Riding the Energy Price Rally Train, But Economic Challenges Persist

Insights

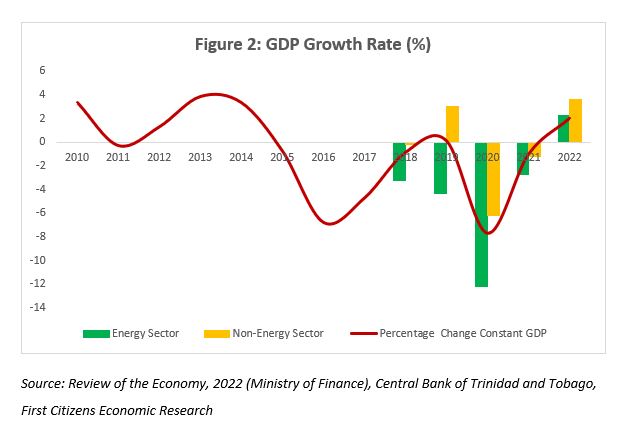

The fortuitous rally in energy prices on the global market has had a positive impact upon most commodity exporters worldwide, including the economy of Trinidad and Tobago (T&T). The recently presented National Budget for fiscal year (FY) 2023 comes at a critical juncture. While the economic fortunes, based on a more favourable global energy price outlook, seems to be on a more positive outlook, there are many challenges which must be addressed. As the worst of the pandemic is over and the economy continues to pick up the pieces from the significant economic fallout, within in the context of a challenging global economy, the budget for the FY has been themed ‘Tenacity and Stability in the Face of Global Challenges’. Not surprisingly, as T&T is an energy-based economy, a significant fraction of economic output, government revenue and export earnings are derived from this sector. However, challenges such as the threat of rising inflation, foreign currency imbalances and erosion of foreign exchange reserves as well as sustained loss of output persist even post pandemic.

Global Energy Prices Lead to Positive Economic Growth Expectations

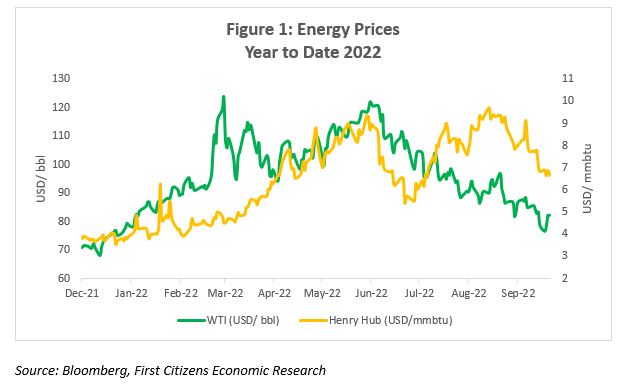

Oil prices as measured by both WTI and Brent, soared past USD100 per barrel during 2022, peaking at around USD123 back in March. Both demand and supply factors drove prices higher in the early part of 2022 – robust demand from a much more optimistic economic recovery at the start of 2022 and then supply issues when the Eastern European crisis broke in February. Since then, though, economic conditions have changed. The aggressive monetary tightening by major central banks across the world has signalled that policymakers are prepared to risk recessionary conditions to tame soaring inflation, which will have implications for global energy demand. This is being assessed by OPEC+, who meets on 5 October 2022 to determine if the bloc’s production will be cut. WTI has fallen around 40% off its 2022 peak and is currently at around USD82 per barrel, while Brent is trading around USD89. Similarly, the natural gas price as measured by Henry Hub has gained around 79% year to date, peaking at around USD9.68 per mmbtu in August, and though it has declined slightly, the price remains firmly above USD6.00.

According to the Ministry of Finance, the upturn will be driven by the coming on stream of several major energy projects as well as continued high energy prices globally, and on the non-energy side, the removal of pandemic-related restrictions should result in an improved environment supportive of potential uptick in consumer and business activity.

Fiscal and Debt Sustainability

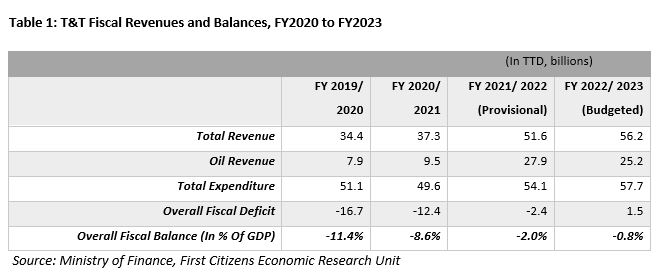

Provisional data for FY 2022 show that energy sector revenue accounted for a massive 54% of total government revenue. This compares to the sector’s average contribution of 26% over the preceding five-year period. From a historical perspective, the country’s fiscal account has consistently been in a deficit position since 2011, recording an average shortfall of 4.4% of GDP. Not surprisingly, the largest deficit was registered in the pandemic year, when revenue dropped by 27%. Table 1 provides a brief synopsis of the more recent fiscal performance as well as the expectations based on the recently concluded budget presentation.

