Credit Card Customer Support

Welcome to our Credit Card Support page. We’re here to help you with any questions or issues you may have regarding your credit card. Below you’ll find answers to common questions, helpful tips, and contact information for further assistance.

Chargebacks

From time to time, “disputes” or “chargebacks” may arise on a credit card account. Credit card chargeback is often submitted by a cardholder because a credit card charge was unauthorized or you bought something online that was never delivered or was defective. Except for unauthorized transactions, you should only initiate a chargeback after you tried to get a refund from the merchant and were not successful. The official first step of the chargeback process is the submission of a “dispute” form. Below are some helpful guidelines you should be aware of when requesting a chargeback.

To submit a chargeback request, download, complete and submit a Credit Card Dispute Form via email to chargebacks@firstcitizensbb.com and a representative will contact you.

What should I do if my Credit Card is lost or stolen?

You are required to immediately call 431-4577 to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Customer Service team is available Monday to Friday from 8am to 4.30pm and our afterhours Support Team is available Monday to Friday from 4.31pm to 7.59am and on Weekend 24/7.

If you are abroad, call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- MasterCard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call or 1-636-722-7111

- Any time you think your credit card may have been compromised, don’t forget that you call 1-246-431-4577 to immediately have your Credit card “block”.

Credit Card Forms

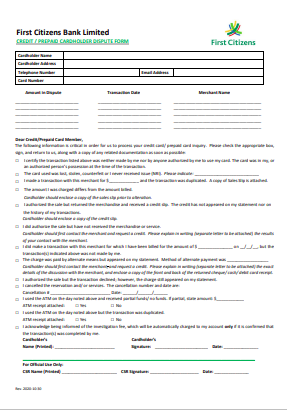

Credit Cardholder Dispute Form

This form allows you, the cardholder to query the legitimacy of any unauthorized credit card transaction posted in your credit card history.

As this process is important, we urge you to take a few minutes to familiarise yourself with some further details on the dispute process. Please click here for further details.

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

- Scan your completed forms and documents to chargebacks@firstcitizensbb.com

- Upon receipt, you would be contacted by or advised further by one of our Chargeback Officers.

Additional Cardholder Form

This form allows you to add that person who is most important to you to your credit card account. Follow the simple steps below:

- Print form and provide requested information.

- Sign the form where indicated (both primary and additional cardholder/s).

- Visit any branch with the completed form along with original plus a copy of the following documents. One (1) ID for the primary and each additional cardholder e.g. electoral id, passport, drivers permit. The IDs are to be certified at the branch.

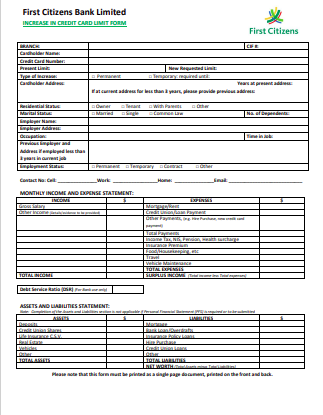

Increase in Credit Card Limit Form

This form allows you to start the application process to increase your credit card limit. Follow the simple steps below:

- Print, complete and sign form where indicated.

- Visit branch with form and original plus a copy of the following documents. The documents are to be certified at the branch. – (One (1) ID e.g. electoral id, passport, drivers permit along with a salary slip not more than one (1) month old.)

- Proof of address dated within three (3) months may be required if the increase in limit results in a change in the type of credit card.

- A Personal Financial Statement (PFS) may be required if the increase in limit results in a change in the type of credit card.

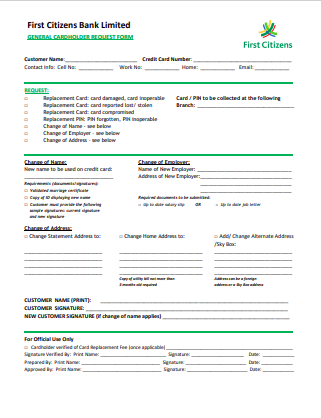

Card & PIN Replacement/ Name & Address Change/ Contact Information Change Form

This form allows you to provide the Bank with all the required information to do the most common amendments required for credit cards. You may follow the simple steps below:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

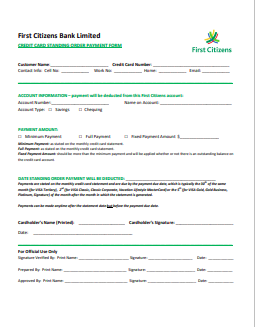

Credit Card Standing Order Payment Form

This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options that suit you. Follow these simple steps:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Credit Card FAQs

Chargeback FAQs

Q1: What is a chargeback?

