October 2020. When launching “The Sand Dollar”, the Central Bank of The Bahamas (CBOB) key considerations were to promote financial inclusion, make their payment system more efficient, allow for non-discriminatory access to the CBDC, and finally, improve the nation’s defences in the fight against money laundering. Access is limited to account based. While uptake in the sand dollar has been slow, with BSD302,785.04 worth of Sand Dollars in circulation, 28,003 digital wallets using them and about 845 merchants accepting them as of November 2021. It is expected that usage will increase in 2022 as the CBOB pushes its usage this year. As of March 2022, systems have been completed to allow for the sand dollar to be integrated into the Bahamas Automated Clearing House (BACH) system, allowing for the transfer from a digital wallet to any deposit account at a local commercial bank.

When carrying out pilot programme for the JAMDEX CBDC, Jamaica utilized a hybrid model with account based access. The pilot took place over the span of 8 months from May 2021 – 31 December 2021. JMD230 million worth of digital currency was issued to deposit taking institutions and authorized payment service providers. In October 2021, the Bank issued $5 million worth of JAMDEX to National Commercial Bank Jamaica Limited, the first issuance of CBDC to a deposit taking institution. The pilot was deemed a success by the Bank of Jamaica (BOJ). The currency is expected to be launched in the first quarter of FY 2022/23 (Q2 2022) and be usable only for domestic use. Users will create an electronic JAMDEX wallet which may be accessed through a website or mobile app. The wallet may be topped up through authorised agents. The JAMDEX wallet will not attract any fees to conduct transactions. The BOJ is not considering interoperability with any other CBDC or usable on any other digital wallet apart from deposit-taking institutions and payment associates in its own ecosystem.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.