In FY2022, total revenue rose by an estimated 38%, driven primarily by an almost 200% surge in energy revenue. Further, the resumption of normal business activity during the course of the year supported tax collections from the non-energy sector. Total expenditure, meanwhile, rose by 9% driven by higher spending on transfers and subsidies, which rose by 13% to a massive TTD30.5 billion. Personnel expenditure, which accounts for around 18% of recurrent expenditure was 2% higher and amounted to TTD9.3 billion.

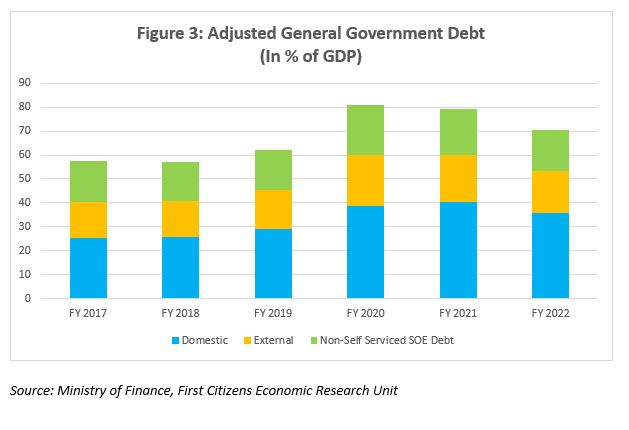

As a result of the widening fiscal shortfalls, the country’s nominal debt levels have also increased. The total general government debt rose to TTD139 billion in FY 2022 from TTD137 billion in FY 2021, 7% of which arose from Open Market Operations activities. The Ministry of Finance estimates that the adjusted general government debt will decline to 70.4% of GDP at the end of FY 2022, notably lower than the 79.5% of GDP at the end of FY 2021 supported by a 2.3% decline in the debt as well as the increase in GDP. Domestic debt accounts for approximately 75% of total debt and is projected to rise by 2.4% in FY 2022 to account for 52.9% of GDP, while external debt should end the FY at around 17.5% of GDP.

External Financial Buffers Critical

The Heritage and Stabilization Fund (HSF) is intended to generate an alternative stream of income to support public expenditure as a result of revenue downturn caused by depletion of non-renewable petroleum resources and to provide a heritage for future generations of citizens[1]. The optimistic energy prices allowed for a deposit of USD163 million into the Heritage and Stabilization Fund (HSF) – the first since 2013. Despite this, the net asset value of the HSF as at mid-September was at USD4.78 billion – down 12.5% relative to September 2021. While there were no withdrawals from the HSF during the FY 2022, the value of the fund has been affected by the volatility of the global financial markets as well as investor uncertainty.

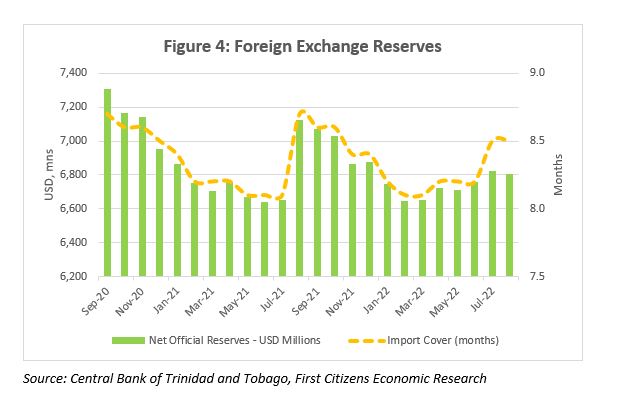

T&T’s external account also benefitted tremendously from the rally in global energy prices. Indeed, the current account posted a surplus of USD2.5 billion in 2021, reversing the deficit of USD1.4 billion in the previous year. The performance was driven by higher export earnings particularly in petrochemicals, petroleum crude and refined products and gas. Accordingly, total energy exports rose to USD8.7 billion, while at the same time, non-energy exports increased by 28.7%, supported by a 59% increase in manufacturing exports. As the economy reopened, total imports also grew by 27%. Despite the improved performance on the current account, the overall balance of payments recorded a deficit of USD74.2 million, thereby resulting in a decline in gross official reserves during the year to USD6.88 billion from USD6.92 billion in 2020.

Opportunity knocks

The current strength in energy prices is just one of the factors required for a sustained recovery in the T&T economy. It must be supported by sound and consistent policies to ensure that the benefit of windfall revenue is long-lasting, especially in the aftermath of the pandemic. The pro-cyclical fiscal policies of past commodity boom cycles have facilitated a disproportionate bias towards social spending and recurrent expenditure and should be one of the stark lessons in the context of the current commodity price upswing and formulation of fiscal policy. While the government has noted a debt to GDP soft target ratio of 75%, a fiscally responsible framework, anchored by a debt to GDP target, which may be more appropriate to ensure a sustained reduction in the country’s indebtedness in the medium-term is required.

The fiscal plan for FY 2023 envisages an 8.8% increase in total revenue, driven largely by what may be very optimistic energy prices, accompanied by a 6.7% increase in total expenditure. Noteworthy is that despite the relatively strong growth in revenue, the overall fiscal balance is still budgeted to end in a deficit position. The downside risks are high, and caution must be exercised in the event that energy prices continue to decline in the face of growing concerns of a global economic slowdown and possibly recessionary conditions.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.

[1] HSF Annual Report 2019 – Ministry of Finance