A chargeback is a claim submitted by a cardholder to challenge the legitimacy of a transaction which is charged and posted to his/her credit card account.

Q2: Who governs the chargeback process?

The chargeback process is governed by the Card Brands (Visa and MasterCard) rules which helps maintain a fair and high standard of service. While there is no guarantee that the bank will recover the money through the chargeback process, all claims received are assessed by the bank and feedback provided.

A3: How is the value of the chargeback determined?

With a chargeback, the value claimed cannot exceed the value of the original transaction. Where a partial refund has already been made, any chargeback will only cover the remaining amount of the original transaction.

Q4: What if I was charged the wrong amount on my Credit Card?

You should contact the merchant first. It may be a simple mistake that they can correct. If you did not receive a refund from the merchant or they have not resolved the query you can complete the dispute form and submit it to the bank. Be sure to include any supporting documents you may have from your contact with the merchant.

Q5: What is the difference between a chargeback and a refund?

When you make a chargeback claim, the bank will request a refund from the merchant on your behalf. There is no guarantee, however, that the merchant will agree to the request or that the bank will be able to recover the money.

With a refund, however, the merchant accepts responsibility for refunding you directly, without the need to make a claim through the bank. You should always request a refund from the merchant first before making a chargeback claim.

Q6: What are the reasons why a transaction is disputed?

A transaction can be disputed for any of the following reasons:-

- Goods Not Received

- Duplicate transaction

- Unauthorized (fraud)

- Difference In Amounts

- Cash Not Received

- Credit Not Received

- Service Cancelled

- Paid by alternate means

- Service not Received

- Declined but Still Charged

Q7: How long do I have to make a chargeback claim?

Queries on any unfamiliar posted credit card transaction must be made by the cardholder within fourteen (14) calendar days after the unfamiliar transaction was done, after which time the Bank will not be obliged to consider any such query. Please ensure you enroll for the banks Online Banking as well as email notification services to monitor your account in real time.

Q8: Who should complete the dispute form?

The dispute form(s) must be completed and signed by the cardholder on whose credit card the disputed transaction was observed. However the primary cardholder (or account owner) is ultimately responsible for making queries.

Q9: What is the maximum number of transactions which can be disputed?

The maximum number of transactions which can be disputed based on the card brand rules is thirty five (35).

Q10: What information do I need to provide to the bank to make a dispute?

The more information you can provide for your chargeback claim, the stronger your claim will be. In addition to the chargeback form, information in the form of invoices, receipts and correspondence e.g. online chat or emails is required.

Q11: How do I make a chargeback claim for an unauthorized transaction?

If you notice an unauthorized transaction on your account it is important that you report this immediately to the bank to block your card and secure your account. No additional information is required other than the dispute form to initiate the dispute with the card brand.

Q12: When I dispute a transaction will my card be replaced?

Your card will only need to be blocked and replaced if your dispute is submitted for an unauthorized transaction. This is a requirement of both Visa and MasterCard International.

Q13: How long does the dispute process take?

According to both Visa and MasterCard Regulations, the dispute process can be completed and the dispute resolved within a minimum of ten (10) weeks to a maximum of six (6) months.

Q14: How do I complete the dispute form?

To complete your dispute form follow the three simple steps below:-

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated. (Click here to access and download the credit card dispute form)

Q15: Where do I submit my completed dispute form?

All completed dispute forms must be submitted to chargebacks@firstcitizensbb.com

Upon receipt you will receive an acknowledgment email.

Q16: Is there a fee for disputing a transaction.

The bank does not charge a fee for disputing a transaction however for unauthorized transaction if the investigations proves you did do the transactions you will be charged a fee of $25 BBD for every disputed transactions.

Q17: Can I dispute a Chip & PIN transaction as unauthorized.

No, based on the card brand rules and regulations there are no disputes rights for transactions authorized via Chip & PIN technology.

Contactless FAQs

Q1. What is Contactless technology?

This feature allows you to simply ‘tap-and-go! The terminal and card communicate using Near Field Communication (NFC) technology which allows you to tap your card over the merchant’s point-of-sale device to make a payment instead of inserting the card.

Q2. Why use Contactless technology?

Contactless technology brings you added convenience when making payments. With just a tap, you can make quick and secure payments.

