Short Selling

Commentary

For most investors, the primary objective of investing in a stock is to make a profit and this is accomplished by taking a “long” position, which means buying and owning the stock with the expectation that the price will rise in value in the future. If the stock price rises above the acquisition cost, the investor benefits from capital gains. For example, if a stock is bought for $5.00 and the share price rises to $8.50, the capital gain is $3.50 ($8.50 – $5.00).

There are other approaches for returns to be made in equity markets. One such method is to short the stock. The Trinidad & Tobago Stock Exchange (TTSE) does not presently facilitate shorting, however the Jamaica Stock Exchange (JSE) recently announced the introduction of shorting stocks in their market. The rise of cross-listed companies on the TTSE and the JSE, along with electronic trading has served to integrate both markets. As such, local investors with a Jamaican brokerage account can utilize a short strategy when implemented.

What is Shorting and why Short Sell?

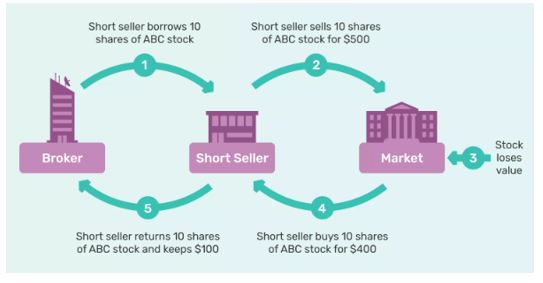

Shorting is premised on the assumption that the price of a stock may fall. This expectation may be influenced by several factors including a deterioration in the company’s financial health, slowing economic growth, the stock may be overvalued or there is a downward trend in the stock’s price movement and general market. To benefit from this expected decline, the investor borrows a stock from a broker and sells it on the open market. Once the price falls, the investor purchases the said stock at a lower price and returns the stock to the broker.

Short Selling a Stock

Short-selling is used for speculation purposes, where the interest is solely to make a profit from price movements. Once the profit is made, focus is shifted to another security. Such an action contradicts the traditional investing methodology of thoroughly analysing a company, understanding the company’s business model, its competitive position in the market and making an investment decision to buy or sell.

Traders often employ short selling strategies to hedge or protect their portfolio from downside risks. An investor may have a long position in a particular security based on its long-term outlook. However, there may be doubts about the company’s near-term performance and adverse price movements are anticipated. In an attempt to cushion the losses that may occur if the price falls, the long position in the asset can be hedged by a short position in the same or similar security, thus as prices fluctuate, the losses in one position will be offset by gains in the other.

Role of Short-Selling in Stock Markets

Short sales play a pivotal role in stock markets and are widely used in the more developed markets. According to the US Securities Exchange Commission (SEC), short sales accounts for roughly 49% of listed equity share volume. Short selling provides two important benefits to stock markets – market liquidity and pricing efficiency.

Market liquidity is improved through short selling as market makers and other parties who facilitate the transaction offsets temporary imbalances in the supply and demand for stocks. The stocks offered for shorting adds to the supply available to purchasers and reduces any artificial price inflation due to a temporary contraction of supply.

Short-selling also aids in improving pricing efficiency of stock markets. A characteristic of an efficient market is the reflection of all buy and sell interest. A buyer purchases a security on the belief that the price will rise while a short seller enters into a transaction on the expectation the price will fall. Market participants in both transactions express their evaluation of future stock price performance that is reflected in the prevailing market price.

Disadvantages and Advantages of Short-Selling

When compared to traditional investing strategies, short-selling poses greater risks. When a stock is bought, the maximum loss an investor can lose is the money invested if the stock price goes to zero. If the share price rises, there is no limit on the profits that can be earned. However in short-selling, an investor is exposed to unlimited downside risk and limited profit potential. For example, an investor enters a short position of 10 shares of ABC at $100. If the stock falls to zero, the investor gets to keep the $1,000. If the price soars to $500 a share, the investor will have to spend $5,000 to buy back the stocks at a loss of $4,000.

Short-sellers may also be exposed to a short squeeze, a market phenomenon in which there is an unexpected rise in the price of a heavily-shorted stock. In an effort to repurchase the stock before the price rises any higher, a large number of short sellers rush to exit their positions and buy the stock, effectively driving the price up further. The upward trend in price also attract buyers, further adding to the stock demand that can create a drastic rise in price, further widening short-seller losses.