Q3. How do I use the Contactless feature on my credit card?

Once the merchant point of sale device is enabled with Contactless technology, you can tap or wave your card 2 inches over the device to make a payment.

Q4. How can I determine whether I can use Contactless at a merchant?

The Contactless icon (see below) will be displayed on the merchant’s machine.

Q5. Will Contactless transactions require a Pin?

Each transaction is assessed “individually” and you will be prompted if you’re required to enter your Pin.

Q6. Is Contactless payment secure?

Contactless uses the same secure and robust technology as Chip & PIN.

When making a payment via Contactless, your personal card information is protected.

Q7. How can I be notified of a Contactless transaction?

First Citizens offers Email Alert Service which delivers convenient, fast and secure real-time notifications. Each notification will provide you with a brief transaction description that includes the merchant’s name, the transaction status (whether approved or declined), transaction value and your real-time available card balance.

Chip & PIN Transactions FAQs

Q1. What is a Chip and PIN credit card?

A credit card with Chip and PIN technology contains an encrypted embedded microchip, which stores data more securely and strongly reduces the possibility of fraud. The security of this technology automatically creates an enhanced customer experience.

Q2. What are the benefits of Chip and PIN credit cards?

Guaranteed international acceptance at merchants including those in the UK and Europe.

Increased protection against lost, stolen or counterfeit card fraud through the ability of the chip to securely store and process data.

Additional layer of security when Chip and PIN credit card is used at a Chip and PIN point of sale terminal/merchant. In this scenario, the customer is required to input his/her PIN, which he/she alone should know.

Q3. Can a First Citizens Credit Card with Chip and PIN technology be compromised?

The Chip and PIN technology remains a safe technology in the payments world. To date, in line with the benefits of the technology, we are not aware of situations where credit cards with the Chip and PIN technology have been compromised. If that unlikely scenario occurs, then the situation will be handled in line with the rules as prescribed by VISA and MasterCard International.

Q4. How will my First Citizens Chip and PIN Credit Card work?

Your First Citizens Chip and PIN Credit Card allows you to do everything you currently do with your credit card; i.e. local, international and online purchases and cash withdrawals.

The process for online transactions is unchanged. However attention is to be paid to the expiry date which you may agree to store on the sites where you regularly shop.

Q5. How will my First Citizens Chip and PIN Credit Card work at a chip enabled point of sale or ATM machine?

When doing a purchase at a merchant with a chip-enabled Point of Sale machines, the cardholder is required to enter his/her PIN to verify the transaction. The system validates the data on the Chip and the PIN, resulting in a more secure transaction.

There is no requirement for the customer’s signature in this scenario. When the transaction is complete, you will be prompted to remove the card and the merchant will provide you with a copy of the sales receipt.

Q6. What is the importance of my PIN with my First Citizens Chip and PIN Credit Card?

Your PIN is required to process purchase transactions at chip enabled point of sale machines as well as for cash withdrawals at chip enabled ATMs.

Therefore your PIN is a central security element for your purchase transactions.

Your First Citizens Chip and PIN Credit Card will be blocked after three (3) inaccurate PIN attempts.

Q7. What are the additional fees on the First Citizens Chip and PIN Credit Card?

There are no additional fees. All fees remain unchanged.

Q8. Is the Chip and PIN technology available for my Visa Debit card as well?

Yes the technology is available for both credit cards and debit cards.

Credit Card Security Tips

Tips on Avoiding Chargebacks

Tip 1: Be clear on return, refund and cancellation policies.

When transacting at merchants especially Travel and Entertainment Merchants e.g. Hotels, Airlines, Car Rentals, Cruises etc. be clear on the return, refund or cancellation policies. This is important as it details the merchant’s terms and conditions and liability if a dispute is made against them. Disputing a transaction at any such merchant does not guarantee you will be reimbursed.

Tip 2: Currency Conversion

When you make a credit card purchase or an ATM withdrawal involving a foreign currency, the amount must be converted to your home currency in order to be processed by your card issuer and charged to your account. You would be charged a currency conversion fee for that purpose. This would account for the difference in the purchase amount versus the charged amount on your credit card statement.

Tip 3: Subscription Charges

When you opt in for a free subscription trial you may be presented with an option to input your card information. This means after the free trial period is over the merchant will automatically bill you for the subscription. If you do not wish to be charged remember to cancel the subscription and remove your card information before the trial period is over

Tip 4: Pending Transactions

If you have a pending transaction that was authorized but never posted to your account send us a secure message or email cardservicesdepartment@firstcitizensbb.com requesting to have the transaction dropped. Examples of pending transactions and the required supporting documentation is outlined below:-

| Example | Supporting Documentation |

|---|---|

| 1. Transaction Declined but still pending. | Decline Receipt |

| 2. You cancelled the transaction with the merchant and you are awaiting a refund but the transaction is still pending. | Approval Receipt Cancellation Receipt |

Tip 5: Transaction Amount

When doing a Chip & PIN Transaction at a merchant be sure to verify the transaction amount before you input your PIN. This will ensure the amount being authorized is correct.

Tip 6: Never Share Your Card Information

You should never disclose or share your card information with anyone. Doing so means you are liable for all transaction completed.

Tip 7: In App Purchases

In-app purchases, prompt users to pay extra for subscriptions, premium features or game add-ons. They are a standard feature on apps available through the Apple App Store and Google Play. Gaming apps encourage players to buy extra lives, unlock new levels or even finish a game for a small fee. These spur-of-the-moment purchases can be an especially costly surprise for parents who allow their children to play games on their phones or tablets as users do not need to enter their credit card information or even a password. To minimize these types of transactions you can do the following:

- You can turn off in-app purchases through your phone’s settings controls.

- Select the option to always require your password for in app purchases.

Security Tips to reduce Friendly Fraud

Reducing friendly fraud can help reduce chargebacks.

There are two main causes of friendly fraud:

Transaction confusion—the cardholder does not recognize the purchase when checking their banking statement and believes they were a victim of fraud and so they dispute the charge.

First-party fraud – Someone else in the household makes a purchase without letting the cardholder know. This can happen for example when a household member pays to stream a movie online using the credit card that’s on file with the streaming service.

Below are some helpful tips to prevent disputing legitimate charges on your credit card account.

1. Keep track of your credit card purchases

Purchase confusion and disputes often arise from simple forgetfulness. One simple solution would be to retain paper receipts to reconcile your monthly credit card statement.

2. Know where your card is at all times

It’s obvious to say but the most reliable way to protect your card from unauthorized purchases is to keep it out of the hands of people who shouldn’t have it. Remember to keep credit cards in a safe, secure place at all times.

3. In app purchases

Maybe a family member made a purchase and never told you about it or your child made a few in-app purchases in a game. Known as “purchase confusion” or “friendly fraud” disputing legitimate charges feeds misinformation into the system when your own purchases are flagged as potential fraud. To minimize these types of transactions you can do the following:

- Select the option to always require your password for in app purchases.

- You can turn off in-app purchases through your phone’s settings controls

4. Work with your bank to resolve disputes

If you see a charge you are uncertain about send us a secure message asking for additional information. The detail provided by the bank can often help you to identify the charge.

Travel Security Tip: Record Your Travel with the Bank

Protect your card when travelling abroad. Before your trip, send us your travel details so that we can contact you in case of emergencies, and monitor your card activity for any suspicious transactions.

Informing us of your travel details is easy! Send us a secure message via Online Banking or email us at cardservicesdepartment@firstcitizensbb.com and be sure to include the following details:

· Name

· Destination

· Date of Departure and Return Date

· Contact Information – phone number and email address while abroad

Cardholders are encouraged to monitor their credit card transaction activity through their email alerts or via their Online Banking App.

Credit Card Security Tips

Cards are now the preferred method of payment for goods and services for many individuals. This is primarily due to its local, international, and online reach and by extension, its unparalleled convenience. As with all banking services, you, in partnership with your Bank, play the biggest role in ensuring that you enjoy the safest card experience possible. Help us protect you by following some simple guidelines as you go about your everyday life, with your First Citizens credit cards:

Tips to keep safe when shopping Online

Look for the “s”: When shopping online, check the URL to ensure it begins with “https://”. The “s” at the end indicates a secure connection.

- Be on the alert – signing up for transaction alerts means you can see when your account has been used for a purchase.

- Avoid shopping on public Wi-Fi – Cybercriminals scavenge for information on public Wi-Fi networks. They latch onto the same Wi-Fi signal and intercept information while it’s being transmitted, thus gaining access to your confidential credit card information and other sensitive data such as account passwords or banking credentials.

- Beware of phishing scams – Be careful of unsolicited and suspicious emails or phone calls. They may try to steal personal information like your account number, username and password. If in doubt, do not click on any links or download files.