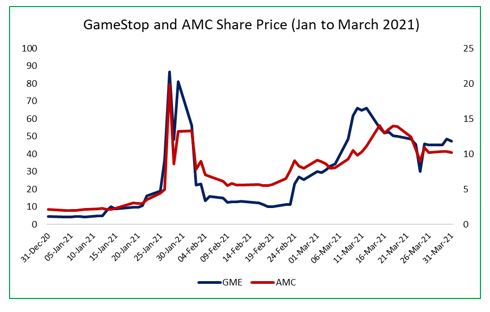

The most infamous short squeeze occurred in 2021 for shares of GameStop (GME) and AMC Entertainment (AMC). When the pandemic hit in 2020, the future of both companies appeared bleak as consumers turned away from brick and mortar retails chains like GME and AMC and preferred online video games. Acting on this perception, many of the largest investment firms entered into short positions against both stocks in the billions of dollars. In 2021, GameStop was one of the most shorted stocks in the world, measured by the short interest that stood over 140% on 4th January 2021.

Individual investors using the online platform WallStreetBets, a sub group of Reddit where discussions on stock and option trading are organized, noticed certain hedge funds had taken significant short positions against the two companies. Launching a coordinated buying spree, the hedge funds were trapped in a short squeeze that pushed GMC and AMC share prices up from US$4.71 and US$2.12 on 31 December 2020 to US$86.87 and US$19.90 on 27th January 2021, this represented increases of 1,745% and 839% respectively.

Another disadvantage arises when it is time to purchase the stock, a short-seller might not find enough shares to buy and return to the broker. Such a situation might arise if the stock is thinly traded or there are many traders also shorting the same stock.

Despite such disadvantages, short-selling is a valuable tool as it allow investors to participate on both sides of the market, the long and short sides, thus reducing the overall risks of trading in markets. In this prevailing bear market, with most indices down in excess of 20%, short-selling would allow investors to make money while markets are falling.

The stock market can be very volatile, with sharp price movements that can negatively impact a portfolio overall returns. If the investor predicts the downward price movement correctly, significant gains can be made, thus effectively hedging the portfolio.

Short selling aids in diversifying an investment portfolio’s risk exposure. It allows the investor to take calculated positions against a particular company and capture better returns that are not available in a long position.

The JSE has begun prepping the market for short-selling stocks with a workshop on the topic held in September 2022. Short-selling is an advanced investment strategy and requires a clear-cut strategy, supported by strong analysis and a deep understanding of the market. If executed correctly, significant gains can be earned, however if not, the investor is exposed to unlimited losses. Investors should approach short selling cautiously and be fully aware of the risks before engaging in such transactions.

DISCLAIMER

First Citizens Bank Limited (hereinafter “the Bank”) has prepared this report which is provided for informational purposes only and without any obligation, whether contractual or otherwise. The content of the report is subject to change without any prior notice. All opinions and estimates in the report constitute the author’s own judgment as at the date of the report. All information contained in the report that has been obtained or arrived at from sources which the Bank believes to be reliable in good faith but the Bank disclaims any warranty, express or implied, as to the accuracy, timeliness, completeness of the information given or the assessments made in the report and opinions expressed in the report may change without notice. The Bank disclaims any and all warranties, express or implied, including without limitation warranties of satisfactory quality and fitness for a particular purpose with respect to the information contained in the report. This report does not constitute nor is it intended as a solicitation, an offer, a recommendation to buy, hold, or sell any securities, products, service, investment or a recommendation to participate in any particular trading scheme discussed herein. The securities discussed in this report may not be suitable to all investors, therefore Investors wishing to purchase any of the securities mentioned should consult an investment adviser. The information in this report is not intended, in part or in whole, as financial advice. The information in this report shall not be used as part of any prospectus, offering memorandum or other disclosure ascribable to any issuer of securities. The use of the information in this report for the purpose of or with the effect of incorporating any such information into any disclosure intended for any investor or potential investor is not authorized.

DISCLOSURE

We, First Citizens Bank Limited hereby state that (1) the views expressed in this Research report reflect our personal view about any or all of the subject securities or issuers referred to in this Research report, (2) we are a beneficial owner of securities of the issuer (3) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this Research report (4) we have acted as underwriter in the distribution of securities referred to in this Research report in the three years immediately preceding and (5) we do have a direct or indirect financial or other interest in the subject securities or issuers referred to in this Research report.