- Protect your computer with an antivirus software/security Software. Make sure your computer and other mobile devices are loaded with the most recent and reputable antivirus and antispyware software that protects you from hackers and identity thieves.

- Keep a record of your online credit card receipts. When you use your credit card online, don’t forget to keep a copy of your receipt. You can then compare the amount on your receipts to the amount on your credit card billing statement to make sure the amount matches.

- Do not share your One Time Password (OTP) with anyone. NEVER give out your OTP to anyone even to a person claiming to be a bank representative. Keep it personal and guard them well.

- If you suspect you card is compromised, call the bank immediately to have the card blocked and replaced.

- Never send your credit card number in an email. Emails are broadcast over the Internet in plain text and can be intercepted by anyone.

- The use of First Citizens Credit Cards for Online Gambling transactions is strictly prohibited. As such, these transactions would be declined.

- The use of First Citizens Credit Cards to conduct face to face or non-face to face transactions at the countries listed below is strictly prohibited. As such, these transactions would be declined. The list may be updated periodically so you should always review prior to travelling.

| Listed Countries | Listed Countries |

|---|---|

| 1. Albania | 15. North Korea |

| 2. Burundi | 16. Somalia |

| 3. Democratic Republic of the Congo | 17. Syria |

| 4. Iraq | 18. Yemen |

| 5. Libya | 19. Bosnia & Herzegovina |

| 6. Nicaragua | 20. Cuba |

| 7. Serbia | 21. Iran |

| 8. Sudan and Darfur | 22. Lebanon |

| 9. Venezuela | 23. Montenegro |

| 10. Belarus | 24. Russia |

| 11. Central Africa Republic | 25. South Sudan |

| 12. Former Yugoslav Republic of Macedonia | 26. Ukraine |

| 13. Kosovo | 27. Zimbabwe |

| 14. Mail |

ATM Security Tips

Keep your PIN a secret

- Your PIN is the most valuable security measure when you access your account through an ATM, so make sure you keep it a secret.

- Always block the view of the ATM keypad with your hand while entering your PIN. Never disclose your PIN to anyone, not event family.

- Avoid writing it down anywhere and commit it to memory.

Don’t accept help

- Never accept help from anyone at the ATM.

- Never disclose your PIN to anyone or get them to transact on your behalf. Do not count your cash in front of others.

Choose the right location

- Using a secured ATM is essential for your safety.

- Always use ATM machines during the day or at well-lit locations during the night.

- Avoid using an ATM after midnight or one that’s in a deserted place.

Stay alert

- Stay alert at all times while accessing an ATM and aware of your surroundings.

- Never Use any ATM that has suspicious protruding parts or unusual card readers or if you smell glue.

ATM never returned my card

- If you are utilizing an ATM and it kept your card contact the bank immediately via 1-246-431-4577 to have the card blocked.

- Send a secure message via Online Banking to have your card replaced.

Transaction Queries

If you did an ATM transaction and your account got debited but you never received the funds or you received some of the funds complete the Credit Card or Visa Debit Card dispute form and submit it to the bank via the email address listed below.

Click here to access and download the Credit Card or Debit Card Dispute form.

Credit Card Dispute email – Chargebacks@firstcitizensbb.com

Visa Debit Card Dispute email – Chargebacks@firstcitizensbb.com

Point of Sale Security Tips

Stay alert

- Be vigilant at merchants never let your card out of your sight

- Use your card at merchants where the Point of Sale (POS) machine is always visible

- Do not provide any personal information to merchants other than your ID

- If your transaction was “declined” make sure you get a copy of the receipt

- Always leave with your card and receipt

Keep your PIN safe

- Never divulge your PIN to anyone, not even family.

- Cover your hand when entering your PIN at the point of sale terminal,

- Verify the transaction value prior to entering your PIN and finalizing your transaction

Transactions Alerts

- Log in to your Online Banking to review your account activity regularly. If there are transactions you do not recognize contact the bank immediately to have your card blocked and replaced. Send a secure message via Online Banking to have your card replaced.

Transaction Queries

- If you did a Point of Sales transaction and your account got debited twice or the transaction declined but you were still charged complete the Credit Card or Visa Debit Card dispute form and submit it to the bank via the email address listed below. Click here to access and download the Credit Card or Debit Card Dispute form.

- Credit Card Dispute email – Chargebacks@firstcitizensbb.com

- Visa Debit Card Dispute email – Chargebacks@firstcitizensbb.com